Payroll automation streamlines employee payment processes by using specialized software to calculate wages, tax deductions, and direct deposits, significantly reducing manual errors and time consumption. Enterprise Resource Planning (ERP) payroll integrates payroll functions within broader business systems, enhancing data consistency across finance, human resources, and compliance reporting. Discover how each solution can optimize your organization's payroll management efficiency.

Why it is important

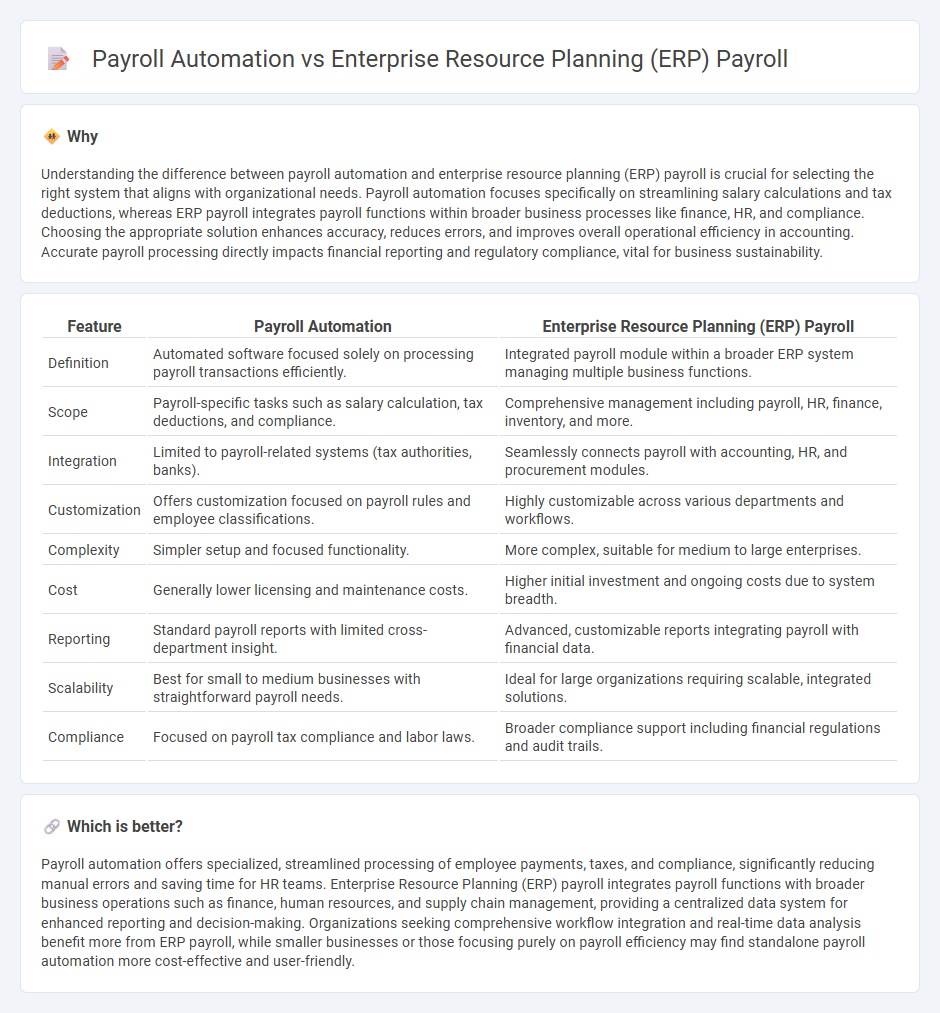

Understanding the difference between payroll automation and enterprise resource planning (ERP) payroll is crucial for selecting the right system that aligns with organizational needs. Payroll automation focuses specifically on streamlining salary calculations and tax deductions, whereas ERP payroll integrates payroll functions within broader business processes like finance, HR, and compliance. Choosing the appropriate solution enhances accuracy, reduces errors, and improves overall operational efficiency in accounting. Accurate payroll processing directly impacts financial reporting and regulatory compliance, vital for business sustainability.

