Double entry accounting records financial transactions with equal debits and credits to maintain balanced ledgers, ensuring accuracy and error detection. Triple entry accounting enhances this system by incorporating a cryptographic receipt for each transaction, increasing transparency and security in financial records. Explore the benefits of both methods to optimize your accounting practices.

Why it is important

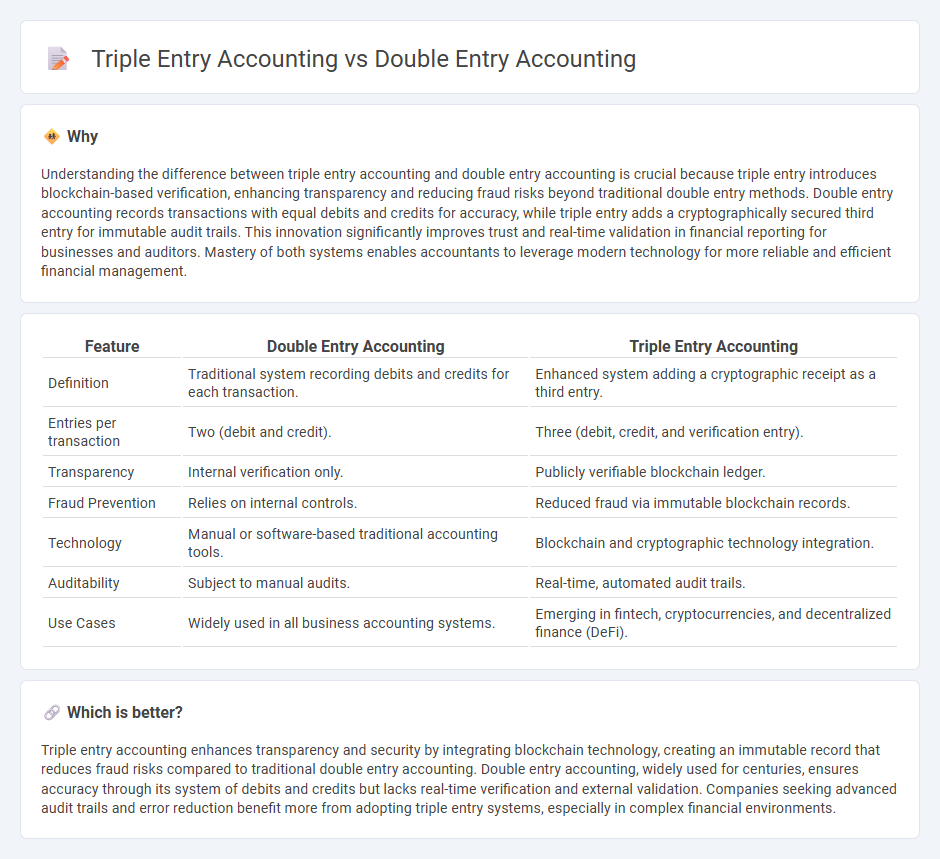

Understanding the difference between triple entry accounting and double entry accounting is crucial because triple entry introduces blockchain-based verification, enhancing transparency and reducing fraud risks beyond traditional double entry methods. Double entry accounting records transactions with equal debits and credits for accuracy, while triple entry adds a cryptographically secured third entry for immutable audit trails. This innovation significantly improves trust and real-time validation in financial reporting for businesses and auditors. Mastery of both systems enables accountants to leverage modern technology for more reliable and efficient financial management.

Comparison Table

| Feature | Double Entry Accounting | Triple Entry Accounting |

|---|---|---|

| Definition | Traditional system recording debits and credits for each transaction. | Enhanced system adding a cryptographic receipt as a third entry. |

| Entries per transaction | Two (debit and credit). | Three (debit, credit, and verification entry). |

| Transparency | Internal verification only. | Publicly verifiable blockchain ledger. |

| Fraud Prevention | Relies on internal controls. | Reduced fraud via immutable blockchain records. |

| Technology | Manual or software-based traditional accounting tools. | Blockchain and cryptographic technology integration. |

| Auditability | Subject to manual audits. | Real-time, automated audit trails. |

| Use Cases | Widely used in all business accounting systems. | Emerging in fintech, cryptocurrencies, and decentralized finance (DeFi). |

Which is better?

Triple entry accounting enhances transparency and security by integrating blockchain technology, creating an immutable record that reduces fraud risks compared to traditional double entry accounting. Double entry accounting, widely used for centuries, ensures accuracy through its system of debits and credits but lacks real-time verification and external validation. Companies seeking advanced audit trails and error reduction benefit more from adopting triple entry systems, especially in complex financial environments.

Connection

Triple entry accounting builds upon the foundational principles of double entry accounting by introducing a cryptographic receipt that records each transaction, enhancing transparency and security. While double entry accounting maintains two corresponding entries (debit and credit) for accuracy, triple entry accounting adds a third entry as a shared, immutable ledger, often enabled by blockchain technology. This connection strengthens financial accountability and reduces fraud by providing a verifiable transaction record accessible to all involved parties.

Key Terms

**Double Entry Accounting:**

Double entry accounting records each financial transaction in two accounts, ensuring that total debits equal total credits to maintain the accounting equation's balance. This system enhances accuracy and error detection by providing a clear audit trail for assets, liabilities, equity, revenues, and expenses. Explore the fundamentals of double entry accounting to strengthen your financial management skills.

Debit

Double entry accounting records each financial transaction with equal debits and credits, maintaining balance in accounting ledgers and ensuring accuracy in financial statements. Triple entry accounting adds a cryptographic third entry, enhancing transparency and reducing fraud by linking the debit and credit through an immutable ledger. Explore the advantages of debit management in both systems to understand their impact on modern accounting practices.

Credit

Double entry accounting records credits as decreases in asset accounts or increases in liability and equity accounts, ensuring every credit has a corresponding debit entry for balanced financial statements. Triple entry accounting extends this by adding a cryptographic receipt, creating an immutable third entry that enhances transparency and reduces fraud risk in credit transactions. Explore the advantages of triple entry accounting for more secure and reliable credit recording.

Source and External Links

Double-Entry Accounting: What It Is and How It Works - Every financial transaction is recorded in at least two accounts, ensuring that debits and credits always balance, such as increasing an asset and decreasing a liability for the same amount.

Double-Entry Accounting: What It Is and Why It Matters - This system requires each transaction to have both a debit and a credit entry, creating a complete and accurate picture of a business's financial activities.

Double-Entry Accounting: What Is It, And Why Is It Important? - By recording every transaction twice (once as a debit and once as a credit), double-entry accounting helps prevent errors, supports compliance, and enables detailed financial reporting.

dowidth.com

dowidth.com