Forensic accounting software specializes in detecting fraud, analyzing financial discrepancies, and supporting legal investigations by providing detailed audit trails and data analytics. Billing and invoicing software streamlines the creation, management, and tracking of invoices and payments to improve cash flow and client billing accuracy. Explore the key features and benefits of both to determine which solution best fits your accounting needs.

Why it is important

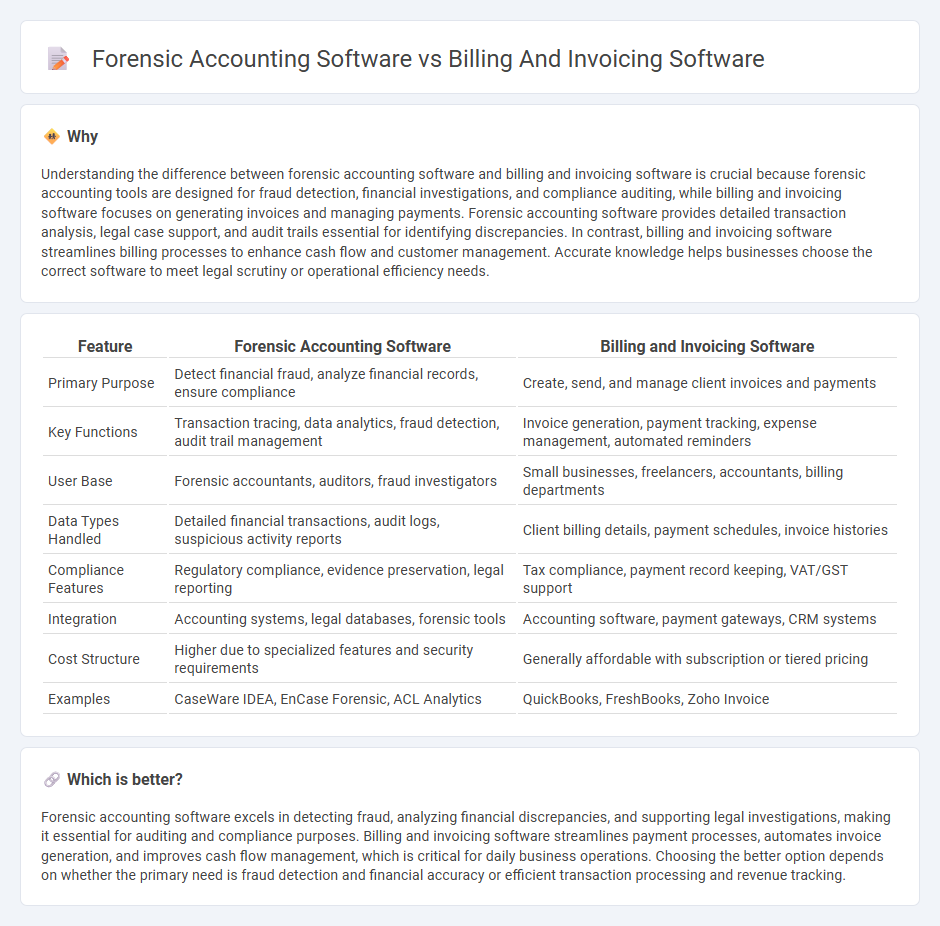

Understanding the difference between forensic accounting software and billing and invoicing software is crucial because forensic accounting tools are designed for fraud detection, financial investigations, and compliance auditing, while billing and invoicing software focuses on generating invoices and managing payments. Forensic accounting software provides detailed transaction analysis, legal case support, and audit trails essential for identifying discrepancies. In contrast, billing and invoicing software streamlines billing processes to enhance cash flow and customer management. Accurate knowledge helps businesses choose the correct software to meet legal scrutiny or operational efficiency needs.

Comparison Table

| Feature | Forensic Accounting Software | Billing and Invoicing Software |

|---|---|---|

| Primary Purpose | Detect financial fraud, analyze financial records, ensure compliance | Create, send, and manage client invoices and payments |

| Key Functions | Transaction tracing, data analytics, fraud detection, audit trail management | Invoice generation, payment tracking, expense management, automated reminders |

| User Base | Forensic accountants, auditors, fraud investigators | Small businesses, freelancers, accountants, billing departments |

| Data Types Handled | Detailed financial transactions, audit logs, suspicious activity reports | Client billing details, payment schedules, invoice histories |

| Compliance Features | Regulatory compliance, evidence preservation, legal reporting | Tax compliance, payment record keeping, VAT/GST support |

| Integration | Accounting systems, legal databases, forensic tools | Accounting software, payment gateways, CRM systems |

| Cost Structure | Higher due to specialized features and security requirements | Generally affordable with subscription or tiered pricing |

| Examples | CaseWare IDEA, EnCase Forensic, ACL Analytics | QuickBooks, FreshBooks, Zoho Invoice |

Which is better?

Forensic accounting software excels in detecting fraud, analyzing financial discrepancies, and supporting legal investigations, making it essential for auditing and compliance purposes. Billing and invoicing software streamlines payment processes, automates invoice generation, and improves cash flow management, which is critical for daily business operations. Choosing the better option depends on whether the primary need is fraud detection and financial accuracy or efficient transaction processing and revenue tracking.

Connection

Forensic accounting software and billing and invoicing software are connected through their shared ability to enhance financial transparency and accuracy by meticulously tracking transactions and detecting anomalies. Forensic accounting software analyzes billing and invoicing records to identify discrepancies, fraudulent activities, and errors, ensuring compliance with financial regulations. Integrating these systems improves audit efficiency, reduces financial fraud risks, and supports thorough financial investigations.

Key Terms

Automation

Billing and invoicing software automates the generation, tracking, and management of customer invoices to streamline payment processes and improve cash flow. Forensic accounting software automates the analysis of financial records for fraud detection, compliance auditing, and legal investigations, integrating data analytics and evidence management tools. Explore the key differences and advantages of automation in both software types to optimize your financial operations.

Compliance

Billing and invoicing software streamlines transaction recording and generates accurate financial documents essential for regulatory compliance. Forensic accounting software specializes in detecting fraud, analyzing financial discrepancies, and supporting legal investigations to ensure adherence to compliance standards. Explore detailed comparisons to understand which software enhances your organization's compliance framework effectively.

Audit Trail

Billing and invoicing software primarily generates and organizes financial documents for customer transactions, but its audit trail capabilities are often limited to basic transaction logs. Forensic accounting software provides detailed audit trails with comprehensive data tracking, enabling thorough analysis of financial discrepancies and fraud detection. Explore the distinct advantages of audit trail features in both to determine the best solution for your financial oversight needs.

Source and External Links

Salesforce Revenue Cloud - A comprehensive billing and revenue management solution for businesses.

Wave Invoicing - A straightforward invoicing tool that helps small businesses manage customer information and payments efficiently.

Invoice Ninja - A free and flexible invoicing software designed for small businesses and freelancers, offering features like automatic reminders and multi-currency support.

dowidth.com

dowidth.com