Forensic data analytics focuses on detecting and preventing fraud through detailed examination of financial data, using advanced techniques like data mining and pattern recognition. Performance auditing evaluates the efficiency, effectiveness, and economy of an organization's operations, ensuring compliance and optimal resource use. Explore the differences and applications of these essential accounting approaches to enhance financial integrity and organizational performance.

Why it is important

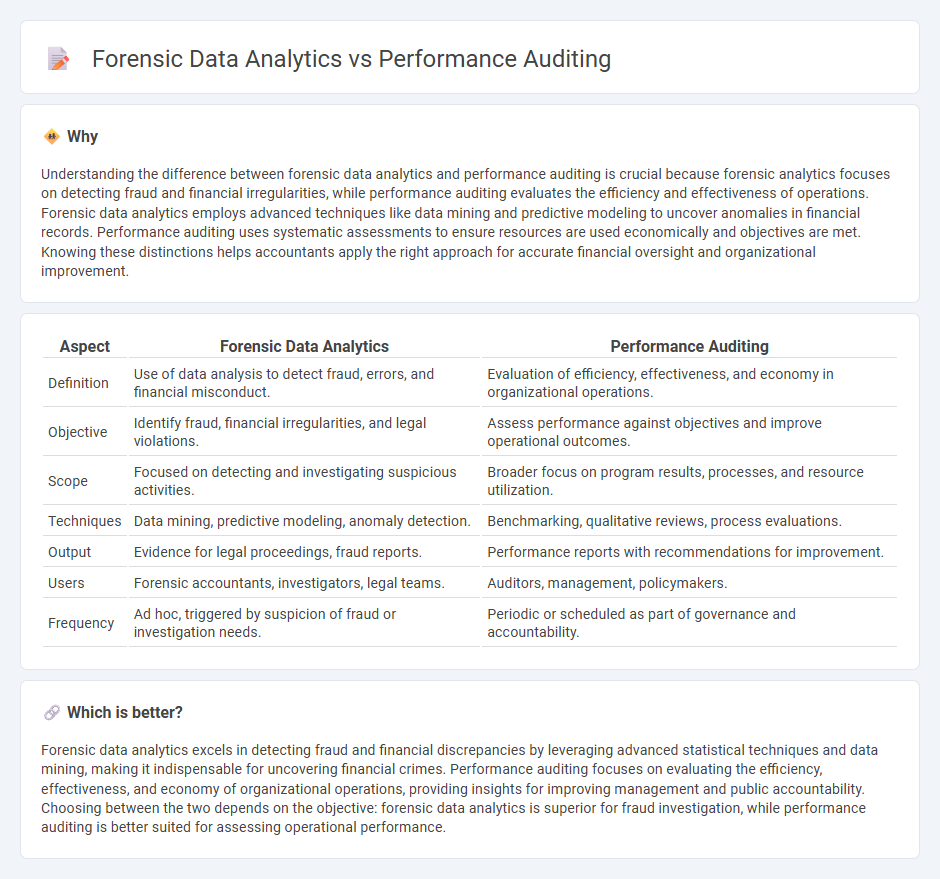

Understanding the difference between forensic data analytics and performance auditing is crucial because forensic analytics focuses on detecting fraud and financial irregularities, while performance auditing evaluates the efficiency and effectiveness of operations. Forensic data analytics employs advanced techniques like data mining and predictive modeling to uncover anomalies in financial records. Performance auditing uses systematic assessments to ensure resources are used economically and objectives are met. Knowing these distinctions helps accountants apply the right approach for accurate financial oversight and organizational improvement.

Comparison Table

| Aspect | Forensic Data Analytics | Performance Auditing |

|---|---|---|

| Definition | Use of data analysis to detect fraud, errors, and financial misconduct. | Evaluation of efficiency, effectiveness, and economy in organizational operations. |

| Objective | Identify fraud, financial irregularities, and legal violations. | Assess performance against objectives and improve operational outcomes. |

| Scope | Focused on detecting and investigating suspicious activities. | Broader focus on program results, processes, and resource utilization. |

| Techniques | Data mining, predictive modeling, anomaly detection. | Benchmarking, qualitative reviews, process evaluations. |

| Output | Evidence for legal proceedings, fraud reports. | Performance reports with recommendations for improvement. |

| Users | Forensic accountants, investigators, legal teams. | Auditors, management, policymakers. |

| Frequency | Ad hoc, triggered by suspicion of fraud or investigation needs. | Periodic or scheduled as part of governance and accountability. |

Which is better?

Forensic data analytics excels in detecting fraud and financial discrepancies by leveraging advanced statistical techniques and data mining, making it indispensable for uncovering financial crimes. Performance auditing focuses on evaluating the efficiency, effectiveness, and economy of organizational operations, providing insights for improving management and public accountability. Choosing between the two depends on the objective: forensic data analytics is superior for fraud investigation, while performance auditing is better suited for assessing operational performance.

Connection

Forensic data analytics enhances performance auditing by enabling detailed examination of financial records to detect irregularities, fraud, and compliance issues. Performance auditing relies on this analytical capability to assess the efficiency, effectiveness, and integrity of financial operations within an organization. The integration of forensic data analytics improves audit accuracy, supports risk identification, and strengthens overall governance frameworks in accounting.

Key Terms

**Performance Auditing:**

Performance auditing evaluates the efficiency, effectiveness, and economy of government programs or organizational operations by systematically assessing financial and operational data. It identifies areas of improvement, compliance with policies, and resource utilization to enhance accountability and overall performance. Explore further to understand how performance auditing drives strategic decision-making and operational excellence.

Efficiency

Performance auditing evaluates operational efficiency and effectiveness by analyzing processes, resource utilization, and outcomes to identify improvements. Forensic data analytics concentrates on detecting fraud, errors, and irregularities through detailed examination of transactional data and patterns. Explore more strategies to enhance organizational efficiency and security.

Effectiveness

Performance auditing evaluates operational efficiency and effectiveness by systematically reviewing processes, controls, and outcomes to ensure organizational objectives are met. Forensic data analytics focuses on detecting, investigating, and preventing fraud or irregularities through detailed examination of transactional data and patterns. Explore how combining these approaches enhances organizational accountability and risk management.

Source and External Links

How to Conduct a Performance Audit - This document provides guidance on conducting performance audits, which are designed to improve operational performance, reduce costs, and facilitate informed decision-making in government operations.

Performance Auditing - This report discusses how performance auditing evaluates the economy, efficiency, and effectiveness of organizational operations, ensuring strategic objectives are met and identifying areas for improvement.

About Performance Audits - Performance audits assess the efficiency and effectiveness of government programs, comparing current practices to legal requirements and best practices to identify potential improvements.

dowidth.com

dowidth.com