Fair value measurement reflects the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Recoverable amount is the higher of an asset's fair value less costs to sell and its value in use, representing the maximum recoverable cash flows. Explore the distinctions and applications of these key valuation concepts to enhance your accounting expertise.

Why it is important

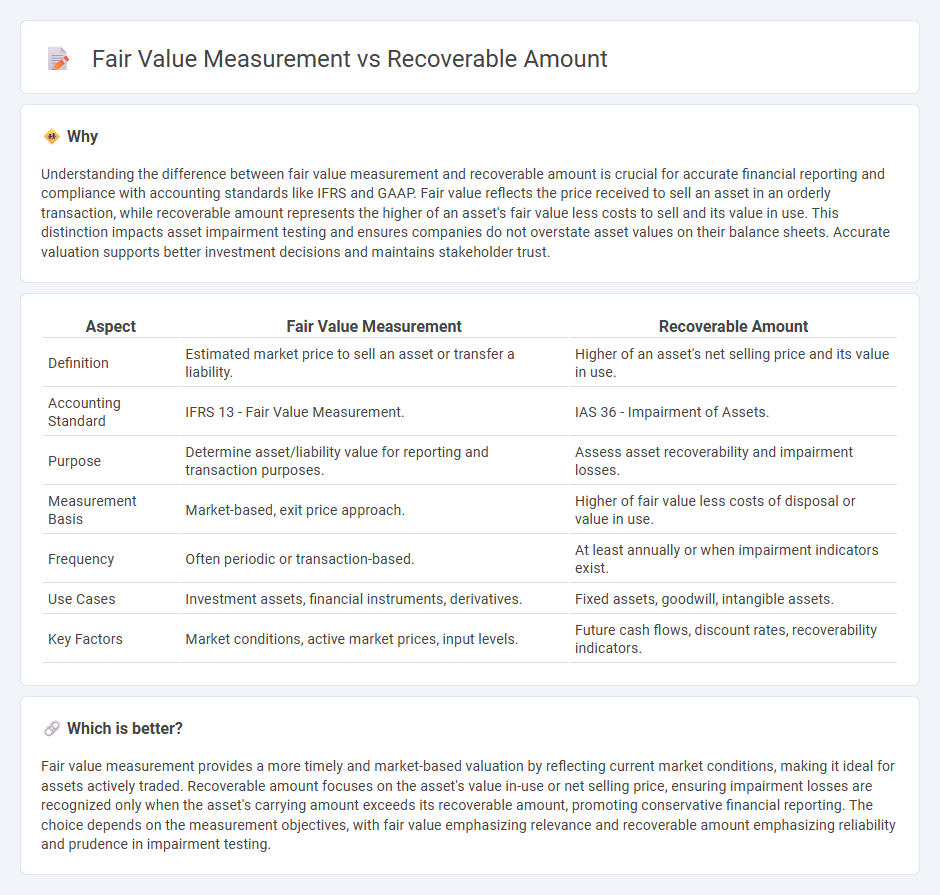

Understanding the difference between fair value measurement and recoverable amount is crucial for accurate financial reporting and compliance with accounting standards like IFRS and GAAP. Fair value reflects the price received to sell an asset in an orderly transaction, while recoverable amount represents the higher of an asset's fair value less costs to sell and its value in use. This distinction impacts asset impairment testing and ensures companies do not overstate asset values on their balance sheets. Accurate valuation supports better investment decisions and maintains stakeholder trust.

Comparison Table

| Aspect | Fair Value Measurement | Recoverable Amount |

|---|---|---|

| Definition | Estimated market price to sell an asset or transfer a liability. | Higher of an asset's net selling price and its value in use. |

| Accounting Standard | IFRS 13 - Fair Value Measurement. | IAS 36 - Impairment of Assets. |

| Purpose | Determine asset/liability value for reporting and transaction purposes. | Assess asset recoverability and impairment losses. |

| Measurement Basis | Market-based, exit price approach. | Higher of fair value less costs of disposal or value in use. |

| Frequency | Often periodic or transaction-based. | At least annually or when impairment indicators exist. |

| Use Cases | Investment assets, financial instruments, derivatives. | Fixed assets, goodwill, intangible assets. |

| Key Factors | Market conditions, active market prices, input levels. | Future cash flows, discount rates, recoverability indicators. |

Which is better?

Fair value measurement provides a more timely and market-based valuation by reflecting current market conditions, making it ideal for assets actively traded. Recoverable amount focuses on the asset's value in-use or net selling price, ensuring impairment losses are recognized only when the asset's carrying amount exceeds its recoverable amount, promoting conservative financial reporting. The choice depends on the measurement objectives, with fair value emphasizing relevance and recoverable amount emphasizing reliability and prudence in impairment testing.

Connection

Fair value measurement and recoverable amount are interconnected accounting concepts used to assess asset values for accurate financial reporting. Fair value represents the market-based measurement of an asset's worth, while recoverable amount is the higher of an asset's fair value less costs to sell and its value in use. This connection ensures impairments are recognized when carrying amounts exceed recoverable amounts, aligning asset valuations with current market conditions and expected cash flows.

Key Terms

Impairment

Recoverable amount in impairment testing refers to the higher of an asset's fair value less costs of disposal and its value in use, ensuring asset recoverability under IAS 36. Fair value measurement, as defined by IFRS 13, reflects the price received to sell an asset in an orderly transaction between market participants at the measurement date. Explore detailed guidance on impairment and valuation methodologies to enhance compliance and financial reporting accuracy.

Carrying amount

The recoverable amount represents the higher of an asset's fair value less costs of disposal and its value in use, directly impacting the carrying amount by ensuring it is not overstated on the balance sheet. Fair value measurement, defined as the price to sell an asset in an orderly transaction between market participants, influences the carrying amount through periodic revaluation or impairment testing. Explore further to understand their distinct roles in asset valuation and financial reporting.

Market-based valuation

The recoverable amount represents the higher of an asset's fair value less costs of disposal and its value in use, reflecting the maximum recoverable value under impairment testing. Fair value measurement concentrates on the market-based valuation using observable inputs, primarily active market prices for identical or similar assets, ensuring a current exit price perspective. Explore detailed insights on recoverable amount and fair value measurement methodologies in market-based valuations for comprehensive asset evaluation.

Source and External Links

Recoverable Amount: Definition, Formula and Example - FreshBooks - The recoverable amount is the higher value between the estimated net sales price (fair value less costs to sell) and the value in use, which is the present value of future cash flows expected from the asset during its useful life.

Recoverable amount definition - AccountingTools - Recoverable amount is the greater of an asset's fair value less costs to sell or its value in use, used to determine impairment, where the asset's carrying amount must not exceed this recoverable amount.

What is Recoverable Amount? - SuperfastCPA CPA Review - The recoverable amount is the higher of an asset's fair value less costs to sell and its value in use; if the carrying amount exceeds the recoverable amount, impairment must be recorded by reducing the carrying amount to this recoverable amount.

dowidth.com

dowidth.com