Tokenized assets accounting involves recording digital representations of real-world assets with distinct ownership rights and regulated frameworks, while cryptocurrencies accounting requires managing decentralized digital currencies recognized primarily for their medium of exchange and speculative nature. Both accounting methods must address challenges like volatility, valuation, and regulatory compliance, but tokenized assets often demand integration with traditional asset ledgers. Explore in-depth differences and best practices in accounting for tokenized assets versus cryptocurrencies.

Why it is important

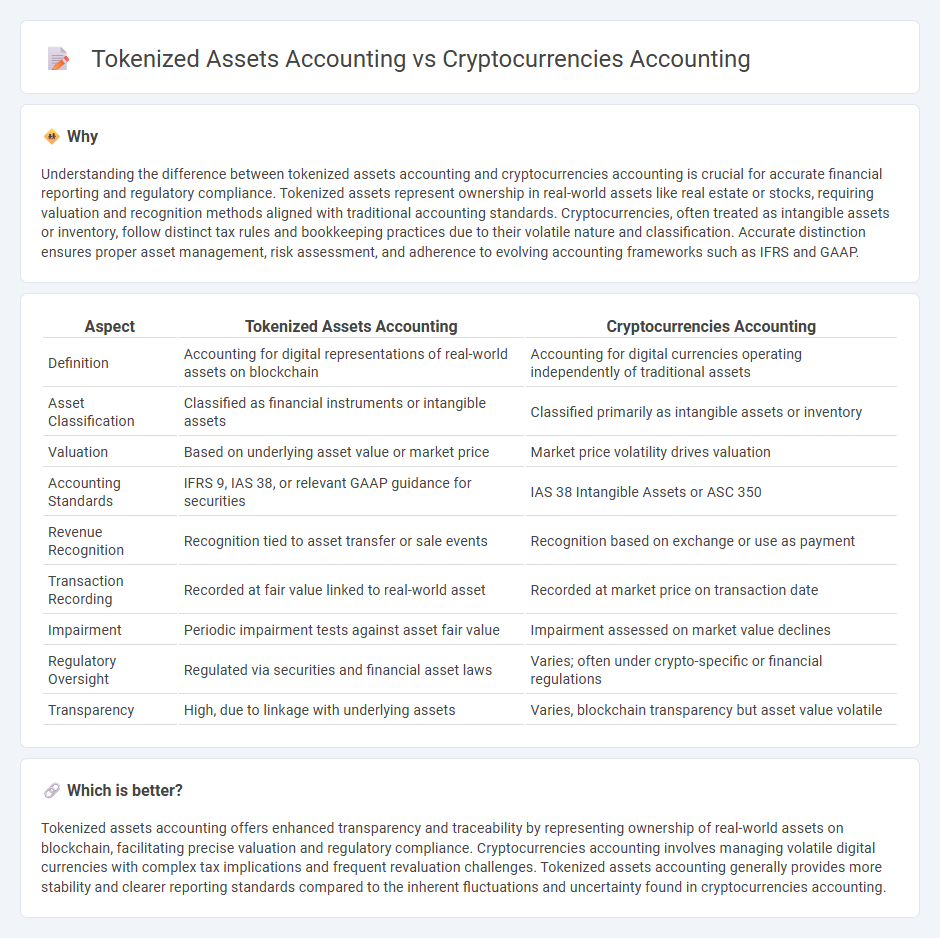

Understanding the difference between tokenized assets accounting and cryptocurrencies accounting is crucial for accurate financial reporting and regulatory compliance. Tokenized assets represent ownership in real-world assets like real estate or stocks, requiring valuation and recognition methods aligned with traditional accounting standards. Cryptocurrencies, often treated as intangible assets or inventory, follow distinct tax rules and bookkeeping practices due to their volatile nature and classification. Accurate distinction ensures proper asset management, risk assessment, and adherence to evolving accounting frameworks such as IFRS and GAAP.

Comparison Table

| Aspect | Tokenized Assets Accounting | Cryptocurrencies Accounting |

|---|---|---|

| Definition | Accounting for digital representations of real-world assets on blockchain | Accounting for digital currencies operating independently of traditional assets |

| Asset Classification | Classified as financial instruments or intangible assets | Classified primarily as intangible assets or inventory |

| Valuation | Based on underlying asset value or market price | Market price volatility drives valuation |

| Accounting Standards | IFRS 9, IAS 38, or relevant GAAP guidance for securities | IAS 38 Intangible Assets or ASC 350 |

| Revenue Recognition | Recognition tied to asset transfer or sale events | Recognition based on exchange or use as payment |

| Transaction Recording | Recorded at fair value linked to real-world asset | Recorded at market price on transaction date |

| Impairment | Periodic impairment tests against asset fair value | Impairment assessed on market value declines |

| Regulatory Oversight | Regulated via securities and financial asset laws | Varies; often under crypto-specific or financial regulations |

| Transparency | High, due to linkage with underlying assets | Varies, blockchain transparency but asset value volatile |

Which is better?

Tokenized assets accounting offers enhanced transparency and traceability by representing ownership of real-world assets on blockchain, facilitating precise valuation and regulatory compliance. Cryptocurrencies accounting involves managing volatile digital currencies with complex tax implications and frequent revaluation challenges. Tokenized assets accounting generally provides more stability and clearer reporting standards compared to the inherent fluctuations and uncertainty found in cryptocurrencies accounting.

Connection

Tokenized assets accounting and cryptocurrencies accounting are connected through the shared need to accurately record and report digital asset transactions on the blockchain ledger, ensuring compliance with financial regulations. Both require specialized accounting frameworks that address valuation challenges, asset classification, and secure custody solutions for digital tokens. Advances in decentralized finance (DeFi) and blockchain technology continuously influence accounting standards, integrating tokenized asset management with cryptocurrency accounting practices.

Key Terms

Fair Value Measurement

Fair value measurement in cryptocurrencies accounting involves determining the current market price of digital currencies using observable inputs such as active exchange rates and trading volumes. Tokenized assets accounting requires valuing underlying assets represented by tokens, often relying on appraisals, market comparables, or discounted cash flow analyses reflecting their intrinsic value. Explore the detailed methodologies and regulatory considerations behind these valuation approaches to enhance your understanding.

Impairment Testing

Impairment testing in cryptocurrencies accounting centers on evaluating digital assets' fair value fluctuations and assessing temporary or permanent declines in value based on market volatility. In tokenized assets accounting, impairment testing involves analyzing underlying asset performance and potential legal or regulatory impacts that affect token valuations. Explore detailed methodologies and standards for impairment testing in both domains to enhance your financial reporting accuracy.

Source and External Links

FASB Announces First-Ever Crypto Accounting Rules | Gordon Law - The Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2023-08, requiring cryptocurrencies to be measured at their current fair market value and reported directly in a company's net income, marking a shift from the prior intangible asset treatment and enhancing transparency in financial reporting as of 2025.

FASB's New Guidance on Accounting for Crypto Assets - The new FASB guidance mandates measuring crypto assets at fair value with changes reflected in net income, and provides specific accounting treatments for cryptocurrency mining activities, including recognizing mined crypto at fair value as income and associated costs as expenses.

Accounting for Cryptocurrencies in 2025 - BDO USA - ASU 2023-08 requires all entities holding qualifying crypto assets to measure them at fair value with changes reported in net income each period, along with enhanced disclosure requirements effective for fiscal years beginning after December 15, 2024.

dowidth.com

dowidth.com