Microtransaction accounting focuses on the precise tracking and recording of small-value transactions, essential for businesses with high-frequency, low-cost sales. Refund accounting manages the accurate reversal and adjustment of previously recorded sales to maintain financial integrity and compliance. Explore our detailed guide to understand key differences and best practices in both accounting methods.

Why it is important

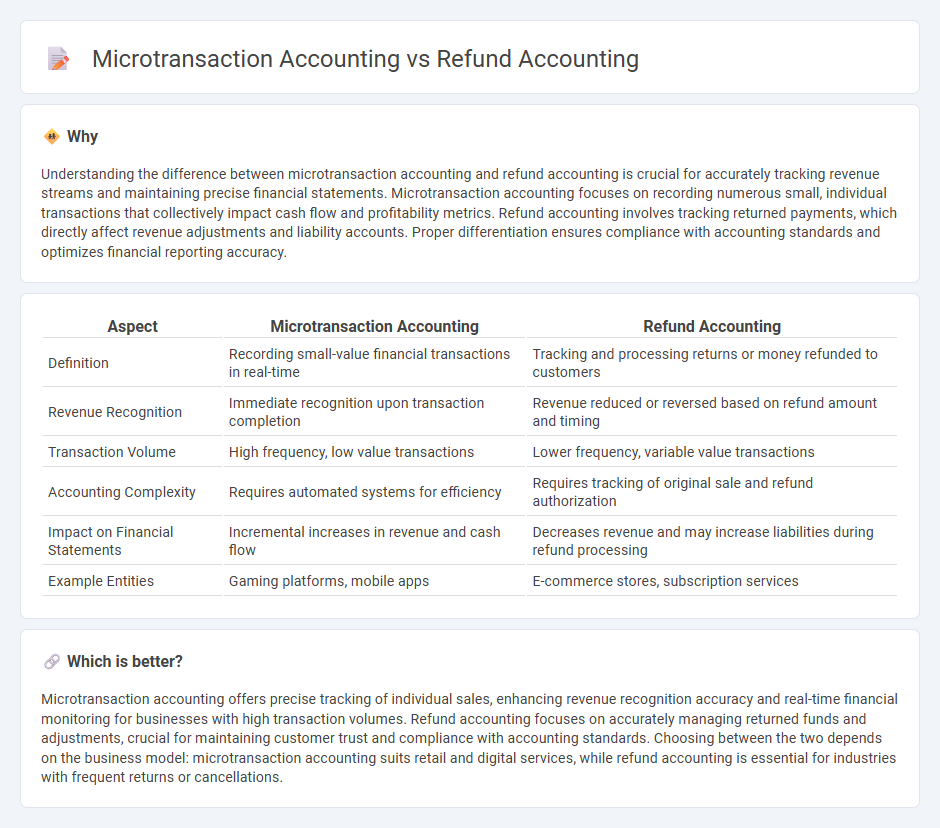

Understanding the difference between microtransaction accounting and refund accounting is crucial for accurately tracking revenue streams and maintaining precise financial statements. Microtransaction accounting focuses on recording numerous small, individual transactions that collectively impact cash flow and profitability metrics. Refund accounting involves tracking returned payments, which directly affect revenue adjustments and liability accounts. Proper differentiation ensures compliance with accounting standards and optimizes financial reporting accuracy.

Comparison Table

| Aspect | Microtransaction Accounting | Refund Accounting |

|---|---|---|

| Definition | Recording small-value financial transactions in real-time | Tracking and processing returns or money refunded to customers |

| Revenue Recognition | Immediate recognition upon transaction completion | Revenue reduced or reversed based on refund amount and timing |

| Transaction Volume | High frequency, low value transactions | Lower frequency, variable value transactions |

| Accounting Complexity | Requires automated systems for efficiency | Requires tracking of original sale and refund authorization |

| Impact on Financial Statements | Incremental increases in revenue and cash flow | Decreases revenue and may increase liabilities during refund processing |

| Example Entities | Gaming platforms, mobile apps | E-commerce stores, subscription services |

Which is better?

Microtransaction accounting offers precise tracking of individual sales, enhancing revenue recognition accuracy and real-time financial monitoring for businesses with high transaction volumes. Refund accounting focuses on accurately managing returned funds and adjustments, crucial for maintaining customer trust and compliance with accounting standards. Choosing between the two depends on the business model: microtransaction accounting suits retail and digital services, while refund accounting is essential for industries with frequent returns or cancellations.

Connection

Microtransaction accounting involves recording numerous small financial transactions, often in digital platforms or gaming environments, requiring precise tracking of revenue and expenses at a granular level. Refund accounting directly impacts microtransaction accounting by necessitating adjustments to revenue recognition and expense reports when customers return funds, ensuring accurate financial statements. Both processes rely on detailed transaction data and robust reconciliation methods to maintain financial integrity and compliance with accounting standards.

Key Terms

Revenue Recognition

Refund accounting tracks the reversal of revenue when customers return products or request refunds, impacting recognized revenue and necessitating adjustments to financial statements under ASC 606 standards. Microtransaction accounting involves recording numerous small-value purchases, often in digital goods or gaming, requiring precise revenue recognition to reflect real-time earning from digital content. Explore deeper insights into how these accounting methods influence revenue recognition and compliance challenges.

Deferred Revenue

Deferred revenue in refund accounting is recorded when a company anticipates potential returns, adjusting liabilities accordingly to reflect possible revenue reversals. In microtransaction accounting, deferred revenue arises from small, incremental payments, requiring precise tracking of revenue recognition to ensure compliance with revenue protection standards. Explore how companies balance these accounting methods to optimize financial reporting accuracy.

Chargebacks

Chargeback accounting meticulously tracks returned funds from disputed transactions, emphasizing detailed records to reconcile refunds and maintain merchant credibility. Microtransaction accounting focuses on recording small, high-frequency purchases, where managing chargebacks ensures accurate revenue recognition and minimizes fraud risks. Discover how integrating precise chargeback management enhances both refund and microtransaction accounting processes.

Source and External Links

Refund Journal Entry: 2023 Guide with Examples - HubiFi - Refund accounting involves recording a customer refund through journal entries that reduce sales revenue and reflect cash outflow or accounts receivable adjustments, with key accounts including Sales Returns and Allowances, Cash, and possibly Inventory and Cost of Goods Sold to maintain accurate financial records.

Refund Entry in Accounting: 2024 Guide - HubiFi - Refunds must be accounted for by separately reporting refund liabilities and related assets representing returned goods, ensuring clear financial statements and compliance with accounting standards like GAAP, while also accurately reflecting cash flow impacts and inventory adjustments.

Refund Accounting Under GAAP - Numeral - Under GAAP, refunds reduce recognized revenue and create liabilities on the balance sheet, requiring businesses to adjust revenue recognition and record refund obligations in the period the refund is assured, thereby maintaining accurate income statement and balance sheet reporting.

dowidth.com

dowidth.com