Sustainability ledger focuses on tracking environmental, social, and governance (ESG) metrics to measure a company's long-term ecological and social performance. Social impact accounting evaluates the tangible benefits and changes generated by organizational activities on communities and stakeholders, emphasizing measurable social outcomes. Explore how these accounting methods transform corporate responsibility and decision-making.

Why it is important

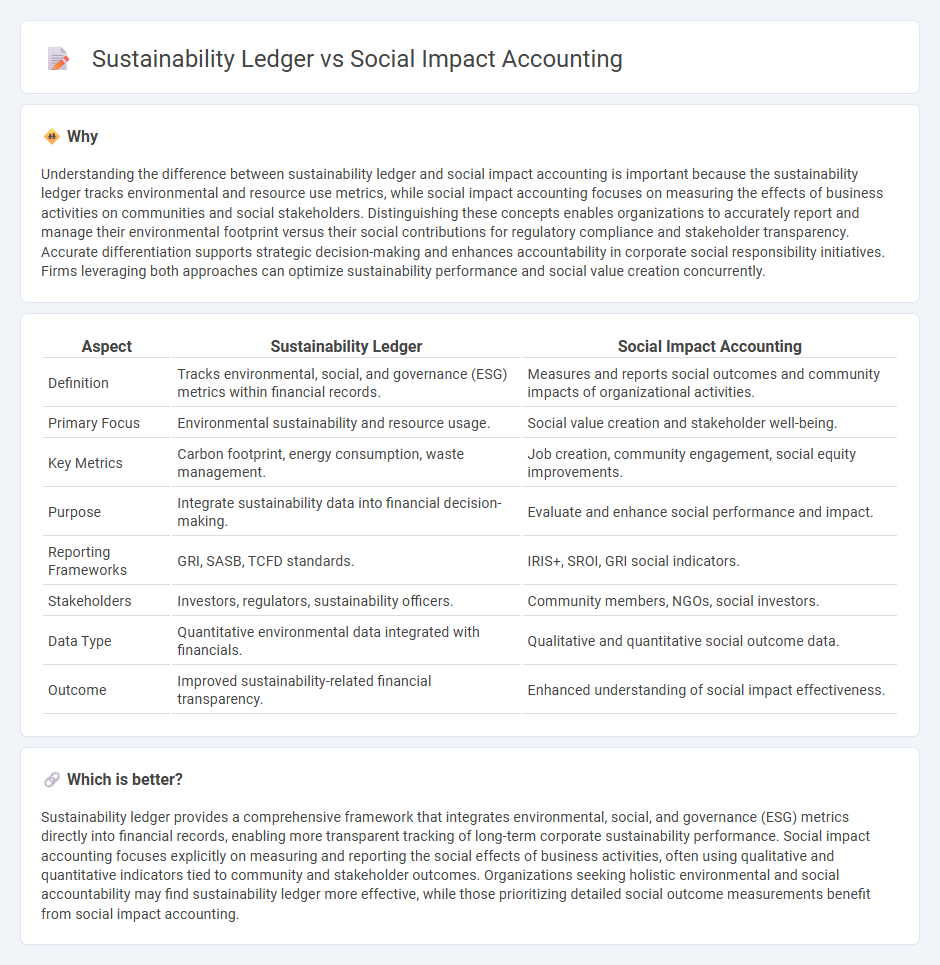

Understanding the difference between sustainability ledger and social impact accounting is important because the sustainability ledger tracks environmental and resource use metrics, while social impact accounting focuses on measuring the effects of business activities on communities and social stakeholders. Distinguishing these concepts enables organizations to accurately report and manage their environmental footprint versus their social contributions for regulatory compliance and stakeholder transparency. Accurate differentiation supports strategic decision-making and enhances accountability in corporate social responsibility initiatives. Firms leveraging both approaches can optimize sustainability performance and social value creation concurrently.

