Digital ledger technology enhances transparency and security by creating immutable records across decentralized networks, revolutionizing traditional accounting processes. Cloud accounting offers flexible, real-time financial management through internet-based platforms, enabling seamless collaboration and automated data synchronization. Explore how these innovative solutions transform financial record-keeping and decision-making in modern accounting.

Why it is important

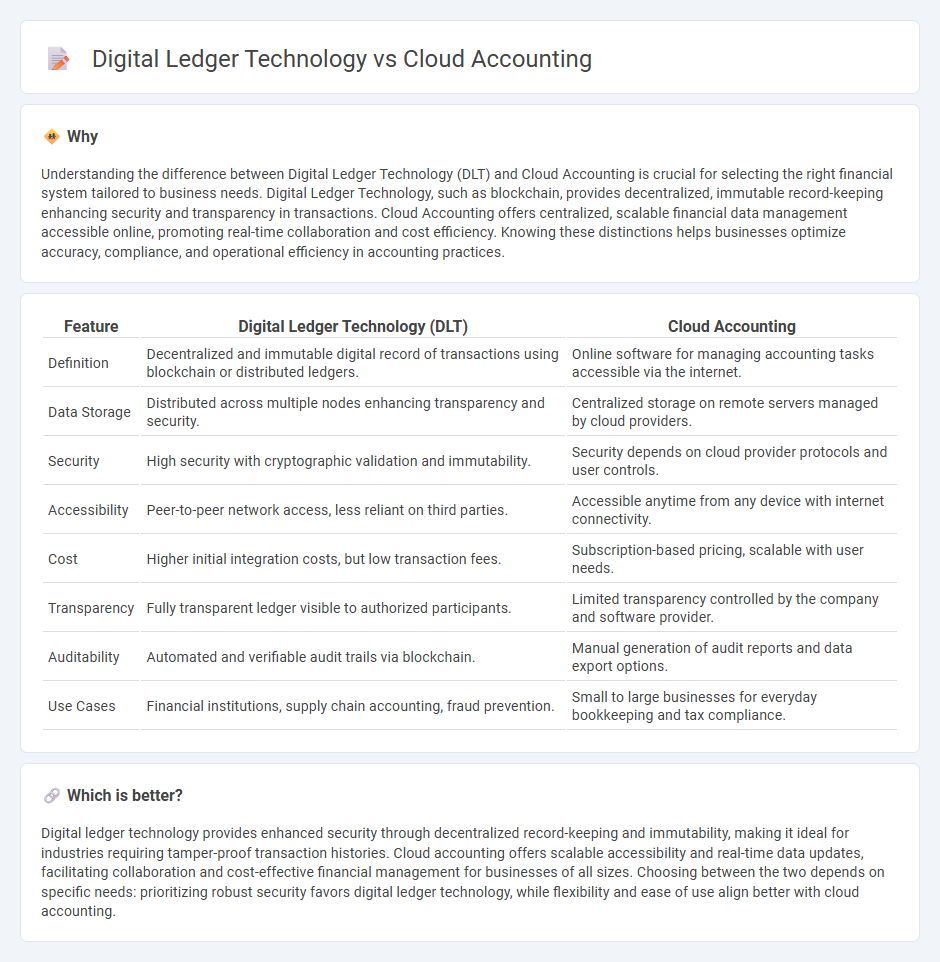

Understanding the difference between Digital Ledger Technology (DLT) and Cloud Accounting is crucial for selecting the right financial system tailored to business needs. Digital Ledger Technology, such as blockchain, provides decentralized, immutable record-keeping enhancing security and transparency in transactions. Cloud Accounting offers centralized, scalable financial data management accessible online, promoting real-time collaboration and cost efficiency. Knowing these distinctions helps businesses optimize accuracy, compliance, and operational efficiency in accounting practices.

Comparison Table

| Feature | Digital Ledger Technology (DLT) | Cloud Accounting |

|---|---|---|

| Definition | Decentralized and immutable digital record of transactions using blockchain or distributed ledgers. | Online software for managing accounting tasks accessible via the internet. |

| Data Storage | Distributed across multiple nodes enhancing transparency and security. | Centralized storage on remote servers managed by cloud providers. |

| Security | High security with cryptographic validation and immutability. | Security depends on cloud provider protocols and user controls. |

| Accessibility | Peer-to-peer network access, less reliant on third parties. | Accessible anytime from any device with internet connectivity. |

| Cost | Higher initial integration costs, but low transaction fees. | Subscription-based pricing, scalable with user needs. |

| Transparency | Fully transparent ledger visible to authorized participants. | Limited transparency controlled by the company and software provider. |

| Auditability | Automated and verifiable audit trails via blockchain. | Manual generation of audit reports and data export options. |

| Use Cases | Financial institutions, supply chain accounting, fraud prevention. | Small to large businesses for everyday bookkeeping and tax compliance. |

Which is better?

Digital ledger technology provides enhanced security through decentralized record-keeping and immutability, making it ideal for industries requiring tamper-proof transaction histories. Cloud accounting offers scalable accessibility and real-time data updates, facilitating collaboration and cost-effective financial management for businesses of all sizes. Choosing between the two depends on specific needs: prioritizing robust security favors digital ledger technology, while flexibility and ease of use align better with cloud accounting.

Connection

Digital ledger technology (DLT) and cloud accounting are connected through their ability to enhance data integrity, transparency, and accessibility in financial record-keeping. DLT provides a decentralized, tamper-proof ledger system that can be integrated with cloud accounting platforms to enable real-time transaction verification and secure data storage. This synergy improves auditability, reduces the risk of fraud, and streamlines accounting processes in businesses of all sizes.

Key Terms

Real-time Data Access

Cloud accounting enables businesses to access financial data instantly through internet-connected platforms, ensuring real-time visibility and streamlined decision-making. Digital ledger technology (DLT), such as blockchain, provides secure, tamper-proof transaction records, enhancing data integrity and transparency in real-time operations. Explore how integrating these technologies can revolutionize financial management and data accuracy.

Decentralization

Cloud accounting centralizes financial data on remote servers accessible via the internet, offering scalability and real-time collaboration but dependent on third-party providers. Digital ledger technology (DLT), including blockchain, decentralizes record-keeping across a distributed network of nodes, enhancing security, transparency, and resistance to tampering without relying on a single point of control. Explore how decentralization in DLT transforms accounting efficiency and trust by discovering its key applications and benefits.

Automation

Cloud accounting leverages internet-based platforms to automate financial processes, enabling real-time data access and streamlined bookkeeping for businesses of all sizes. Digital ledger technology (DLT), including blockchain, enhances automation by providing decentralized, immutable records that improve transaction security and transparency. Explore how integrating cloud accounting with DLT can revolutionize financial automation and unlock new efficiencies.

Source and External Links

Cloud Based Accounting: What is It and Why You Need It - Certinia - Cloud accounting is software hosted on remote servers accessed via the Internet, offering flexibility, real-time updates, scalability, and better collaboration compared to traditional systems.

15 Benefits of Cloud Accounting | NetSuite - Cloud accounting automates many tasks, improves tax compliance, enables remote work, reduces paper use, and enhances accuracy through features like automated transaction import and tax calculations.

Cloud Accounting Benefits | Xero US - Cloud accounting software keeps business books online with features such as real-time dashboards, multi-user access, automated bank feeds, and high security, allowing businesses to access financial data anytime from any device.

dowidth.com

dowidth.com