Real-time expense recognition records costs immediately when incurred, enhancing accuracy in financial reporting by reflecting current expenditures. The matching principle aligns expenses with related revenues in the same period, ensuring consistent and meaningful profit measurement. Explore detailed comparisons to understand how these methods impact your accounting practices.

Why it is important

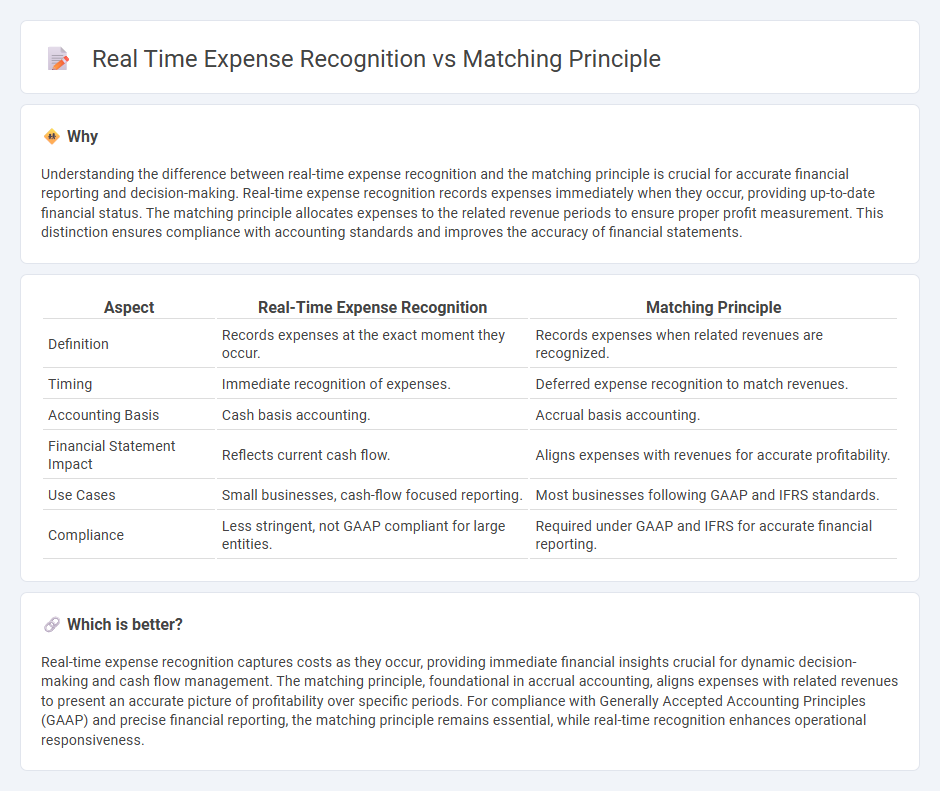

Understanding the difference between real-time expense recognition and the matching principle is crucial for accurate financial reporting and decision-making. Real-time expense recognition records expenses immediately when they occur, providing up-to-date financial status. The matching principle allocates expenses to the related revenue periods to ensure proper profit measurement. This distinction ensures compliance with accounting standards and improves the accuracy of financial statements.

Comparison Table

| Aspect | Real-Time Expense Recognition | Matching Principle |

|---|---|---|

| Definition | Records expenses at the exact moment they occur. | Records expenses when related revenues are recognized. |

| Timing | Immediate recognition of expenses. | Deferred expense recognition to match revenues. |

| Accounting Basis | Cash basis accounting. | Accrual basis accounting. |

| Financial Statement Impact | Reflects current cash flow. | Aligns expenses with revenues for accurate profitability. |

| Use Cases | Small businesses, cash-flow focused reporting. | Most businesses following GAAP and IFRS standards. |

| Compliance | Less stringent, not GAAP compliant for large entities. | Required under GAAP and IFRS for accurate financial reporting. |

Which is better?

Real-time expense recognition captures costs as they occur, providing immediate financial insights crucial for dynamic decision-making and cash flow management. The matching principle, foundational in accrual accounting, aligns expenses with related revenues to present an accurate picture of profitability over specific periods. For compliance with Generally Accepted Accounting Principles (GAAP) and precise financial reporting, the matching principle remains essential, while real-time recognition enhances operational responsiveness.

Connection

Real-time expense recognition ensures that expenses are recorded immediately as they are incurred, accurately reflecting current financial obligations. This practice aligns with the matching principle, which requires that expenses be recognized in the same accounting period as the related revenues to provide a true measure of profitability. Integrating real-time expense tracking with the matching principle enhances financial accuracy and improves decision-making by presenting a clear picture of financial performance.

Key Terms

Accrual Basis

The matching principle under accrual basis accounting ensures expenses are recorded in the same period as the revenues they help generate, providing accurate financial performance measurement. Real-time expense recognition in accrual accounting records expenses as they are incurred, regardless of cash payment timing, enhancing the alignment of financial data with actual business activities. Explore further to understand how these concepts optimize financial reporting accuracy in accrual accounting.

Timing of Recognition

The matching principle mandates expenses to be recognized in the same period as the related revenues, ensuring accurate profit measurement. Real-time expense recognition records expenses immediately when incurred, providing timely financial insight but may not align with revenue recognition. Explore how these timing differences impact financial reporting accuracy.

Financial Statements Accuracy

The matching principle ensures expenses are recorded in the same period as the revenues they help generate, enhancing the accuracy of financial statements by aligning costs with related income. Real-time expense recognition records costs immediately as they occur, promoting timely data but risking mismatched periods if revenues arise later. Explore more to understand how balancing these approaches improves overall financial reporting precision.

Source and External Links

Matching Principle: Understanding How It Works - The matching principle is an international accounting principle that requires all revenues and related expenses to be attributed to the same period in which the revenue is earned, ensuring efforts are linked with accomplishments.

Matching principle definition - This principle requires that revenues and related expenses are recognized together in the same reporting period to properly reflect cause-and-effect relationships and ensure profits are not artificially accelerated or delayed.

What Is the Matching Principle and Why Is It Important? - The matching principle mandates that businesses record expenses alongside the revenues they earn within the same period, forming a core part of accrual accounting and GAAP to provide clear tracking of financial performance.

dowidth.com

dowidth.com