Supply chain finance improves cash flow by optimizing payment terms between buyers and suppliers, leveraging early payment discounts and extended payment cycles. Accounts payable financing specifically focuses on businesses obtaining short-term credit to settle outstanding invoices, often through third-party lenders. Explore how these distinct financing methods can enhance your business liquidity and operational efficiency.

Why it is important

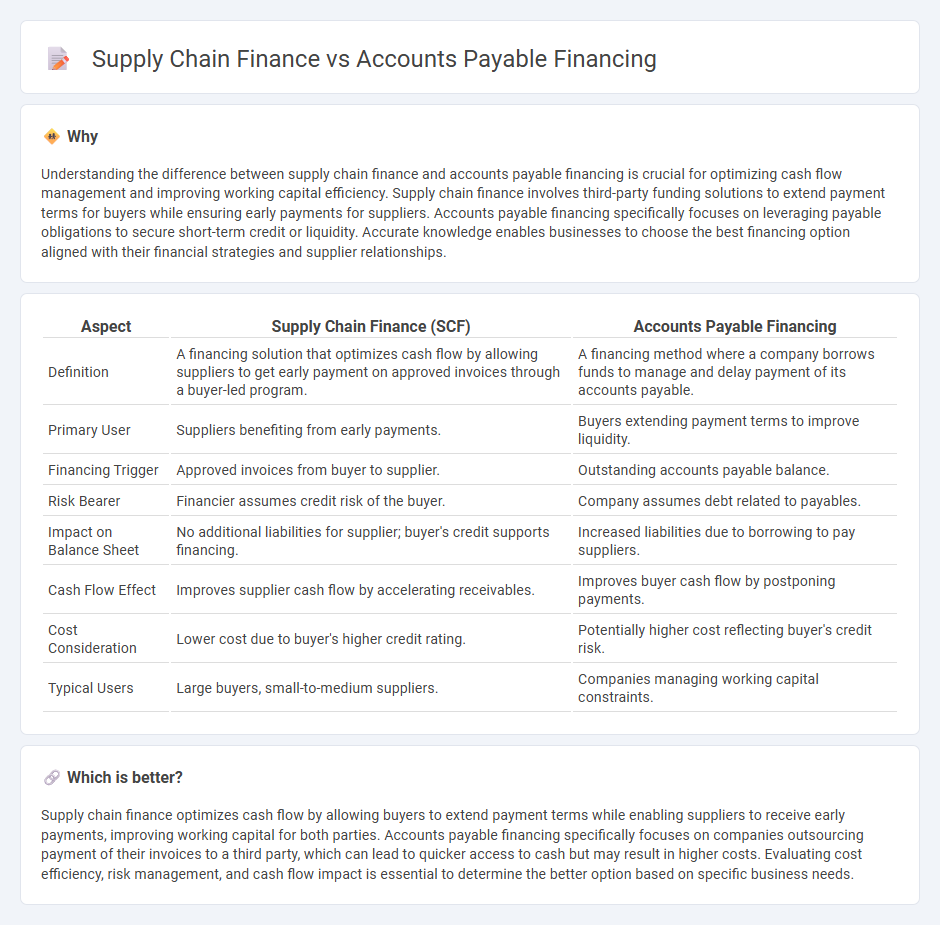

Understanding the difference between supply chain finance and accounts payable financing is crucial for optimizing cash flow management and improving working capital efficiency. Supply chain finance involves third-party funding solutions to extend payment terms for buyers while ensuring early payments for suppliers. Accounts payable financing specifically focuses on leveraging payable obligations to secure short-term credit or liquidity. Accurate knowledge enables businesses to choose the best financing option aligned with their financial strategies and supplier relationships.

Comparison Table

| Aspect | Supply Chain Finance (SCF) | Accounts Payable Financing |

|---|---|---|

| Definition | A financing solution that optimizes cash flow by allowing suppliers to get early payment on approved invoices through a buyer-led program. | A financing method where a company borrows funds to manage and delay payment of its accounts payable. |

| Primary User | Suppliers benefiting from early payments. | Buyers extending payment terms to improve liquidity. |

| Financing Trigger | Approved invoices from buyer to supplier. | Outstanding accounts payable balance. |

| Risk Bearer | Financier assumes credit risk of the buyer. | Company assumes debt related to payables. |

| Impact on Balance Sheet | No additional liabilities for supplier; buyer's credit supports financing. | Increased liabilities due to borrowing to pay suppliers. |

| Cash Flow Effect | Improves supplier cash flow by accelerating receivables. | Improves buyer cash flow by postponing payments. |

| Cost Consideration | Lower cost due to buyer's higher credit rating. | Potentially higher cost reflecting buyer's credit risk. |

| Typical Users | Large buyers, small-to-medium suppliers. | Companies managing working capital constraints. |

Which is better?

Supply chain finance optimizes cash flow by allowing buyers to extend payment terms while enabling suppliers to receive early payments, improving working capital for both parties. Accounts payable financing specifically focuses on companies outsourcing payment of their invoices to a third party, which can lead to quicker access to cash but may result in higher costs. Evaluating cost efficiency, risk management, and cash flow impact is essential to determine the better option based on specific business needs.

Connection

Supply chain finance improves working capital management by accelerating payments to suppliers, which directly impacts accounts payable financing by reducing outstanding payables and enhancing cash flow. Accounts payable financing enables companies to extend payment terms while suppliers receive early payment through third-party financiers, creating a seamless integration within supply chain finance. This connection optimizes liquidity for buyers and suppliers, streamlining financial operations across the supply chain.

Key Terms

Trade Credit

Accounts payable financing and supply chain finance both optimize working capital by extending trade credit terms but differ in scope and structure; accounts payable financing is a short-term credit facility for buyers to delay payments, while supply chain finance involves a broader collaboration between buyers, suppliers, and financial institutions to improve cash flow through early payment solutions. Trade credit plays a central role in these mechanisms, with supply chain finance often enhancing supplier cash flow by enabling early payment at discounted rates. Explore the nuances of trade credit's impact on these financing options to boost your business's financial agility.

Reverse Factoring

Reverse factoring, a key component of supply chain finance, enhances liquidity by allowing suppliers to receive early payment from a financial institution based on buyer-approved invoices. Unlike traditional accounts payable financing where companies directly extend payment terms, reverse factoring involves a third party that mitigates risk and streamlines cash flow for both buyers and suppliers. Explore how reverse factoring transforms financial strategies and optimizes working capital management in modern supply chains.

Payment Terms

Accounts payable financing allows companies to extend payment terms by borrowing against outstanding invoices, improving cash flow without altering supplier relationships. Supply chain finance optimizes payment terms by involving third-party financiers to pay suppliers early while allowing buyers to extend their payment periods, enhancing working capital management across the supply chain. Explore the differences in payment term strategies to optimize your business's financial operations.

Source and External Links

What Is Accounts Payable (AP) Financing? - Ramp - Accounts payable financing is a process where a company involves a third-party lender to cover vendor payments upfront, allowing the company to settle the balance later with interest or fees.

Accounts payable (AP) financing: How it works & key examples - Accounts payable financing allows businesses to borrow funds based on unpaid invoices, providing liquidity while suppliers receive timely payments and buyers manage cash flow.

Accounts payable financing - Bill.com - Accounts payable financing involves a third-party lender providing funds for a buyer's purchases from a vendor, with the buyer paying back the lender according to agreed terms including interest or fees.

dowidth.com

dowidth.com