Embedded finance compliance ensures that financial services integrated within non-financial platforms adhere to industry-specific regulations, reducing risks associated with fraud and operational errors. Regulatory reporting involves the systematic submission of accurate financial data to government authorities to maintain transparency and fulfill legal obligations. Explore the differences between embedded finance compliance and regulatory reporting to enhance your accounting practices.

Why it is important

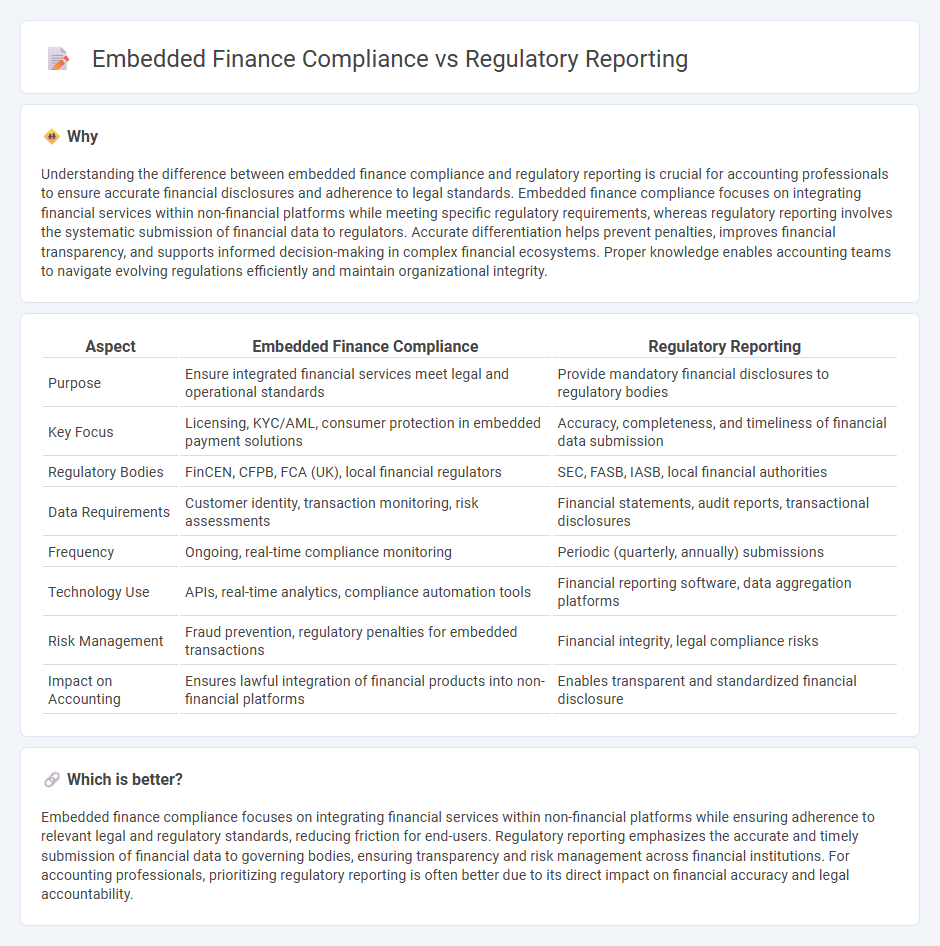

Understanding the difference between embedded finance compliance and regulatory reporting is crucial for accounting professionals to ensure accurate financial disclosures and adherence to legal standards. Embedded finance compliance focuses on integrating financial services within non-financial platforms while meeting specific regulatory requirements, whereas regulatory reporting involves the systematic submission of financial data to regulators. Accurate differentiation helps prevent penalties, improves financial transparency, and supports informed decision-making in complex financial ecosystems. Proper knowledge enables accounting teams to navigate evolving regulations efficiently and maintain organizational integrity.

Comparison Table

| Aspect | Embedded Finance Compliance | Regulatory Reporting |

|---|---|---|

| Purpose | Ensure integrated financial services meet legal and operational standards | Provide mandatory financial disclosures to regulatory bodies |

| Key Focus | Licensing, KYC/AML, consumer protection in embedded payment solutions | Accuracy, completeness, and timeliness of financial data submission |

| Regulatory Bodies | FinCEN, CFPB, FCA (UK), local financial regulators | SEC, FASB, IASB, local financial authorities |

| Data Requirements | Customer identity, transaction monitoring, risk assessments | Financial statements, audit reports, transactional disclosures |

| Frequency | Ongoing, real-time compliance monitoring | Periodic (quarterly, annually) submissions |

| Technology Use | APIs, real-time analytics, compliance automation tools | Financial reporting software, data aggregation platforms |

| Risk Management | Fraud prevention, regulatory penalties for embedded transactions | Financial integrity, legal compliance risks |

| Impact on Accounting | Ensures lawful integration of financial products into non-financial platforms | Enables transparent and standardized financial disclosure |

Which is better?

Embedded finance compliance focuses on integrating financial services within non-financial platforms while ensuring adherence to relevant legal and regulatory standards, reducing friction for end-users. Regulatory reporting emphasizes the accurate and timely submission of financial data to governing bodies, ensuring transparency and risk management across financial institutions. For accounting professionals, prioritizing regulatory reporting is often better due to its direct impact on financial accuracy and legal accountability.

Connection

Embedded finance compliance ensures that financial services integrated within non-financial platforms adhere to legal standards, directly impacting regulatory reporting accuracy and timeliness. Effective synchronization between embedded finance systems and regulatory reporting frameworks reduces risks of non-compliance and financial penalties. Streamlined data flows from embedded finance to regulatory bodies enhance transparency, auditability, and real-time monitoring of financial transactions.

Key Terms

Regulatory reporting:

Regulatory reporting involves the systematic submission of financial and operational data to regulatory authorities to ensure transparency, accuracy, and adherence to legal standards, playing a crucial role in risk management and corporate governance. This compliance process mandates detailed disclosures, timeliness, and format adherence, with frameworks such as Basel III, MiFID II, and Dodd-Frank shaping industry practices. Discover more about how regulatory reporting frameworks safeguard financial ecosystems and drive compliance efficiency.

Financial statements

Regulatory reporting ensures that financial statements comply with standards set by authorities such as the SEC and FASB, providing transparency and accuracy for stakeholders. Embedded finance compliance involves integrating these reporting requirements seamlessly within platforms offering banking, lending, or payments, adhering to industry-specific regulations like GDPR or PCI DSS. Discover how aligning regulatory reporting with embedded finance compliance optimizes financial statement accuracy and regulatory adherence.

Basel III

Basel III establishes stringent regulatory reporting standards that ensure banks maintain adequate capital reserves and liquidity to mitigate systemic risks and enhance financial stability. Embedded finance compliance requires aligning these Basel III mandates within third-party platforms, demanding robust data integration and real-time risk assessment to prevent regulatory breaches. Explore how Basel III shapes compliance frameworks in embedded finance for comprehensive risk management.

Source and External Links

Regulatory Reporting - Regulatory reporting is the process by which financial institutions submit data to regulatory authorities to ensure compliance with statutory and regulatory requirements.

What is Regulatory Reporting: A Beginner's Guide - This guide explains that regulatory reporting involves collecting and submitting financial and operational information to regulatory bodies to demonstrate compliance.

What Is Regulatory Reporting? A Complete Guide - This guide provides an overview of regulatory reporting, including its purpose and the differences between regulatory and financial reporting.

dowidth.com

dowidth.com