Digital ledger technology revolutionizes accounting by providing a decentralized, tamper-proof record of transactions with real-time updates across multiple users. Double-entry bookkeeping remains the foundational method, ensuring accuracy through paired debit and credit entries that balance each financial transaction. Explore the advantages and applications of both methods to enhance your accounting practices.

Why it is important

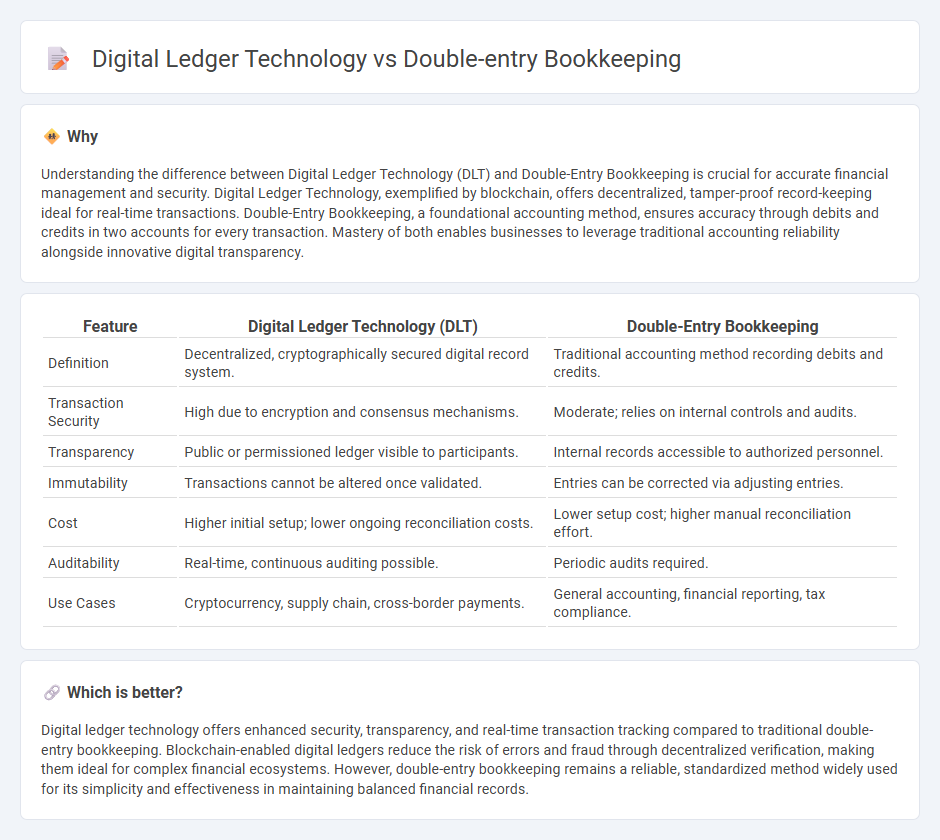

Understanding the difference between Digital Ledger Technology (DLT) and Double-Entry Bookkeeping is crucial for accurate financial management and security. Digital Ledger Technology, exemplified by blockchain, offers decentralized, tamper-proof record-keeping ideal for real-time transactions. Double-Entry Bookkeeping, a foundational accounting method, ensures accuracy through debits and credits in two accounts for every transaction. Mastery of both enables businesses to leverage traditional accounting reliability alongside innovative digital transparency.

Comparison Table

| Feature | Digital Ledger Technology (DLT) | Double-Entry Bookkeeping |

|---|---|---|

| Definition | Decentralized, cryptographically secured digital record system. | Traditional accounting method recording debits and credits. |

| Transaction Security | High due to encryption and consensus mechanisms. | Moderate; relies on internal controls and audits. |

| Transparency | Public or permissioned ledger visible to participants. | Internal records accessible to authorized personnel. |

| Immutability | Transactions cannot be altered once validated. | Entries can be corrected via adjusting entries. |

| Cost | Higher initial setup; lower ongoing reconciliation costs. | Lower setup cost; higher manual reconciliation effort. |

| Auditability | Real-time, continuous auditing possible. | Periodic audits required. |

| Use Cases | Cryptocurrency, supply chain, cross-border payments. | General accounting, financial reporting, tax compliance. |

Which is better?

Digital ledger technology offers enhanced security, transparency, and real-time transaction tracking compared to traditional double-entry bookkeeping. Blockchain-enabled digital ledgers reduce the risk of errors and fraud through decentralized verification, making them ideal for complex financial ecosystems. However, double-entry bookkeeping remains a reliable, standardized method widely used for its simplicity and effectiveness in maintaining balanced financial records.

Connection

Digital ledger technology (DLT) enhances double-entry bookkeeping by providing a decentralized and immutable record of transactions, ensuring higher accuracy and transparency in accounting processes. Each entry in double-entry bookkeeping is recorded on a tamper-proof digital ledger, reducing errors and fraud while streamlining audit trails. By integrating DLT with traditional bookkeeping, businesses achieve real-time reconciliation and improved financial data integrity.

Key Terms

**Double-entry bookkeeping:**

Double-entry bookkeeping is a fundamental accounting method that records financial transactions in two corresponding accounts: debits and credits, ensuring accuracy and balance in financial statements. This system facilitates error detection and provides a comprehensive view of an organization's financial health by maintaining detailed records of assets, liabilities, equity, revenues, and expenses. Explore deeper insights into how double-entry bookkeeping enhances financial transparency and accountability.

Debit and Credit

Double-entry bookkeeping records every financial transaction with equal debits and credits, ensuring balanced accounts and accurate financial statements. Digital ledger technology (DLT) extends this concept by decentralizing records across multiple nodes, enhancing transparency and security while maintaining immutability of debit and credit entries. Explore how integrating these systems can optimize financial accuracy and trust in your business operations.

Ledger

Double-entry bookkeeping records financial transactions in two accounts to ensure accuracy and balance, providing a clear audit trail through debit and credit entries. Digital ledger technology (DLT), including blockchain, offers a decentralized, tamper-resistant ledger that enhances transparency and security by distributing transaction records across a network. Explore how these ledger systems revolutionize financial management and data integrity by learning more about their unique features and applications.

Source and External Links

What is Double-Entry Bookkeeping? - Double-entry bookkeeping is a system where every transaction is recorded twice, using debits and credits to keep the accounting equation (Assets = Liabilities + Equity) balanced, ensuring accuracy and minimizing errors by recording both sides of a transaction.

Double-Entry Accounting: What It Is and Why It Matters - This bookkeeping method records every transaction as one debit and one credit, tracking not just revenue and expenses but also assets, liabilities, and equity, thus providing a complete picture of financial movement in a business.

What Is Double-Entry Bookkeeping? A Simple Guide for ... - Double-entry bookkeeping requires that total debits equal total credits for each transaction, maintaining the fundamental accounting equation and classifying entries into five account types: assets, liabilities, equity, income, and expenses.

dowidth.com

dowidth.com