Digital twin accounting creates a virtual replica of financial processes to simulate real-time data and enhance decision-making accuracy. Predictive analytics in accounting leverages historical financial data and statistical models to forecast future trends and identify potential risks. Discover how these advanced technologies revolutionize accounting practices and optimize financial management.

Why it is important

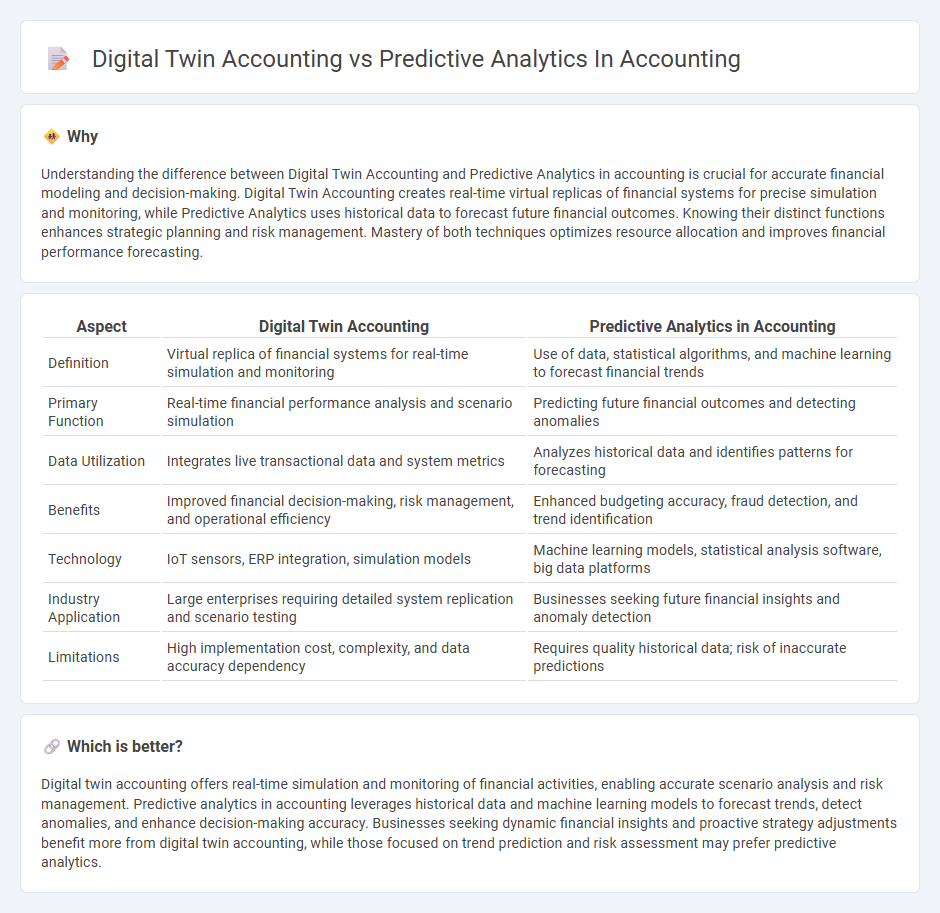

Understanding the difference between Digital Twin Accounting and Predictive Analytics in accounting is crucial for accurate financial modeling and decision-making. Digital Twin Accounting creates real-time virtual replicas of financial systems for precise simulation and monitoring, while Predictive Analytics uses historical data to forecast future financial outcomes. Knowing their distinct functions enhances strategic planning and risk management. Mastery of both techniques optimizes resource allocation and improves financial performance forecasting.

Comparison Table

| Aspect | Digital Twin Accounting | Predictive Analytics in Accounting |

|---|---|---|

| Definition | Virtual replica of financial systems for real-time simulation and monitoring | Use of data, statistical algorithms, and machine learning to forecast financial trends |

| Primary Function | Real-time financial performance analysis and scenario simulation | Predicting future financial outcomes and detecting anomalies |

| Data Utilization | Integrates live transactional data and system metrics | Analyzes historical data and identifies patterns for forecasting |

| Benefits | Improved financial decision-making, risk management, and operational efficiency | Enhanced budgeting accuracy, fraud detection, and trend identification |

| Technology | IoT sensors, ERP integration, simulation models | Machine learning models, statistical analysis software, big data platforms |

| Industry Application | Large enterprises requiring detailed system replication and scenario testing | Businesses seeking future financial insights and anomaly detection |

| Limitations | High implementation cost, complexity, and data accuracy dependency | Requires quality historical data; risk of inaccurate predictions |

Which is better?

Digital twin accounting offers real-time simulation and monitoring of financial activities, enabling accurate scenario analysis and risk management. Predictive analytics in accounting leverages historical data and machine learning models to forecast trends, detect anomalies, and enhance decision-making accuracy. Businesses seeking dynamic financial insights and proactive strategy adjustments benefit more from digital twin accounting, while those focused on trend prediction and risk assessment may prefer predictive analytics.

Connection

Digital twin accounting creates a real-time virtual model of financial processes, enabling continuous monitoring and simulation of accounting activities. Predictive analytics leverages this digital twin data to forecast future financial trends, identify risks, and optimize decision-making. Integrating these technologies enhances accuracy in financial reporting and strategic planning by providing dynamic insights based on current and historical accounting data.

Key Terms

Forecasting algorithms

Predictive analytics in accounting leverages historical financial data and machine learning algorithms to forecast future revenues, expenses, and cash flows with high precision. Digital twin accounting enhances this by creating a real-time, virtual replica of financial systems, integrating forecasting algorithms with dynamic simulations to predict potential outcomes under various business scenarios. Explore how these advanced forecasting algorithms transform financial decision-making and operational efficiency.

Real-time simulation

Predictive analytics in accounting uses historical data and statistical models to forecast financial trends, enhancing decision-making and risk management. Digital twin accounting offers real-time simulation by creating a virtual replica of financial systems, enabling instant scenario analysis and proactive adjustments. Explore the advantages of real-time simulation and how it transforms financial operations.

Virtual ledger

Predictive analytics in accounting leverages historical financial data and machine learning algorithms to forecast future trends, enabling proactive decision-making and risk management. Digital twin accounting, centered on the concept of a Virtual Ledger, creates a real-time, dynamic digital replica of financial systems, facilitating continuous simulation and testing of accounting scenarios. Explore the transformative potential of Virtual Ledger technology and its impact on financial accuracy and operational efficiency.

Source and External Links

The Guide to Smarter Forecasting with Predictive Analytics ... - Pulse - Predictive analytics in accounting uses historical financial data, statistical algorithms, and machine learning to forecast risks, trends, and future performance, enabling more accurate income, expense, and cash flow projections than traditional methods.

How Can Accountants Use Predictive Analytics? - INAA - Accountants apply predictive analytics to improve budgeting accuracy, analyze loss drivers, and forecast sales, thereby offering insightful advice and enhancing client decision-making.

Predictive Analytics in Finance: 5 Key Trends to Watch - Ramp - Predictive analytics transforms accounting from backward-looking reporting to forward-looking strategic guidance by using historical data and machine learning to forecast financial outcomes and recommend optimal actions.

dowidth.com

dowidth.com