Tokenized assets accounting involves recording and valuing digital representations of assets on a blockchain, focusing on transparency, immutability, and real-time tracking of ownership. Inventory accounting manages physical goods held for sale, emphasizing cost methods like FIFO, LIFO, or weighted average to determine the value of stock. Explore the differences in detail to understand how these accounting methods impact financial reporting and asset management.

Why it is important

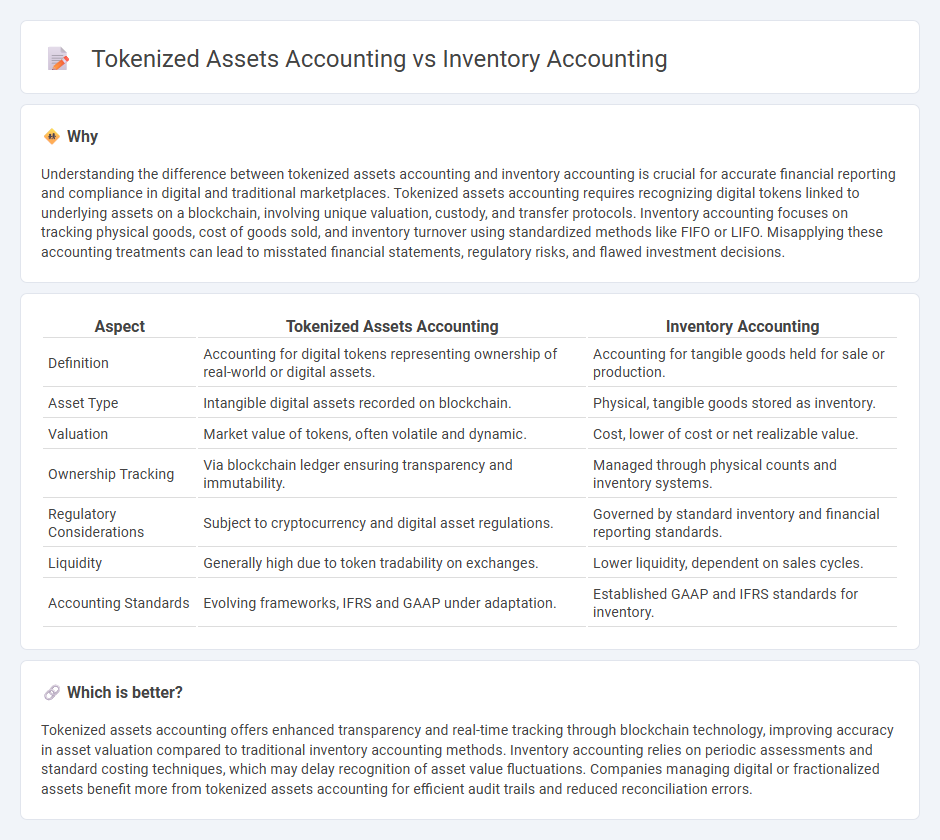

Understanding the difference between tokenized assets accounting and inventory accounting is crucial for accurate financial reporting and compliance in digital and traditional marketplaces. Tokenized assets accounting requires recognizing digital tokens linked to underlying assets on a blockchain, involving unique valuation, custody, and transfer protocols. Inventory accounting focuses on tracking physical goods, cost of goods sold, and inventory turnover using standardized methods like FIFO or LIFO. Misapplying these accounting treatments can lead to misstated financial statements, regulatory risks, and flawed investment decisions.

Comparison Table

| Aspect | Tokenized Assets Accounting | Inventory Accounting |

|---|---|---|

| Definition | Accounting for digital tokens representing ownership of real-world or digital assets. | Accounting for tangible goods held for sale or production. |

| Asset Type | Intangible digital assets recorded on blockchain. | Physical, tangible goods stored as inventory. |

| Valuation | Market value of tokens, often volatile and dynamic. | Cost, lower of cost or net realizable value. |

| Ownership Tracking | Via blockchain ledger ensuring transparency and immutability. | Managed through physical counts and inventory systems. |

| Regulatory Considerations | Subject to cryptocurrency and digital asset regulations. | Governed by standard inventory and financial reporting standards. |

| Liquidity | Generally high due to token tradability on exchanges. | Lower liquidity, dependent on sales cycles. |

| Accounting Standards | Evolving frameworks, IFRS and GAAP under adaptation. | Established GAAP and IFRS standards for inventory. |

Which is better?

Tokenized assets accounting offers enhanced transparency and real-time tracking through blockchain technology, improving accuracy in asset valuation compared to traditional inventory accounting methods. Inventory accounting relies on periodic assessments and standard costing techniques, which may delay recognition of asset value fluctuations. Companies managing digital or fractionalized assets benefit more from tokenized assets accounting for efficient audit trails and reduced reconciliation errors.

Connection

Tokenized assets accounting leverages blockchain technology to represent assets digitally, which requires precise recording and reporting standards similar to those in inventory accounting. Both types rely on accurate tracking of asset quantities, valuation, and movement to ensure financial statement integrity. Integration of tokenized assets into inventory accounting systems enhances transparency and real-time monitoring of asset ownership and availability.

Key Terms

**Inventory Accounting:**

Inventory accounting tracks and values raw materials, work-in-progress, and finished goods using methods like FIFO, LIFO, or weighted average cost to accurately reflect cost of goods sold and ending inventory on financial statements. It ensures compliance with GAAP and IAS standards by monitoring inventory turnover rates, shrinkage, and obsolescence to optimize supply chain efficiency and profitability. Discover how advanced inventory accounting systems enhance real-time data accuracy and strategic decision-making.

Cost of Goods Sold (COGS)

Inventory accounting records Cost of Goods Sold (COGS) based on physical stock movement, using methods like FIFO, LIFO, or weighted average to match costs with sales accurately. Tokenized assets accounting calculates COGS by tracking digital asset transactions on blockchain, ensuring transparent and immutable cost recognition through smart contracts and real-time valuation. Explore the nuances of these approaches to optimize financial accuracy and reporting efficiency.

FIFO/LIFO (Valuation Methods)

Inventory accounting utilizes FIFO (First-In, First-Out) and LIFO (Last-In, First-Out) valuation methods to systematically assign costs to goods sold and ending inventory, ensuring accurate financial reporting under traditional asset management frameworks. Tokenized assets accounting merges blockchain technology with asset valuation, offering real-time traceability and immutable records, which challenge traditional FIFO/LIFO methods by enabling dynamic, market-driven asset tracking and valuation. Explore how these evolving methodologies impact financial transparency and asset liquidity in modern accounting practices.

Source and External Links

Inventory Accounting Guidelines - Division of Financial Services - Inventory accounting involves tracking purchases and sales of physical property held for resale; it requires establishing sales accounts, inventory tracking systems, physical inventory controls, recording transactions, performing annual physical inventories, and adjusting ledger balances accordingly.

What Is Inventory Accounting and Why Is It Important? - Indeed - Inventory accounting is the process of tracking raw materials, work-in-progress, and finished goods to ensure accurate reconciliation of goods arriving and sold, using software and accounting categories to manage and value inventory.

A Guide to Inventory Accounting - Corporate Finance Institute - Inventory accounting assigns value to inventory and reflects it on financial statements, impacting cost of goods sold and profitability, with careful management avoiding overstocking or stockouts for efficient operations.

dowidth.com

dowidth.com