Cryptotax regulations address the taxation of digital assets, requiring detailed reporting of cryptocurrency transactions for accurate tax compliance. IFRS (International Financial Reporting Standards) provide standardized guidelines for financial reporting, including the classification and measurement of crypto assets as intangible assets or inventory. Explore how the intersection of cryptotax rules and IFRS impacts financial transparency and regulatory adherence.

Why it is important

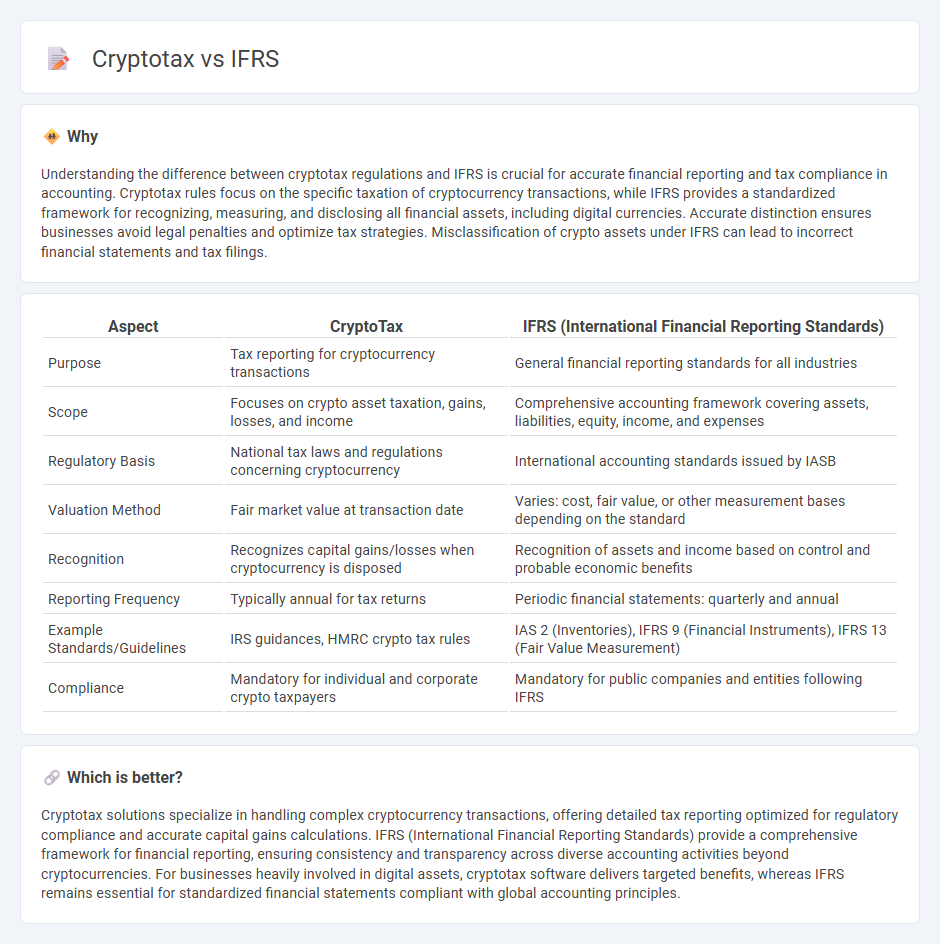

Understanding the difference between cryptotax regulations and IFRS is crucial for accurate financial reporting and tax compliance in accounting. Cryptotax rules focus on the specific taxation of cryptocurrency transactions, while IFRS provides a standardized framework for recognizing, measuring, and disclosing all financial assets, including digital currencies. Accurate distinction ensures businesses avoid legal penalties and optimize tax strategies. Misclassification of crypto assets under IFRS can lead to incorrect financial statements and tax filings.