Comparison Table

| Aspect | Sustainability Ledger | Social Impact Accounting |

|---|---|---|

| Definition | Tracks environmental, social, and governance (ESG) metrics within financial records. | Measures and reports social outcomes and community impacts of organizational activities. |

| Primary Focus | Environmental sustainability and resource usage. | Social value creation and stakeholder well-being. |

| Key Metrics | Carbon footprint, energy consumption, waste management. | Job creation, community engagement, social equity improvements. |

| Purpose | Integrate sustainability data into financial decision-making. | Evaluate and enhance social performance and impact. |

| Reporting Frameworks | GRI, SASB, TCFD standards. | IRIS+, SROI, GRI social indicators. |

| Stakeholders | Investors, regulators, sustainability officers. | Community members, NGOs, social investors. |

| Data Type | Quantitative environmental data integrated with financials. | Qualitative and quantitative social outcome data. |

| Outcome | Improved sustainability-related financial transparency. | Enhanced understanding of social impact effectiveness. |

Which is better?

Sustainability ledger provides a comprehensive framework that integrates environmental, social, and governance (ESG) metrics directly into financial records, enabling more transparent tracking of long-term corporate sustainability performance. Social impact accounting focuses explicitly on measuring and reporting the social effects of business activities, often using qualitative and quantitative indicators tied to community and stakeholder outcomes. Organizations seeking holistic environmental and social accountability may find sustainability ledger more effective, while those prioritizing detailed social outcome measurements benefit from social impact accounting.

Connection

Sustainability ledger integrates environmental, social, and governance (ESG) data into traditional accounting systems to provide a comprehensive view of an organization's long-term value. Social impact accounting quantifies the positive and negative effects an entity has on society, often using metrics aligned with the United Nations Sustainable Development Goals (SDGs). Together, they enable businesses to track sustainability performance, enhance transparency, and support responsible investment decisions.

Key Terms

**Social Impact Accounting:**

Social Impact Accounting measures and quantifies the social outcomes and value generated by organizations, focusing on metrics like improved community well-being, reduced inequality, and enhanced social equity. This approach prioritizes transparency and accountability in social performance, enabling stakeholders to assess the real-world effects beyond financial results. Discover how Social Impact Accounting drives meaningful change and supports responsible business practices.

Social Return on Investment (SROI)

Social impact accounting measures and quantifies the social value generated by projects, emphasizing outcomes that benefit communities and stakeholders, while sustainability ledger tracks environmental and social performance within broader corporate responsibility efforts. Social Return on Investment (SROI) serves as a key metric in social impact accounting, transforming social outcomes into monetary terms to evaluate effectiveness and inform decision-making. Explore how integrating SROI into these frameworks enhances transparency and drives meaningful social progress.

Stakeholder Engagement

Social impact accounting prioritizes measuring tangible outcomes and quantitative data to assess how organizational activities affect various stakeholders, emphasizing transparency and accountability. The sustainability ledger integrates environmental, social, and governance (ESG) metrics into financial reporting, fostering continuous stakeholder engagement through comprehensive, real-time data tracking. Explore how blending both approaches enhances stakeholder communication and drives meaningful corporate responsibility.

Source and External Links

Accounting Social Impact - Carleton University - Social impact accounting broadens traditional accounting by including social and environmental objectives, capturing factors like volunteer hours to measure value beyond financial metrics and providing tools such as the Expanded Value Added Statement (EVAS) to better communicate social value creation.

The Case for Impact Accounting - IFVI - Impact accounting translates social and environmental impacts into monetary terms, enabling businesses and investors to analyze and act on these impacts within familiar financial frameworks, thus advancing more holistic and sustainable decision-making.

Emergence of Impact Accounting: The Journey to Apply Monetary Value - Thomson Reuters - Impact accounting is an evolving discipline that assigns monetary values to human, social, and natural capital for ESG reporting, aiming to standardize and integrate impact measurement into corporate accounting to better reflect sustainability and enterprise value creation.

dowidth.com

dowidth.com