Cryptofinance reconciliation involves matching cryptocurrency transactions and digital asset balances to ensure accuracy in blockchain records, focusing on wallet addresses and exchange activities. Tax account reconciliation, on the other hand, centers on aligning financial statements with tax reporting requirements, emphasizing compliance with tax laws and regulations. Discover how these reconciliation processes impact financial accuracy and regulatory adherence for businesses managing digital and traditional assets.

Why it is important

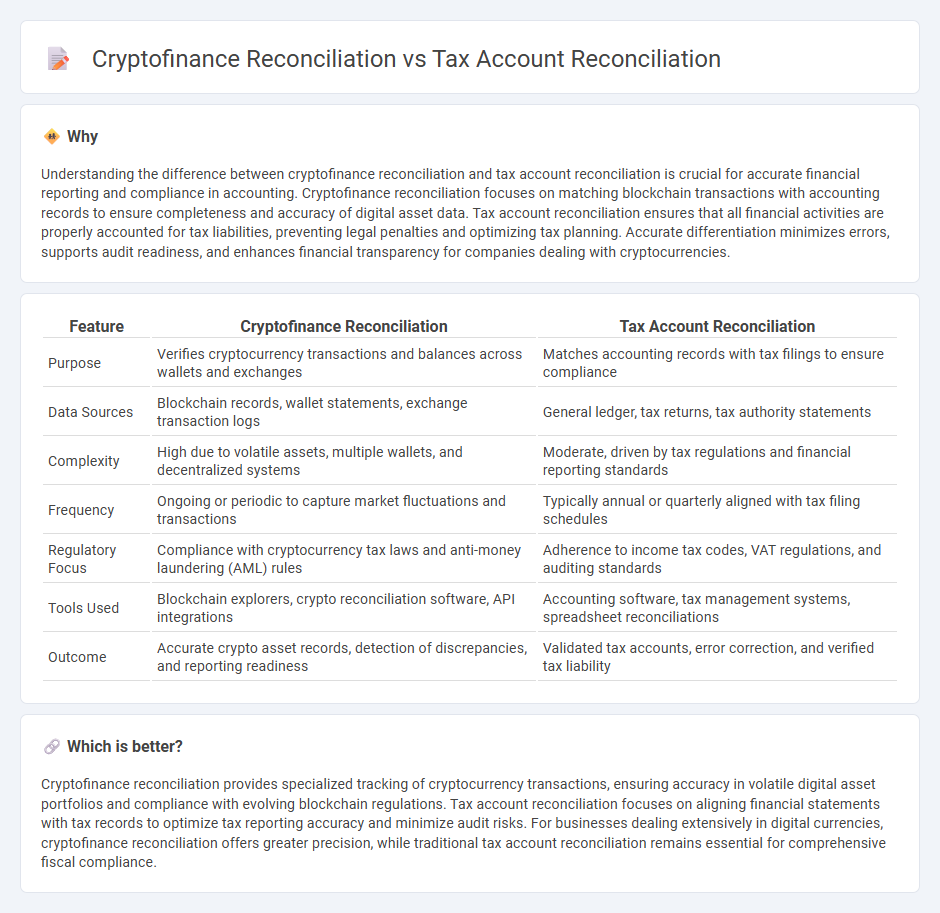

Understanding the difference between cryptofinance reconciliation and tax account reconciliation is crucial for accurate financial reporting and compliance in accounting. Cryptofinance reconciliation focuses on matching blockchain transactions with accounting records to ensure completeness and accuracy of digital asset data. Tax account reconciliation ensures that all financial activities are properly accounted for tax liabilities, preventing legal penalties and optimizing tax planning. Accurate differentiation minimizes errors, supports audit readiness, and enhances financial transparency for companies dealing with cryptocurrencies.

Comparison Table

| Feature | Cryptofinance Reconciliation | Tax Account Reconciliation |

|---|---|---|

| Purpose | Verifies cryptocurrency transactions and balances across wallets and exchanges | Matches accounting records with tax filings to ensure compliance |

| Data Sources | Blockchain records, wallet statements, exchange transaction logs | General ledger, tax returns, tax authority statements |

| Complexity | High due to volatile assets, multiple wallets, and decentralized systems | Moderate, driven by tax regulations and financial reporting standards |

| Frequency | Ongoing or periodic to capture market fluctuations and transactions | Typically annual or quarterly aligned with tax filing schedules |

| Regulatory Focus | Compliance with cryptocurrency tax laws and anti-money laundering (AML) rules | Adherence to income tax codes, VAT regulations, and auditing standards |

| Tools Used | Blockchain explorers, crypto reconciliation software, API integrations | Accounting software, tax management systems, spreadsheet reconciliations |

| Outcome | Accurate crypto asset records, detection of discrepancies, and reporting readiness | Validated tax accounts, error correction, and verified tax liability |

Which is better?

Cryptofinance reconciliation provides specialized tracking of cryptocurrency transactions, ensuring accuracy in volatile digital asset portfolios and compliance with evolving blockchain regulations. Tax account reconciliation focuses on aligning financial statements with tax records to optimize tax reporting accuracy and minimize audit risks. For businesses dealing extensively in digital currencies, cryptofinance reconciliation offers greater precision, while traditional tax account reconciliation remains essential for comprehensive fiscal compliance.

Connection

Cryptofinance reconciliation and tax account reconciliation are connected through their mutual focus on ensuring accuracy and compliance in financial records. Both processes involve systematically matching transaction data, which enhances transparency and supports regulatory reporting requirements. Effective integration of cryptofinance and tax reconciliations reduces errors and streamlines audit trails in accounting systems.

Key Terms

Compliance

Tax account reconciliation ensures accurate reporting of income, deductions, and credits in compliance with IRS regulations, reducing audit risks and penalties. Cryptofinance reconciliation involves verifying blockchain transactions and wallet balances to meet evolving regulatory standards such as FATF guidelines and SEC compliance. Explore detailed methods and tools to optimize compliance in both tax and cryptofinance reconciliation.

Blockchain

Tax account reconciliation involves verifying transactions against tax records to ensure compliance with regulatory requirements, often using traditional accounting systems. Cryptofinance reconciliation specifically addresses blockchain transaction verification, enabling accurate tracking of cryptocurrency transfers, smart contracts, and digital asset movements through decentralized ledgers. Explore deeper insights into blockchain-based reconciliation methods and their impact on financial transparency.

Reporting

Tax account reconciliation emphasizes accurate matching of financial transactions to ensure compliance with tax regulations and precise reporting of taxable events. Cryptofinance reconciliation involves aligning blockchain transactions with accounting records to trace asset movements, ensuring transparency and regulatory adherence in digital asset reporting. Explore detailed methodologies and tools to enhance reporting accuracy in both tax account and cryptofinance reconciliations.

Source and External Links

What is Account Reconciliation? | F&A Glossary - BlackLine - Tax account reconciliation involves gathering necessary data from account ledgers and source documents, analyzing discrepancies by comparing the general ledger with independent records like bank statements, investigating mismatches, making adjustments, and retaining all supporting documentation for review and audit purposes.

Understanding Reconciliation in Accounting in 2025 | Cleer Tax - The reconciliation process verifies consistency by comparing company books to external documents such as bank statements or invoices, identifying discrepancies like timing differences or errors, making necessary adjustments, and documenting the entire process to maintain accuracy and audit trails.

Account Reconciliation: Types, Processes, and Common Pitfalls - Tax account reconciliation primarily uses documentation review--examining transactions against source receipts and statements--and analytics review, which uses historical data comparison to detect anomalies that may indicate errors or fraudulent activities.

dowidth.com

dowidth.com