Revenue recognition automation streamlines the process of accurately recording income by automatically matching transactions to accounting standards such as ASC 606 or IFRS 15. Billing automation enhances operational efficiency by generating invoices, managing payment schedules, and reducing human error in client billing. Explore how integrating these automation solutions can optimize your financial workflow and compliance.

Why it is important

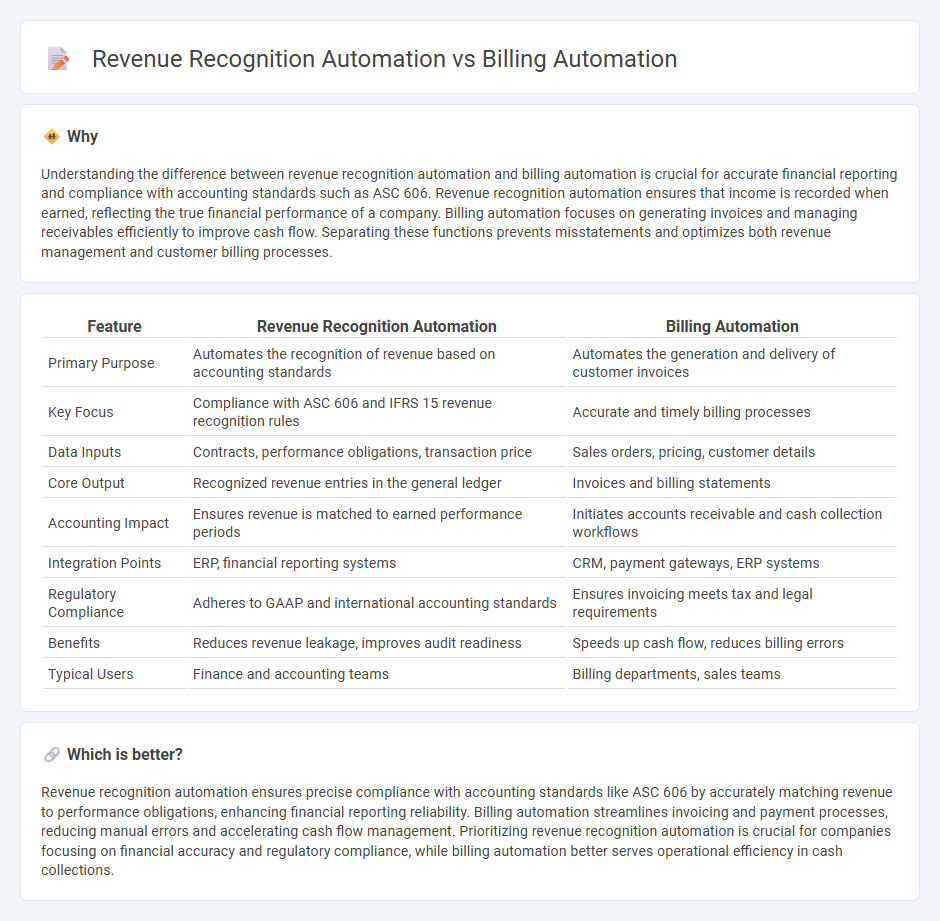

Understanding the difference between revenue recognition automation and billing automation is crucial for accurate financial reporting and compliance with accounting standards such as ASC 606. Revenue recognition automation ensures that income is recorded when earned, reflecting the true financial performance of a company. Billing automation focuses on generating invoices and managing receivables efficiently to improve cash flow. Separating these functions prevents misstatements and optimizes both revenue management and customer billing processes.

Comparison Table

| Feature | Revenue Recognition Automation | Billing Automation |

|---|---|---|

| Primary Purpose | Automates the recognition of revenue based on accounting standards | Automates the generation and delivery of customer invoices |

| Key Focus | Compliance with ASC 606 and IFRS 15 revenue recognition rules | Accurate and timely billing processes |

| Data Inputs | Contracts, performance obligations, transaction price | Sales orders, pricing, customer details |

| Core Output | Recognized revenue entries in the general ledger | Invoices and billing statements |

| Accounting Impact | Ensures revenue is matched to earned performance periods | Initiates accounts receivable and cash collection workflows |

| Integration Points | ERP, financial reporting systems | CRM, payment gateways, ERP systems |

| Regulatory Compliance | Adheres to GAAP and international accounting standards | Ensures invoicing meets tax and legal requirements |

| Benefits | Reduces revenue leakage, improves audit readiness | Speeds up cash flow, reduces billing errors |

| Typical Users | Finance and accounting teams | Billing departments, sales teams |

Which is better?

Revenue recognition automation ensures precise compliance with accounting standards like ASC 606 by accurately matching revenue to performance obligations, enhancing financial reporting reliability. Billing automation streamlines invoicing and payment processes, reducing manual errors and accelerating cash flow management. Prioritizing revenue recognition automation is crucial for companies focusing on financial accuracy and regulatory compliance, while billing automation better serves operational efficiency in cash collections.

Connection

Revenue recognition automation and billing automation are interconnected through their roles in streamlining financial processes and ensuring accurate revenue reporting. Revenue recognition automation applies accounting standards to determine when and how much revenue to record, while billing automation generates invoices based on contracts and usage data, feeding essential information into the revenue recognition system. Integrating these automations reduces manual errors, accelerates the financial close cycle, and ensures compliance with ASC 606 and IFRS 15 standards.

Key Terms

**Billing Automation:**

Billing automation streamlines invoicing processes by generating accurate bills, managing payment schedules, and reducing manual errors, significantly improving cash flow management. It integrates with CRM and ERP systems to ensure real-time synchronization of customer data and billing information, enhancing operational efficiency. Explore how advanced billing automation tools can transform your financial workflows for greater accuracy and speed.

Invoice Generation

Billing automation streamlines the invoice generation process by automatically creating accurate invoices based on predefined rules and customer data, reducing manual errors and improving cash flow efficiency. Revenue recognition automation ensures compliance with accounting standards by accurately matching revenue to the appropriate periods, reflecting the true financial performance without delays. Explore our detailed comparison to understand how each automation impacts your financial operations and boosts business accuracy.

Payment Processing

Billing automation streamlines invoicing and payment collection, reducing manual errors and accelerating cash flow by integrating with payment gateways for seamless transaction processing. Revenue recognition automation ensures compliance with financial standards by accurately recognizing revenue based on contract terms and delivery milestones, minimizing audit risks. Explore how combining payment processing with both billing and revenue recognition automation enhances financial accuracy and operational efficiency.

Source and External Links

What Is Automated Billing? - Automated billing uses software to collect data, generate and send invoices, process payments, and track transactions with minimal manual intervention, streamlining the entire billing workflow for businesses.

Automated billing systems explained - These systems integrate with company databases and CRMs to automatically create invoices, process payments through various gateways, send payment reminders, and provide real-time analytics--reducing errors and improving financial efficiency.

What is Automated Billing? - DealHub - Automated billing software handles recurring payments, sends overdue reminders, generates detailed financial reports, and integrates with existing accounting tools, offering businesses a comprehensive and customizable solution for managing invoicing and collections.

dowidth.com

dowidth.com