Comparison Table

| Aspect | CryptoTax | IFRS (International Financial Reporting Standards) |

|---|---|---|

| Purpose | Tax reporting for cryptocurrency transactions | General financial reporting standards for all industries |

| Scope | Focuses on crypto asset taxation, gains, losses, and income | Comprehensive accounting framework covering assets, liabilities, equity, income, and expenses |

| Regulatory Basis | National tax laws and regulations concerning cryptocurrency | International accounting standards issued by IASB |

| Valuation Method | Fair market value at transaction date | Varies: cost, fair value, or other measurement bases depending on the standard |

| Recognition | Recognizes capital gains/losses when cryptocurrency is disposed | Recognition of assets and income based on control and probable economic benefits |

| Reporting Frequency | Typically annual for tax returns | Periodic financial statements: quarterly and annual |

| Example Standards/Guidelines | IRS guidances, HMRC crypto tax rules | IAS 2 (Inventories), IFRS 9 (Financial Instruments), IFRS 13 (Fair Value Measurement) |

| Compliance | Mandatory for individual and corporate crypto taxpayers | Mandatory for public companies and entities following IFRS |

Which is better?

Cryptotax solutions specialize in handling complex cryptocurrency transactions, offering detailed tax reporting optimized for regulatory compliance and accurate capital gains calculations. IFRS (International Financial Reporting Standards) provide a comprehensive framework for financial reporting, ensuring consistency and transparency across diverse accounting activities beyond cryptocurrencies. For businesses heavily involved in digital assets, cryptotax software delivers targeted benefits, whereas IFRS remains essential for standardized financial statements compliant with global accounting principles.

Connection

Cryptotax regulations intersect with IFRS (International Financial Reporting Standards) by requiring precise classification and valuation of digital assets on financial statements. IFRS standards such as IFRS 9 and IAS 38 provide frameworks for recognizing cryptocurrency as financial instruments or intangible assets, influencing tax reporting and compliance. Accurate application of IFRS principles ensures transparent reporting, aiding in the calculation of tax liabilities on cryptocurrency transactions.

Key Terms

Fair Value Measurement

Fair Value Measurement under IFRS requires assets and liabilities to be valued at their current market price, emphasizing transparency and consistency in financial reporting. Cryptocurrency tax regulations often face challenges in applying fair value due to market volatility and differing jurisdictional guidance on valuation methods. Explore how integrating IFRS fair value principles can enhance crypto tax compliance and reporting accuracy.

Digital Asset Classification

IFRS classifies digital assets under existing frameworks, often treating cryptocurrencies as intangible assets or inventory, influencing tax treatment and reporting standards globally. Cryptotax regulations vary widely, with some jurisdictions defining digital assets as property, commodities, or currency, directly impacting taxable events and compliance requirements. Explore detailed distinctions and implications for accurate reporting and tax planning in the evolving digital asset landscape.

Revenue Recognition

IFRS standards require revenue recognition when control of goods or services is transferred to the customer, which contrasts with crypto tax rules that often focus on the timing of cryptocurrency transactions and realized gains. Revenue from cryptocurrency activities must be carefully assessed under IFRS 15, factoring in smart contract terms and underlying asset control, whereas tax authorities may emphasize event-based recognition for taxable income reporting. Explore detailed guidance on aligning revenue recognition principles with crypto tax compliance to optimize financial reporting and tax strategies.

Source and External Links

What is IFRS | Definition | Xero US - IFRS, or International Financial Reporting Standards, are a set of accounting rules for how financial information should be gathered and presented, ensuring consistency, comparability, and credibility worldwide under standards maintained by the International Accounting Standards Board (IASB).

International Financial Reporting Standards - Wikipedia - IFRS are international accounting standards issued by the IFRS Foundation, designed for global use in preparing financial statements, with requirements including balance sheets, income statements, statements of changes in equity, cash flow statements, and disclosure notes, and providing more principle-based, flexible guidelines compared to rule-based U.S. GAAP.

What are the IFRS Standards in Accounting - IFRS standards are globally recognized guidelines that determine how transactions and accounting events are reported in financial statements, aiming to create a common accounting language for transparency and consistency across companies and countries, but are not currently adopted in the U.S., which uses its own GAAP system.

dowidth.com

dowidth.com