Embedded finance reporting integrates financial data within business operations, enabling real-time insights and streamlined decision-making through advanced analytics and automation. External audit reports provide independent verification of financial statements, ensuring compliance with regulatory standards and enhancing stakeholder trust through thorough examination by certified auditors. Discover how these reporting methods complement each other to optimize financial accuracy and transparency.

Why it is important

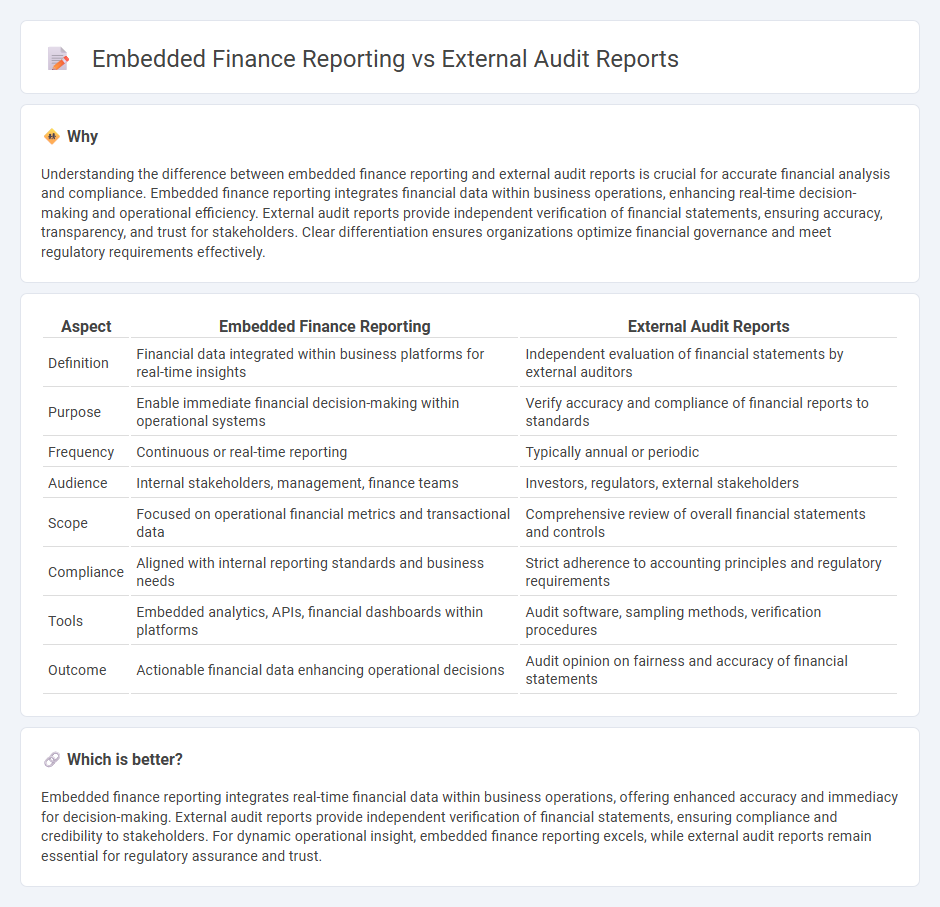

Understanding the difference between embedded finance reporting and external audit reports is crucial for accurate financial analysis and compliance. Embedded finance reporting integrates financial data within business operations, enhancing real-time decision-making and operational efficiency. External audit reports provide independent verification of financial statements, ensuring accuracy, transparency, and trust for stakeholders. Clear differentiation ensures organizations optimize financial governance and meet regulatory requirements effectively.

Comparison Table

| Aspect | Embedded Finance Reporting | External Audit Reports |

|---|---|---|

| Definition | Financial data integrated within business platforms for real-time insights | Independent evaluation of financial statements by external auditors |

| Purpose | Enable immediate financial decision-making within operational systems | Verify accuracy and compliance of financial reports to standards |

| Frequency | Continuous or real-time reporting | Typically annual or periodic |

| Audience | Internal stakeholders, management, finance teams | Investors, regulators, external stakeholders |

| Scope | Focused on operational financial metrics and transactional data | Comprehensive review of overall financial statements and controls |

| Compliance | Aligned with internal reporting standards and business needs | Strict adherence to accounting principles and regulatory requirements |

| Tools | Embedded analytics, APIs, financial dashboards within platforms | Audit software, sampling methods, verification procedures |

| Outcome | Actionable financial data enhancing operational decisions | Audit opinion on fairness and accuracy of financial statements |

Which is better?

Embedded finance reporting integrates real-time financial data within business operations, offering enhanced accuracy and immediacy for decision-making. External audit reports provide independent verification of financial statements, ensuring compliance and credibility to stakeholders. For dynamic operational insight, embedded finance reporting excels, while external audit reports remain essential for regulatory assurance and trust.

Connection

Embedded finance reporting integrates financial data directly within operational platforms, enhancing real-time accuracy and transparency crucial for external audit reports. External auditors rely on this seamless financial integration to verify compliance, assess risk, and validate financial statements with greater efficiency. This connection streamlines audit processes and improves the reliability of financial disclosures in accounting.

Key Terms

Audit Opinion

External audit reports provide an independent assessment of a company's financial statements, focusing on the audit opinion that confirms adherence to accounting standards and reveals any material misstatements. Embedded finance reporting integrates financial services within non-financial platforms, emphasizing real-time transaction data and compliance with regulatory frameworks, which impacts the audit opinion differently by highlighting operational controls and transactional accuracy. Explore more about how audit opinions differ in these contexts to enhance your financial oversight strategies.

Regulatory Compliance

External audit reports thoroughly assess financial statements to ensure compliance with accounting standards and regulatory frameworks mandated by governing bodies. Embedded finance reporting involves integrating financial services within non-financial platforms, requiring adherence to specific fintech regulations such as PCI DSS and GDPR alongside traditional compliance. Explore detailed differences and compliance strategies to optimize your financial reporting framework.

Real-time Data Integration

External audit reports traditionally provide retrospective financial analysis based on periodically collected data, often resulting in delayed insights into an organization's financial health. Embedded finance reporting leverages real-time data integration by seamlessly incorporating transactional data, enabling immediate and continuous financial visibility within business operations. Explore how real-time data integration transforms financial reporting accuracy and decision-making by diving deeper into embedded finance solutions.

Source and External Links

Understanding the Purpose and Benefits of External Audits - This article discusses the main goals and benefits of external audits, including validating internal controls and enhancing decision-making.

Internal vs External Audit: Key Differences & Similarities - This blog post explains the differences between internal and external audits, focusing on their roles, user groups, and legal requirements.

How do I find an external audit report for a publicly traded company? - This FAQ provides instructions on how to locate and access external audit reports for publicly traded companies through the SEC's Edgar database.

dowidth.com

dowidth.com