Cryptocurrency valuation involves assessing digital assets based on market demand, transaction volume, and blockchain technology, differing significantly from intangible asset valuation, which focuses on assets such as patents or trademarks using methods like cost, market, or income approaches. While intangible asset valuation emphasizes legal rights and future income potential, cryptocurrency valuation is highly volatile and influenced by regulatory changes and market sentiment. Explore further to understand the key differences and methodologies behind these critical valuation processes.

Why it is important

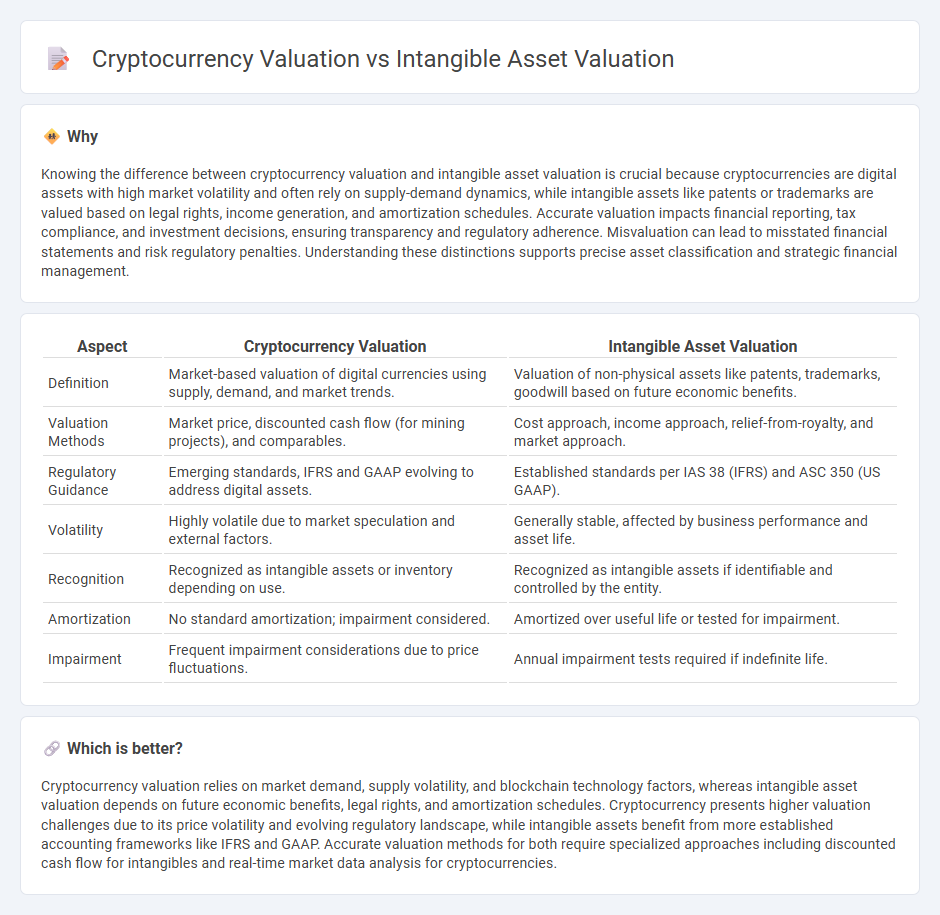

Knowing the difference between cryptocurrency valuation and intangible asset valuation is crucial because cryptocurrencies are digital assets with high market volatility and often rely on supply-demand dynamics, while intangible assets like patents or trademarks are valued based on legal rights, income generation, and amortization schedules. Accurate valuation impacts financial reporting, tax compliance, and investment decisions, ensuring transparency and regulatory adherence. Misvaluation can lead to misstated financial statements and risk regulatory penalties. Understanding these distinctions supports precise asset classification and strategic financial management.

Comparison Table

| Aspect | Cryptocurrency Valuation | Intangible Asset Valuation |

|---|---|---|

| Definition | Market-based valuation of digital currencies using supply, demand, and market trends. | Valuation of non-physical assets like patents, trademarks, goodwill based on future economic benefits. |

| Valuation Methods | Market price, discounted cash flow (for mining projects), and comparables. | Cost approach, income approach, relief-from-royalty, and market approach. |

| Regulatory Guidance | Emerging standards, IFRS and GAAP evolving to address digital assets. | Established standards per IAS 38 (IFRS) and ASC 350 (US GAAP). |

| Volatility | Highly volatile due to market speculation and external factors. | Generally stable, affected by business performance and asset life. |

| Recognition | Recognized as intangible assets or inventory depending on use. | Recognized as intangible assets if identifiable and controlled by the entity. |

| Amortization | No standard amortization; impairment considered. | Amortized over useful life or tested for impairment. |

| Impairment | Frequent impairment considerations due to price fluctuations. | Annual impairment tests required if indefinite life. |

Which is better?

Cryptocurrency valuation relies on market demand, supply volatility, and blockchain technology factors, whereas intangible asset valuation depends on future economic benefits, legal rights, and amortization schedules. Cryptocurrency presents higher valuation challenges due to its price volatility and evolving regulatory landscape, while intangible assets benefit from more established accounting frameworks like IFRS and GAAP. Accurate valuation methods for both require specialized approaches including discounted cash flow for intangibles and real-time market data analysis for cryptocurrencies.

Connection

Cryptocurrency valuation and intangible asset valuation are connected through their reliance on market-based approaches and fair value measurements. Both require assessing future economic benefits, considering factors like market demand, technological utility, and regulatory impacts. Accurate valuation models enhance financial reporting, risk management, and investment decision-making in accounting practices.

Key Terms

Fair Value

Fair value measurement of intangible assets involves assessing market participant assumptions, emphasizing factors like useful life, risk, and future cash flows under IFRS 13 guidelines. Cryptocurrency valuation, driven by market demand, supply, and network utility, lacks consistent regulatory frameworks, making fair value estimation more volatile and speculative. Explore in depth the contrasting methodologies and challenges in fair value assessment of these unique asset classes.

Amortization

Intangible asset valuation often incorporates amortization to systematically expense the asset's cost over its useful life, reflecting its diminishing value on financial statements. In contrast, cryptocurrency valuation lacks amortization because these digital assets do not have a determinable lifespan or systematic consumption pattern, resulting in valuation based on market price fluctuations. Explore the differences in accounting treatment and valuation methodologies for a deeper understanding.

Market Volatility

Intangible asset valuation depends on stable metrics like historical earnings, brand strength, and intellectual property rights, while cryptocurrency valuation is heavily influenced by market volatility, trading volume, and investor sentiment. Cryptocurrencies often experience rapid price fluctuations due to speculative trading and regulatory news, unlike intangible assets that have more predictable cash flow projections. Explore detailed methodologies and market trends to better understand how volatility impacts these distinct valuation models.

Source and External Links

Intangible Asset Valuation: 5 Valuation Methods & Guide - This resource explains various valuation methods including the With-and-Without Method, describing step-by-step how to calculate the value of intangible assets like trademarks using discounted cash flow models and accounting for tax benefits and probabilities.

What Is Intangible Asset Valuation? - Defines intangible asset valuation as determining the monetary worth of non-physical assets and details three primary approaches: Income, Market, and Cost, highlighting specific income-based techniques like Relief from Royalty and With-and-Without Methods.

5 Methods For Valuing Intangible Assets In Your Company - Describes five common valuation methods including Cost Approach, Market Approach, Income Approach, qualitative assessments, and hybrid approaches, emphasizing the importance of selecting an approach based on data availability and asset type.

dowidth.com

dowidth.com