Environmental Social Governance (ESG) accounting focuses on measuring a company's impact on environmental, social, and governance factors, aligning financial performance with ethical and regulatory standards. Sustainability accounting, however, extends beyond ESG by integrating long-term environmental stewardship and resource management into overall financial reporting. Explore the distinctions and applications of these frameworks to enhance responsible business practices.

Why it is important

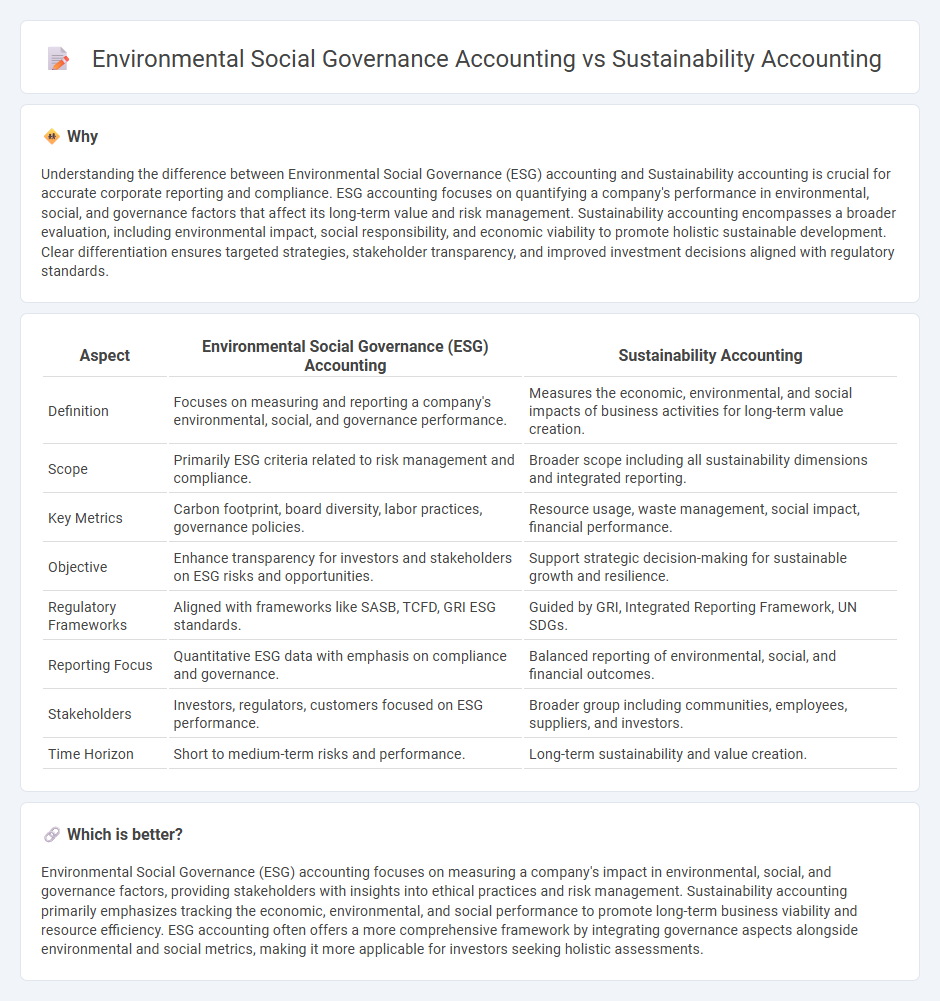

Understanding the difference between Environmental Social Governance (ESG) accounting and Sustainability accounting is crucial for accurate corporate reporting and compliance. ESG accounting focuses on quantifying a company's performance in environmental, social, and governance factors that affect its long-term value and risk management. Sustainability accounting encompasses a broader evaluation, including environmental impact, social responsibility, and economic viability to promote holistic sustainable development. Clear differentiation ensures targeted strategies, stakeholder transparency, and improved investment decisions aligned with regulatory standards.