Comparison Table

| Feature | Payroll Automation | Enterprise Resource Planning (ERP) Payroll |

|---|---|---|

| Definition | Automated software focused solely on processing payroll transactions efficiently. | Integrated payroll module within a broader ERP system managing multiple business functions. |

| Scope | Payroll-specific tasks such as salary calculation, tax deductions, and compliance. | Comprehensive management including payroll, HR, finance, inventory, and more. |

| Integration | Limited to payroll-related systems (tax authorities, banks). | Seamlessly connects payroll with accounting, HR, and procurement modules. |

| Customization | Offers customization focused on payroll rules and employee classifications. | Highly customizable across various departments and workflows. |

| Complexity | Simpler setup and focused functionality. | More complex, suitable for medium to large enterprises. |

| Cost | Generally lower licensing and maintenance costs. | Higher initial investment and ongoing costs due to system breadth. |

| Reporting | Standard payroll reports with limited cross-department insight. | Advanced, customizable reports integrating payroll with financial data. |

| Scalability | Best for small to medium businesses with straightforward payroll needs. | Ideal for large organizations requiring scalable, integrated solutions. |

| Compliance | Focused on payroll tax compliance and labor laws. | Broader compliance support including financial regulations and audit trails. |

Which is better?

Payroll automation offers specialized, streamlined processing of employee payments, taxes, and compliance, significantly reducing manual errors and saving time for HR teams. Enterprise Resource Planning (ERP) payroll integrates payroll functions with broader business operations such as finance, human resources, and supply chain management, providing a centralized data system for enhanced reporting and decision-making. Organizations seeking comprehensive workflow integration and real-time data analysis benefit more from ERP payroll, while smaller businesses or those focusing purely on payroll efficiency may find standalone payroll automation more cost-effective and user-friendly.

Connection

Payroll automation integrates seamlessly with Enterprise Resource Planning (ERP) systems by streamlining employee payment processes, ensuring accuracy, and reducing manual errors. ERP payroll modules centralize payroll data within the broader business management suite, enabling real-time financial reporting and compliance with tax regulations. This connection enhances operational efficiency by synchronizing payroll with accounting, HR, and time-tracking functions.

Key Terms

Integration

Enterprise Resource Planning (ERP) payroll solutions offer seamless integration with core business processes such as finance, human resources, and inventory management, enabling centralized data management and enhanced accuracy in payroll processing. Payroll automation tools, while specialized and efficient in processing salaries, taxes, and compliance, often require separate systems that may lead to data silos and increased manual intervention for cross-functional data synchronization. Explore more about how ERP payroll integration can optimize payroll accuracy and operational efficiency within your enterprise.

Workflow

Enterprise Resource Planning (ERP) payroll integrates payroll processing within a comprehensive business management system, enabling seamless data flow across departments and reducing manual data entry errors. Payroll automation specifically streamlines payroll tasks such as timesheet processing, tax calculations, and direct deposits by utilizing specialized software to enhance accuracy and efficiency. Explore how combining ERP payroll with payroll automation can optimize your workforce management and financial operations.

Compliance

Enterprise Resource Planning (ERP) payroll systems integrate payroll processing with other business functions but may require customization to meet specific compliance needs, such as tax regulations and labor laws. Payroll automation tools streamline payroll tasks with built-in compliance features like real-time updates on tax changes and automated filings, reducing the risk of errors and penalties. Explore detailed comparisons to understand which solution best ensures compliance and efficiency for your organization.

Source and External Links

21 Best ERP Payroll Software Reviewed In 2025 - This article reviews various ERP payroll software options, highlighting their pricing plans and features to help businesses streamline payroll processes.

Modern Payroll ERP Strategies Your Accounting Team Needs - This blog discusses the importance of integrating payroll with ERP systems, focusing on benefits for small and medium-sized businesses.

ERP vs. All-in-One Payroll & HR Software - This article compares ERP systems with all-in-one payroll and HR software, highlighting their distinct features and advantages for managing business processes.

dowidth.com

dowidth.com