Forensic analysis focuses on detecting and investigating financial fraud, providing detailed insights into irregularities and legal compliance issues. Operational review evaluates accounting processes and internal controls to enhance efficiency and accuracy in financial reporting. Explore the key differences and applications to deepen your understanding of these critical accounting practices.

Why it is important

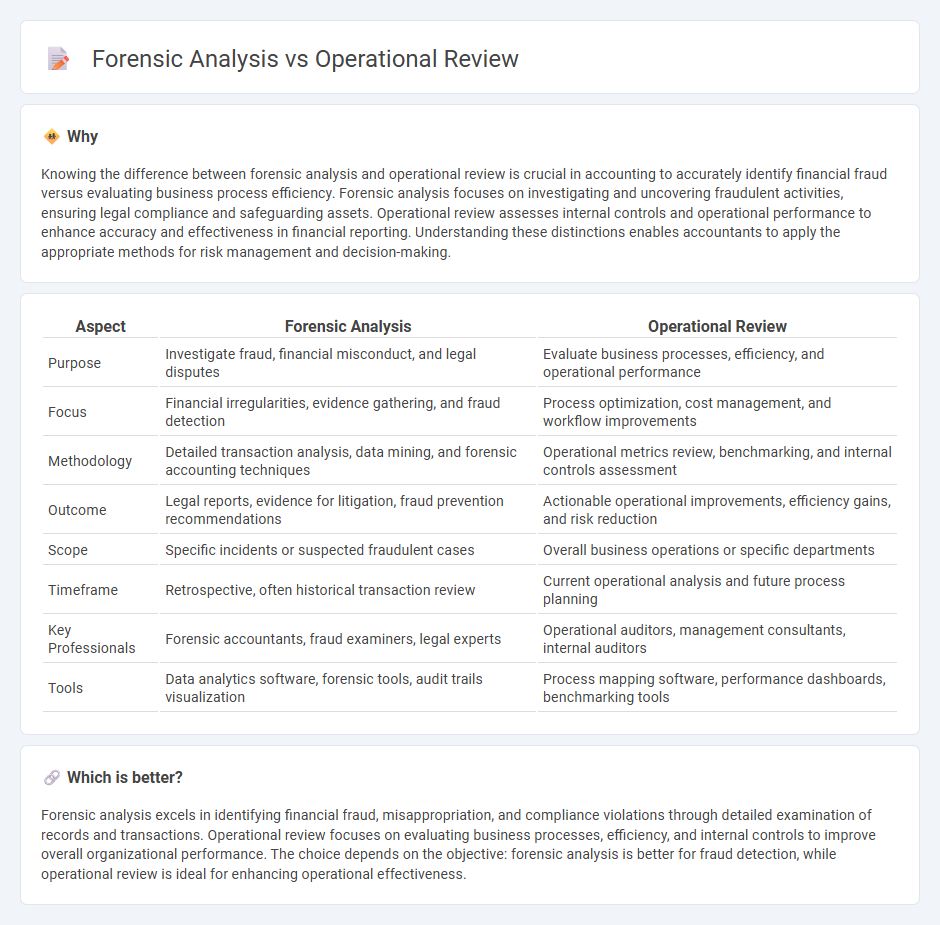

Knowing the difference between forensic analysis and operational review is crucial in accounting to accurately identify financial fraud versus evaluating business process efficiency. Forensic analysis focuses on investigating and uncovering fraudulent activities, ensuring legal compliance and safeguarding assets. Operational review assesses internal controls and operational performance to enhance accuracy and effectiveness in financial reporting. Understanding these distinctions enables accountants to apply the appropriate methods for risk management and decision-making.

Comparison Table

| Aspect | Forensic Analysis | Operational Review |

|---|---|---|

| Purpose | Investigate fraud, financial misconduct, and legal disputes | Evaluate business processes, efficiency, and operational performance |

| Focus | Financial irregularities, evidence gathering, and fraud detection | Process optimization, cost management, and workflow improvements |

| Methodology | Detailed transaction analysis, data mining, and forensic accounting techniques | Operational metrics review, benchmarking, and internal controls assessment |

| Outcome | Legal reports, evidence for litigation, fraud prevention recommendations | Actionable operational improvements, efficiency gains, and risk reduction |

| Scope | Specific incidents or suspected fraudulent cases | Overall business operations or specific departments |

| Timeframe | Retrospective, often historical transaction review | Current operational analysis and future process planning |

| Key Professionals | Forensic accountants, fraud examiners, legal experts | Operational auditors, management consultants, internal auditors |

| Tools | Data analytics software, forensic tools, audit trails visualization | Process mapping software, performance dashboards, benchmarking tools |

Which is better?

Forensic analysis excels in identifying financial fraud, misappropriation, and compliance violations through detailed examination of records and transactions. Operational review focuses on evaluating business processes, efficiency, and internal controls to improve overall organizational performance. The choice depends on the objective: forensic analysis is better for fraud detection, while operational review is ideal for enhancing operational effectiveness.

Connection

Forensic analysis in accounting systematically uncovers financial discrepancies and fraud by examining detailed transaction records, while operational review evaluates internal controls and processes to ensure efficiency and compliance. The connection lies in their shared goal of identifying risks and financial irregularities, with forensic analysis providing evidence-based insights that inform operational improvements. Integrating these approaches strengthens corporate governance and mitigates potential financial losses.

Key Terms

Efficiency

Operational review evaluates business processes to identify inefficiencies and enhance productivity by analyzing workflows and resource allocation. Forensic analysis investigates financial discrepancies and fraud by examining transactional data and compliance with regulations. Explore deeper insights into optimizing efficiency through these distinct approaches.

Fraud Detection

Operational review emphasizes evaluating internal controls and processes to identify fraud risks and inefficiencies within business operations. Forensic analysis involves detailed investigation and evidence gathering specifically aimed at uncovering fraudulent activities and supporting legal actions. Explore how combining these approaches enhances fraud detection effectiveness.

Internal Controls

Operational review assesses the effectiveness and efficiency of internal controls to support business objectives, identifying areas for improvement in processes and risk management. Forensic analysis examines internal controls specifically to detect, investigate, and prevent fraud or financial misconduct through detailed evidence gathering and analysis. Explore more to understand how these approaches differ in safeguarding organizational integrity.

Source and External Links

How to carry out an Operational Review - This webpage provides a step-by-step guide on conducting an operational review, including preparatory work, interviews, and presenting a final report.

What are Operational Reviews - This page explains what operational reviews are, highlighting their role in evaluating an organization's performance and compliance with internal objectives and procedures.

What is an Operation Review and why do you need it? - This article discusses operational reviews as a means to identify operational hazards and improve risk management strategies in facilities.

dowidth.com

dowidth.com