Comparison Table

| Aspect | Environmental Social Governance (ESG) Accounting | Sustainability Accounting |

|---|---|---|

| Definition | Focuses on measuring and reporting a company's environmental, social, and governance performance. | Measures the economic, environmental, and social impacts of business activities for long-term value creation. |

| Scope | Primarily ESG criteria related to risk management and compliance. | Broader scope including all sustainability dimensions and integrated reporting. |

| Key Metrics | Carbon footprint, board diversity, labor practices, governance policies. | Resource usage, waste management, social impact, financial performance. |

| Objective | Enhance transparency for investors and stakeholders on ESG risks and opportunities. | Support strategic decision-making for sustainable growth and resilience. |

| Regulatory Frameworks | Aligned with frameworks like SASB, TCFD, GRI ESG standards. | Guided by GRI, Integrated Reporting Framework, UN SDGs. |

| Reporting Focus | Quantitative ESG data with emphasis on compliance and governance. | Balanced reporting of environmental, social, and financial outcomes. |

| Stakeholders | Investors, regulators, customers focused on ESG performance. | Broader group including communities, employees, suppliers, and investors. |

| Time Horizon | Short to medium-term risks and performance. | Long-term sustainability and value creation. |

Which is better?

Environmental Social Governance (ESG) accounting focuses on measuring a company's impact in environmental, social, and governance factors, providing stakeholders with insights into ethical practices and risk management. Sustainability accounting primarily emphasizes tracking the economic, environmental, and social performance to promote long-term business viability and resource efficiency. ESG accounting often offers a more comprehensive framework by integrating governance aspects alongside environmental and social metrics, making it more applicable for investors seeking holistic assessments.

Connection

Environmental Social Governance (ESG) accounting integrates non-financial factors such as environmental impact, social responsibility, and corporate governance into traditional accounting practices to provide a holistic view of a company's sustainability performance. Sustainability accounting focuses on measuring and reporting economic, environmental, and social impacts to support long-term value creation and stakeholder transparency. Both frameworks prioritize transparency, risk management, and ethical decision-making, reflecting the growing demand for corporate accountability in sustainable development.

Key Terms

Triple Bottom Line

Sustainability accounting integrates environmental, social, and economic performance by measuring a company's impact on the Triple Bottom Line, encompassing Planet, People, and Profit. Environmental Social Governance (ESG) accounting focuses more specifically on quantifying and reporting corporate governance, environmental responsibility, and social impact within investment and regulatory frameworks. Explore deeper insights into how these accounting approaches drive responsible business practices and long-term value creation.

Materiality Assessment

Sustainability accounting emphasizes measuring and reporting on a company's environmental, social, and economic impacts with a comprehensive materiality assessment that identifies issues affecting long-term value creation. Environmental Social Governance (ESG) accounting prioritizes stakeholder-related criteria and regulatory compliance, focusing on material topics that influence investor decisions and risk management. Explore the methodologies and frameworks used in both approaches to deepen your understanding of materiality assessment in sustainable business practices.

Integrated Reporting

Sustainability accounting emphasizes measuring and managing environmental, social, and economic impacts of business operations, while Environmental Social Governance (ESG) accounting focuses specifically on corporate governance, social responsibility, and environmental factors in investment decisions. Integrated Reporting combines financial and non-financial data, providing a holistic view of a company's performance and long-term value creation by linking sustainability accounting with ESG metrics. Explore more about how Integrated Reporting bridges these frameworks to enhance corporate transparency and stakeholder engagement.

Source and External Links

Sustainability accounting - Sustainability accounting is a subcategory of financial accounting that focuses on disclosing non-financial information about a company's environmental, social, and economic performance to external stakeholders, often using frameworks like the triple bottom line (People, Planet, Profit) and standards such as the Global Reporting Initiative (GRI) to improve transparency and accountability.

Sustainability accounting: Using accounting to better society - Also known as ESG (Environmental, Social, and Governance) accounting, sustainability accounting involves measuring, reporting, and verifying a company's impact on society and the environment, helping businesses set and achieve sustainability goals while being held accountable by investors, governments, and the public.

Sustainable Accounting: Measuring Environmental and Social Impact - Sustainable accounting is the process of quantifying and reporting an organization's environmental, social, and economic impacts, guided by global standards like those from the Sustainability Accounting Standards Board (SASB), to support informed decision-making and communicate sustainability performance to stakeholders.

dowidth.com

dowidth.com