Crypto asset valuation involves determining the fair value of digital currencies using market-based data, ensuring accurate representation on financial statements. The revaluation model allows companies to adjust the asset value periodically to reflect current market conditions, enhancing transparency and relevance. Explore how these accounting methods impact financial reporting in the dynamic crypto asset landscape.

Why it is important

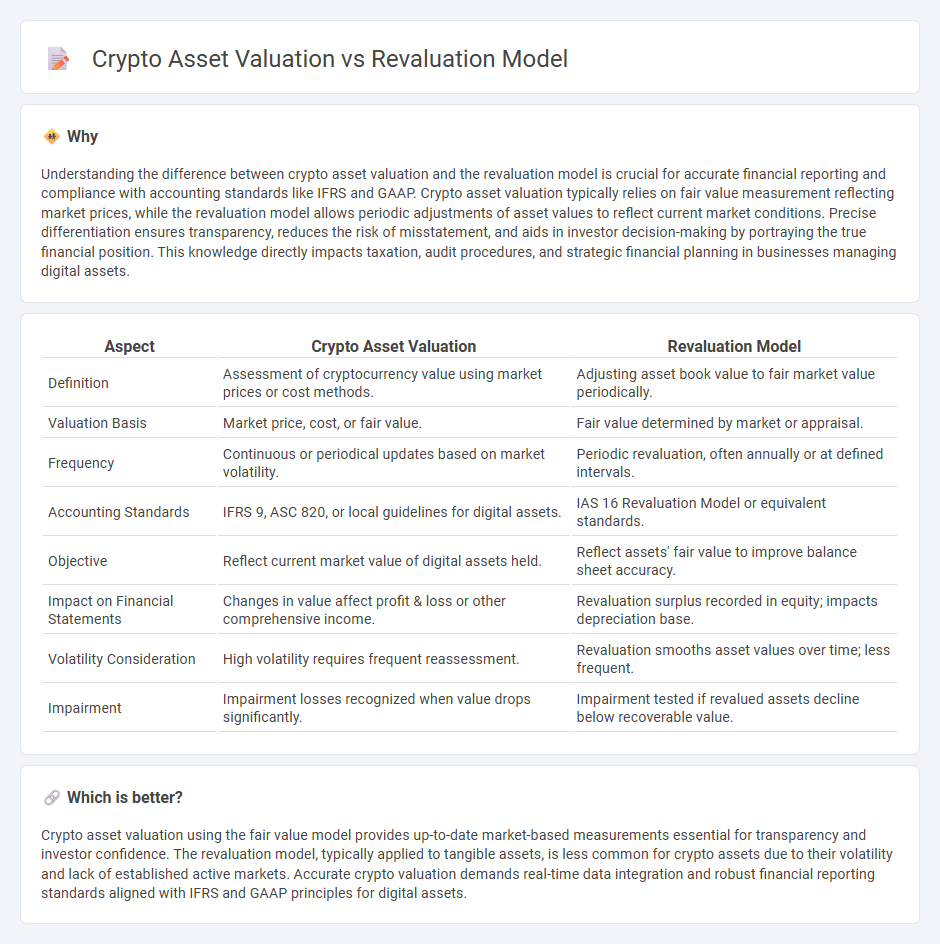

Understanding the difference between crypto asset valuation and the revaluation model is crucial for accurate financial reporting and compliance with accounting standards like IFRS and GAAP. Crypto asset valuation typically relies on fair value measurement reflecting market prices, while the revaluation model allows periodic adjustments of asset values to reflect current market conditions. Precise differentiation ensures transparency, reduces the risk of misstatement, and aids in investor decision-making by portraying the true financial position. This knowledge directly impacts taxation, audit procedures, and strategic financial planning in businesses managing digital assets.

Comparison Table

| Aspect | Crypto Asset Valuation | Revaluation Model |

|---|---|---|

| Definition | Assessment of cryptocurrency value using market prices or cost methods. | Adjusting asset book value to fair market value periodically. |

| Valuation Basis | Market price, cost, or fair value. | Fair value determined by market or appraisal. |

| Frequency | Continuous or periodical updates based on market volatility. | Periodic revaluation, often annually or at defined intervals. |

| Accounting Standards | IFRS 9, ASC 820, or local guidelines for digital assets. | IAS 16 Revaluation Model or equivalent standards. |

| Objective | Reflect current market value of digital assets held. | Reflect assets' fair value to improve balance sheet accuracy. |

| Impact on Financial Statements | Changes in value affect profit & loss or other comprehensive income. | Revaluation surplus recorded in equity; impacts depreciation base. |

| Volatility Consideration | High volatility requires frequent reassessment. | Revaluation smooths asset values over time; less frequent. |

| Impairment | Impairment losses recognized when value drops significantly. | Impairment tested if revalued assets decline below recoverable value. |

Which is better?

Crypto asset valuation using the fair value model provides up-to-date market-based measurements essential for transparency and investor confidence. The revaluation model, typically applied to tangible assets, is less common for crypto assets due to their volatility and lack of established active markets. Accurate crypto valuation demands real-time data integration and robust financial reporting standards aligned with IFRS and GAAP principles for digital assets.

Connection

Crypto asset valuation relies heavily on the revaluation model, which allows businesses to adjust the carrying amount of digital currencies to fair value periodically, reflecting market fluctuations. This approach ensures that financial statements present a more accurate and up-to-date value of crypto assets, supporting transparent and reliable accounting practices. Utilizing standardized revaluation techniques helps manage volatility risks inherent in crypto markets and complies with International Financial Reporting Standards (IFRS).

Key Terms

Fair Value

The revaluation model updates asset values on the balance sheet to reflect Fair Value, providing more accurate financial reporting compared to historical cost accounting, especially critical for volatile crypto assets. Fair Value measurement in crypto valuation integrates market prices, liquidity, and volatility factors, essential for transparency and regulatory compliance. Explore more about leveraging Fair Value in revaluation models to enhance crypto asset financial statements.

Impairment

The revaluation model for asset valuation involves periodically adjusting an asset's book value to reflect its fair market value, which may lead to upward or downward adjustments depending on market conditions. In contrast, crypto asset valuation often requires assessing impairment through expected credit loss models or write-downs to zero when fair value drops significantly and is not expected to recover. Explore detailed methodologies and best practices for impairment recognition in crypto asset valuation to enhance financial transparency.

Volatility

The revaluation model assesses asset values based on periodic market price adjustments, which can be challenging due to the high volatility inherent in crypto assets like Bitcoin and Ethereum. Crypto asset valuation techniques must account for rapid price fluctuations and market sentiment shifts, factors less emphasized in traditional revaluation frameworks. Explore the complexities of crypto asset volatility and its impact on valuation models to better understand this dynamic market.

Source and External Links

What is the Revaluation Model? - SuperfastCPA CPA Review - The Revaluation Model is an accounting approach for long-lived assets where after initial recognition at cost, assets are subsequently carried at their fair value at revaluation date minus accumulated depreciation and impairment losses, with changes adjusted in the financial statements.

Revaluation model definition - AccountingTools - The revaluation model allows assets to be carried at their fair value, requiring periodic revaluations to avoid material differences from fair value, with IFRS suggesting revaluations every 3 to 5 years or more frequently if fair values are volatile.

9.4.2: Revaluation Model - Business LibreTexts - The revaluation model captures asset value changes over time, where upward adjustments increase revaluation surplus equity, and downward adjustments first reduce surplus before recognizing expenses; reversals of impairments may also be recorded.

dowidth.com

dowidth.com