Carbon accounting measures greenhouse gas emissions to evaluate environmental impact, focusing on sustainability and regulatory compliance. Cash accounting records financial transactions only when cash changes hands, emphasizing straightforward bookkeeping and cash flow. Explore the differences to understand how each approach supports business goals and environmental responsibility.

Why it is important

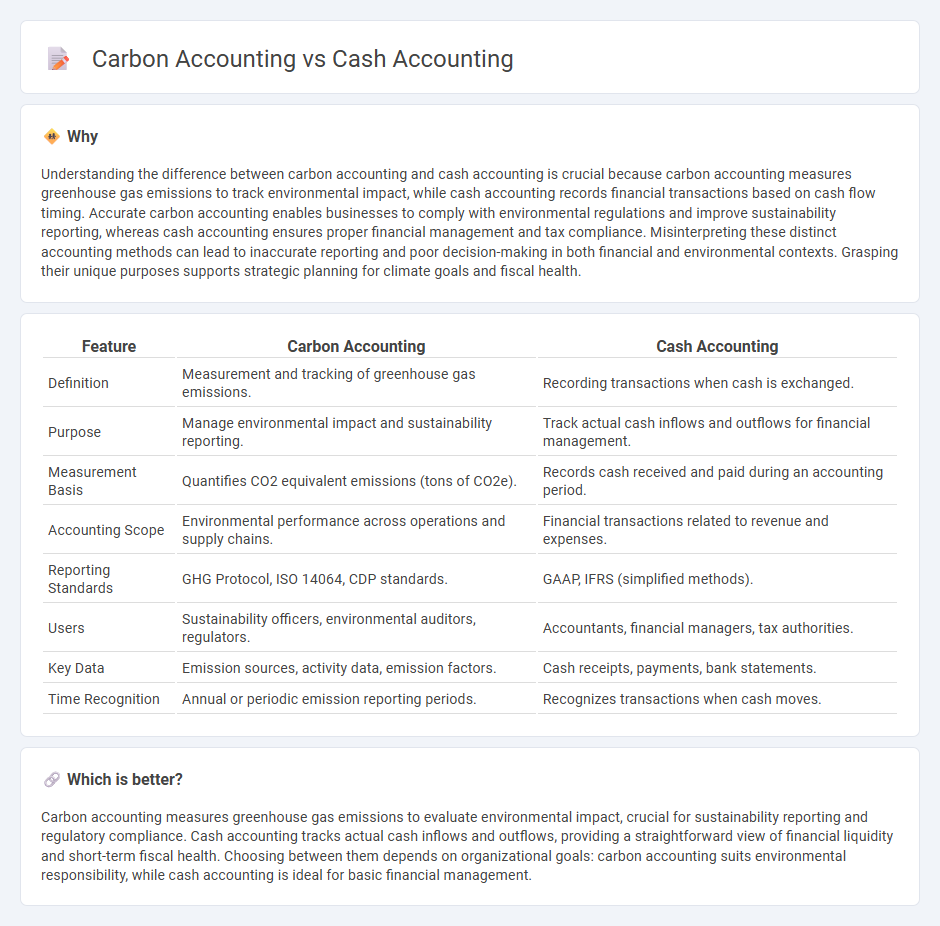

Understanding the difference between carbon accounting and cash accounting is crucial because carbon accounting measures greenhouse gas emissions to track environmental impact, while cash accounting records financial transactions based on cash flow timing. Accurate carbon accounting enables businesses to comply with environmental regulations and improve sustainability reporting, whereas cash accounting ensures proper financial management and tax compliance. Misinterpreting these distinct accounting methods can lead to inaccurate reporting and poor decision-making in both financial and environmental contexts. Grasping their unique purposes supports strategic planning for climate goals and fiscal health.

Comparison Table

| Feature | Carbon Accounting | Cash Accounting |

|---|---|---|

| Definition | Measurement and tracking of greenhouse gas emissions. | Recording transactions when cash is exchanged. |

| Purpose | Manage environmental impact and sustainability reporting. | Track actual cash inflows and outflows for financial management. |

| Measurement Basis | Quantifies CO2 equivalent emissions (tons of CO2e). | Records cash received and paid during an accounting period. |

| Accounting Scope | Environmental performance across operations and supply chains. | Financial transactions related to revenue and expenses. |

| Reporting Standards | GHG Protocol, ISO 14064, CDP standards. | GAAP, IFRS (simplified methods). |

| Users | Sustainability officers, environmental auditors, regulators. | Accountants, financial managers, tax authorities. |

| Key Data | Emission sources, activity data, emission factors. | Cash receipts, payments, bank statements. |

| Time Recognition | Annual or periodic emission reporting periods. | Recognizes transactions when cash moves. |

Which is better?

Carbon accounting measures greenhouse gas emissions to evaluate environmental impact, crucial for sustainability reporting and regulatory compliance. Cash accounting tracks actual cash inflows and outflows, providing a straightforward view of financial liquidity and short-term fiscal health. Choosing between them depends on organizational goals: carbon accounting suits environmental responsibility, while cash accounting is ideal for basic financial management.

Connection

Carbon accounting tracks greenhouse gas emissions to evaluate environmental impact, while cash accounting records financial transactions based on cash flow timing. Both practices intersect in sustainability reporting, where accurate financial data supports carbon footprint assessments and enables businesses to allocate budgets for emission reduction initiatives. Integrating carbon metrics with cash accounting improves transparency and drives strategic investments in sustainable operations.

Key Terms

Timing of Recognition

Cash accounting recognizes transactions only when cash is exchanged, leading to immediate reflection of financial activities. Carbon accounting tracks greenhouse gas emissions based on when they occur, independent of cash flow timing, ensuring accurate environmental impact measurement. Explore the nuances of timing in accounting methods to better manage financial and sustainability reporting.

Measurement Basis

Cash accounting records transactions based on actual cash flow, recognizing revenues and expenses when money changes hands, whereas carbon accounting measures greenhouse gas emissions using standardized protocols to quantify the environmental impact of activities regardless of cash flow timing. Carbon accounting incorporates scopes 1, 2, and 3 emissions, providing a comprehensive assessment of direct and indirect emissions, while cash accounting centers solely on financial exchanges. Explore further to understand how measurement bases influence financial and environmental reporting accuracy.

Reporting Standards

Cash accounting records financial transactions when cash changes hands, emphasizing simplicity and immediate recognition of revenues and expenses. Carbon accounting follows international reporting standards such as the Greenhouse Gas Protocol and ISO 14064, focusing on accurate measurement and reporting of greenhouse gas emissions for sustainability transparency. Explore detailed comparisons and standards to enhance your knowledge of financial and environmental reporting.

Source and External Links

Cash-based accounting: A guide to the cash basis - This resource provides an overview of cash-based accounting, including how it works, its pros and cons, and its impact on tax reporting.

Cash Basis Accounting: Definition, Example, Pros and Cons - This webpage explains the definition, examples, and advantages and disadvantages of cash basis accounting, along with its use in small businesses.

cash method of accounting - This article discusses the cash method of accounting, highlighting its usage by individuals and small businesses, and contrasting it with the accrual method.

dowidth.com

dowidth.com