Sustainability reporting focuses on disclosing environmental, social, and governance (ESG) impacts to stakeholders, highlighting a company's commitment to sustainable practices over a specific period. Integrated reporting combines financial data with sustainability information, providing a holistic view of how an organization's strategy, governance, performance, and prospects create value over time. Explore further to understand how these reporting frameworks influence corporate transparency and stakeholder engagement.

Why it is important

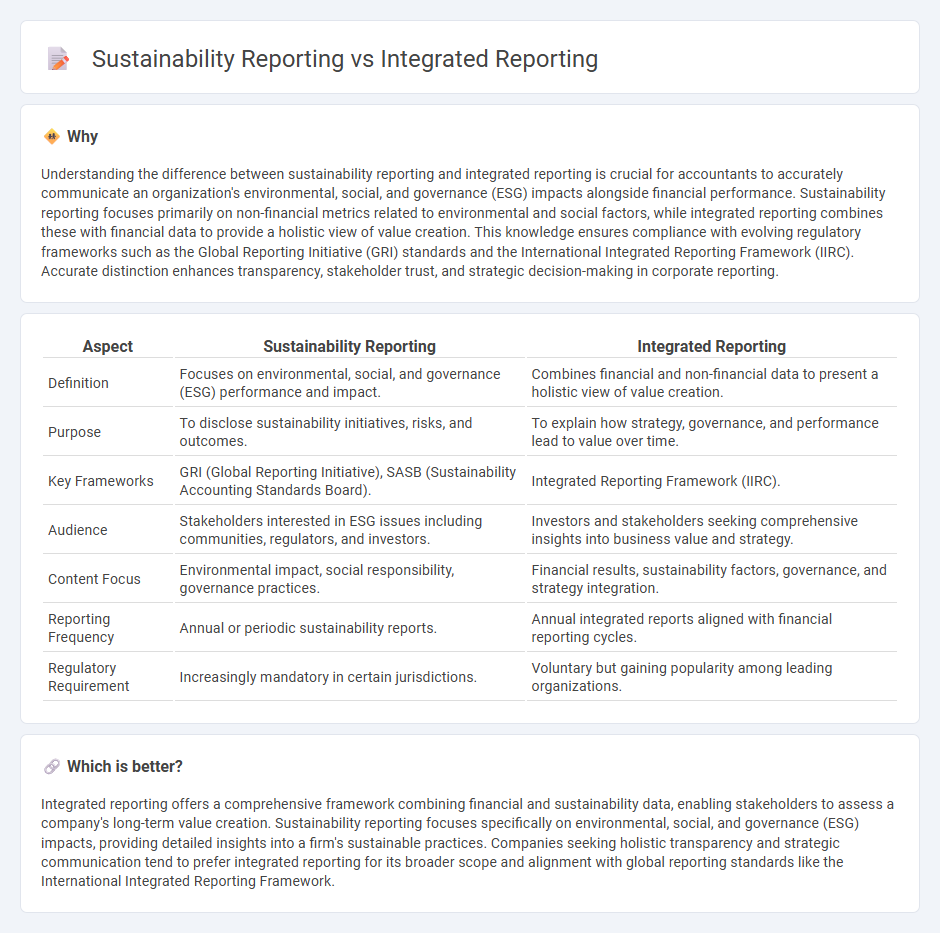

Understanding the difference between sustainability reporting and integrated reporting is crucial for accountants to accurately communicate an organization's environmental, social, and governance (ESG) impacts alongside financial performance. Sustainability reporting focuses primarily on non-financial metrics related to environmental and social factors, while integrated reporting combines these with financial data to provide a holistic view of value creation. This knowledge ensures compliance with evolving regulatory frameworks such as the Global Reporting Initiative (GRI) standards and the International Integrated Reporting Framework (IIRC). Accurate distinction enhances transparency, stakeholder trust, and strategic decision-making in corporate reporting.

Comparison Table

| Aspect | Sustainability Reporting | Integrated Reporting |

|---|---|---|

| Definition | Focuses on environmental, social, and governance (ESG) performance and impact. | Combines financial and non-financial data to present a holistic view of value creation. |

| Purpose | To disclose sustainability initiatives, risks, and outcomes. | To explain how strategy, governance, and performance lead to value over time. |

| Key Frameworks | GRI (Global Reporting Initiative), SASB (Sustainability Accounting Standards Board). | Integrated Reporting Framework (IIRC). |

| Audience | Stakeholders interested in ESG issues including communities, regulators, and investors. | Investors and stakeholders seeking comprehensive insights into business value and strategy. |

| Content Focus | Environmental impact, social responsibility, governance practices. | Financial results, sustainability factors, governance, and strategy integration. |

| Reporting Frequency | Annual or periodic sustainability reports. | Annual integrated reports aligned with financial reporting cycles. |

| Regulatory Requirement | Increasingly mandatory in certain jurisdictions. | Voluntary but gaining popularity among leading organizations. |

Which is better?

Integrated reporting offers a comprehensive framework combining financial and sustainability data, enabling stakeholders to assess a company's long-term value creation. Sustainability reporting focuses specifically on environmental, social, and governance (ESG) impacts, providing detailed insights into a firm's sustainable practices. Companies seeking holistic transparency and strategic communication tend to prefer integrated reporting for its broader scope and alignment with global reporting standards like the International Integrated Reporting Framework.

Connection

Sustainability reporting and integrated reporting are connected through their shared goal of providing a comprehensive view of an organization's environmental, social, and governance (ESG) performance alongside financial results. Integrated reporting combines financial and sustainability data to enhance transparency and inform stakeholders about long-term value creation. This connection supports more holistic decision-making by incorporating non-financial metrics, such as carbon emissions and social impact, into traditional accounting frameworks.

Key Terms

Value Creation

Integrated reporting combines financial, environmental, social, and governance data to provide a holistic view of value creation over time, emphasizing how an organization's strategy and resource allocation generate sustainable value. Sustainability reporting focuses specifically on environmental, social, and governance (ESG) performance, detailing how a company manages its impacts on society and the planet. Explore the key differences and benefits of each reporting approach to enhance your understanding of value creation.

ESG (Environmental, Social, Governance)

Integrated reporting combines financial and ESG (Environmental, Social, Governance) data to provide a holistic view of a company's value creation over time, emphasizing how sustainability impacts financial performance. Sustainability reporting focuses specifically on ESG metrics, detailing environmental impact, social responsibility, and governance practices without necessarily linking them directly to financial outcomes. Explore the distinctions and benefits of both approaches to better understand their roles in corporate transparency and stakeholder engagement.

Connectivity of Information

Integrated reporting enhances the connectivity of information by combining financial and non-financial data into a cohesive narrative, facilitating a comprehensive view of an organization's strategy, governance, performance, and prospects. In contrast, sustainability reporting primarily concentrates on environmental, social, and governance (ESG) metrics without necessarily linking them to financial outcomes, which may result in fragmented insights. Explore further to understand how integrated reporting drives holistic decision-making through interconnected disclosures.

Source and External Links

Integrated Reporting - Integrated reporting is a process that communicates how an organization's strategy, governance, performance, and prospects lead to value creation over time.

What is Integrated Reporting? - Integrated reporting provides a comprehensive view of a company's financial and non-financial factors, emphasizing strategic relevance and future orientation.

Integrated Reporting - This webpage offers insights into integrated reporting as an evolution of corporate reporting, focusing on conciseness, strategic relevance, and future orientation.

dowidth.com

dowidth.com