Algorithmic compliance refers to the use of automated systems and software to ensure adherence to accounting standards by systematically applying rules and controls. Substantive compliance focuses on the accuracy and validity of financial data through detailed verification and analysis beyond mere rule-following. Explore further to understand how these compliance approaches impact financial reporting and audit quality.

Why it is important

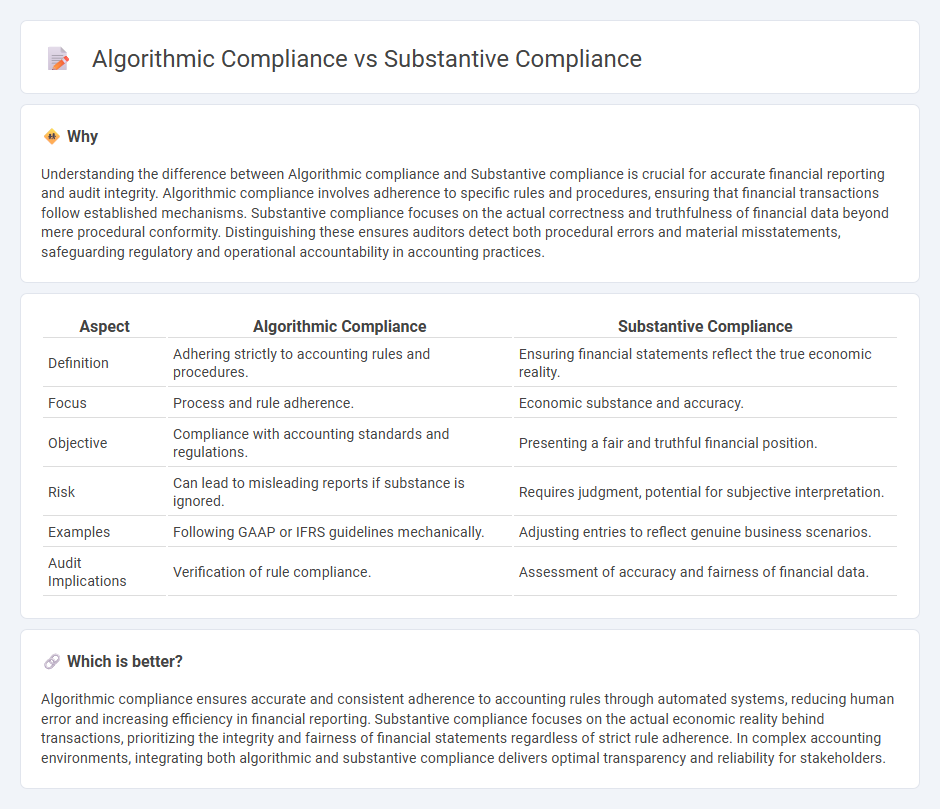

Understanding the difference between Algorithmic compliance and Substantive compliance is crucial for accurate financial reporting and audit integrity. Algorithmic compliance involves adherence to specific rules and procedures, ensuring that financial transactions follow established mechanisms. Substantive compliance focuses on the actual correctness and truthfulness of financial data beyond mere procedural conformity. Distinguishing these ensures auditors detect both procedural errors and material misstatements, safeguarding regulatory and operational accountability in accounting practices.

Comparison Table

| Aspect | Algorithmic Compliance | Substantive Compliance |

|---|---|---|

| Definition | Adhering strictly to accounting rules and procedures. | Ensuring financial statements reflect the true economic reality. |

| Focus | Process and rule adherence. | Economic substance and accuracy. |

| Objective | Compliance with accounting standards and regulations. | Presenting a fair and truthful financial position. |

| Risk | Can lead to misleading reports if substance is ignored. | Requires judgment, potential for subjective interpretation. |

| Examples | Following GAAP or IFRS guidelines mechanically. | Adjusting entries to reflect genuine business scenarios. |

| Audit Implications | Verification of rule compliance. | Assessment of accuracy and fairness of financial data. |

Which is better?

Algorithmic compliance ensures accurate and consistent adherence to accounting rules through automated systems, reducing human error and increasing efficiency in financial reporting. Substantive compliance focuses on the actual economic reality behind transactions, prioritizing the integrity and fairness of financial statements regardless of strict rule adherence. In complex accounting environments, integrating both algorithmic and substantive compliance delivers optimal transparency and reliability for stakeholders.

Connection

Algorithmic compliance and substantive compliance intersect in accounting through the integration of automated processes that ensure adherence to regulatory standards while verifying the accuracy of financial data. Algorithmic compliance systems use predefined rules and software to monitor transactions in real-time, enhancing the detection of discrepancies and potential fraud. Substantive compliance focuses on the thorough evaluation of financial records and controls, which are increasingly supported by algorithm-driven insights to validate the integrity and reliability of accounting information.

Key Terms

Judgment-based Verification

Substantive compliance emphasizes adherence to the spirit and intent of regulations through judgment-based verification, ensuring that outcomes align with legal and ethical standards beyond mere rule-following. Algorithmic compliance relies on automated processes and predefined codes to verify adherence, often lacking the nuanced assessment that human judgment offers. Explore deeper insights into how judgment-based verification enhances compliance effectiveness compared to algorithmic methods.

Automated Controls

Automated controls in substantive compliance emphasize verifying transaction accuracy and data integrity, ensuring regulatory adherence through direct evidence assessment, while algorithmic compliance relies on programmed rules and predictive analytics to monitor and flag potential compliance issues in real-time. Substantive controls often involve detailed audit trails and manual validation checkpoints, contrasting with algorithmic methods that automate decision-making processes based on large datasets. Discover how integrating both approaches can enhance compliance frameworks and risk management strategies.

Regulatory Interpretation

Substantive compliance emphasizes adhering to the underlying intent and goals of regulations, ensuring actions meet the regulatory purpose beyond mere rule-following. Algorithmic compliance centers on automating rule-checking through software, focusing on literal interpretation and procedural adherence to regulatory texts. Explore how regulatory interpretation influences the effectiveness of both approaches and their practical implications.

Source and External Links

What does 'substantive compliance' really mean? - There is no single explicit threshold for 'substantive compliance': firms must take action on all relevant regulatory requirements--even if those actions are workarounds, no-changes, or deferrals--and be prepared to demonstrate their approach when challenged by regulators.

substantial compliance Definition, Meaning & Usage - 'Substantial compliance' means meeting the main or crucial requirements of a rule, contract, or law, fulfilling its purpose even if not all specific details are followed exactly.

42 CFR SS 488.301 - Definitions - In healthcare regulation, 'substantial compliance' is a level where any identified deficiencies do not pose more than a minimal risk to resident health or safety.

dowidth.com

dowidth.com