Blockchain reconciliation offers real-time, transparent transaction verification through a decentralized ledger, significantly reducing errors compared to legacy system reconciliation, which relies on manual data entry and batch processing with higher risks of discrepancies. This innovative technology enhances accuracy and efficiency by automating record matching and providing immutable audit trails unavailable in traditional reconciliation methods. Explore how blockchain reconciliation transforms accounting accuracy and operational workflows.

Why it is important

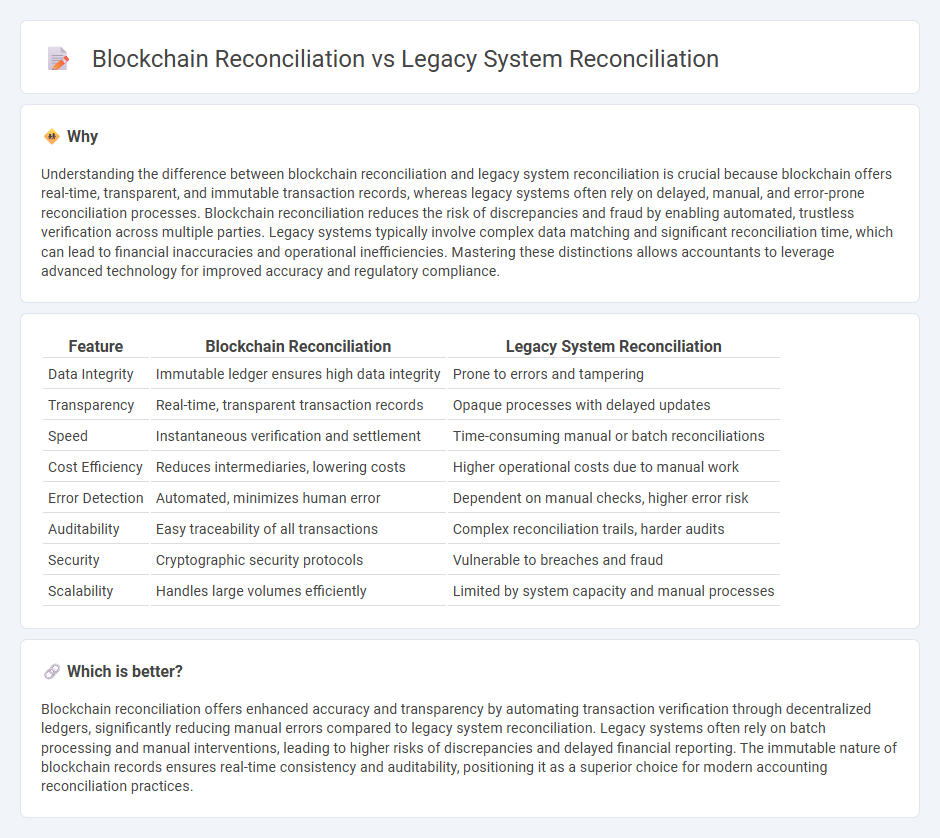

Understanding the difference between blockchain reconciliation and legacy system reconciliation is crucial because blockchain offers real-time, transparent, and immutable transaction records, whereas legacy systems often rely on delayed, manual, and error-prone reconciliation processes. Blockchain reconciliation reduces the risk of discrepancies and fraud by enabling automated, trustless verification across multiple parties. Legacy systems typically involve complex data matching and significant reconciliation time, which can lead to financial inaccuracies and operational inefficiencies. Mastering these distinctions allows accountants to leverage advanced technology for improved accuracy and regulatory compliance.

Comparison Table

| Feature | Blockchain Reconciliation | Legacy System Reconciliation |

|---|---|---|

| Data Integrity | Immutable ledger ensures high data integrity | Prone to errors and tampering |

| Transparency | Real-time, transparent transaction records | Opaque processes with delayed updates |

| Speed | Instantaneous verification and settlement | Time-consuming manual or batch reconciliations |

| Cost Efficiency | Reduces intermediaries, lowering costs | Higher operational costs due to manual work |

| Error Detection | Automated, minimizes human error | Dependent on manual checks, higher error risk |

| Auditability | Easy traceability of all transactions | Complex reconciliation trails, harder audits |

| Security | Cryptographic security protocols | Vulnerable to breaches and fraud |

| Scalability | Handles large volumes efficiently | Limited by system capacity and manual processes |

Which is better?

Blockchain reconciliation offers enhanced accuracy and transparency by automating transaction verification through decentralized ledgers, significantly reducing manual errors compared to legacy system reconciliation. Legacy systems often rely on batch processing and manual interventions, leading to higher risks of discrepancies and delayed financial reporting. The immutable nature of blockchain records ensures real-time consistency and auditability, positioning it as a superior choice for modern accounting reconciliation practices.

Connection

Blockchain reconciliation and legacy system reconciliation are connected through their shared goal of verifying and validating financial transactions to ensure accuracy and consistency. Blockchain technology enhances reconciliation processes by providing immutable, transparent transaction records, reducing discrepancies common in legacy systems dependent on manual data entry. Integrating blockchain with legacy accounting systems streamlines reconciliation workflows, improves data integrity, and accelerates audit processes in financial management.

Key Terms

Double-entry bookkeeping

Legacy system reconciliation relies heavily on double-entry bookkeeping, where transactions are recorded in two accounts to maintain balance and detect errors during financial audits. Blockchain reconciliation enhances this process by providing an immutable, transparent ledger that automates transaction verification, reducing discrepancies and increasing trust in financial records. Explore how blockchain technology is revolutionizing double-entry bookkeeping and financial reconciliation efficiency.

Immutable ledger

Legacy system reconciliation often relies on centralized databases prone to errors and delays, lacking an immutable ledger to ensure data integrity. Blockchain reconciliation leverages a decentralized, immutable ledger that guarantees tamper-proof, transparent transaction records, enhancing trust and accuracy in financial processes. Explore how blockchain's immutable ledger revolutionizes reconciliation accuracy and security.

Manual adjustments

Legacy system reconciliation often requires extensive manual adjustments due to fragmented data sources and slow error detection, increasing the risk of human error and delayed financial accuracy. Blockchain reconciliation automates data verification with a decentralized ledger, minimizing the need for manual intervention and enhancing transparency through real-time updates. Explore how blockchain can transform reconciliation processes and reduce operational risks.

Source and External Links

Requirements for Taxpayer Reconciliation of Legacy System Ledger Balances - Legacy system reconciliation involves providing documentation such as reconciliation request letters, payment slips, and bank confirmations to account for uncaptured or late payments for accurate ledger balance adjustments.

Load legacy Payment details for reconciliation in Cash Management - Legacy system reconciliation in Oracle Cloud Cash Management can be done by importing legacy payment details and bank statements to match and verify payments that were originally processed outside the current system.

Persistent challenges: hindrance of legacy systems in reconciliation - Legacy systems often hinder reconciliation due to outdated tools lacking modern features, making it necessary to upgrade for improved compliance, reduced errors, and better alignment with current customer and business needs.

dowidth.com

dowidth.com