Fractional CFO services offer strategic financial leadership by analyzing cash flow, budgeting, and forecasting to drive business growth, while bookkeeping focuses on recording daily transactions and maintaining accurate financial records. Businesses seeking both expert financial planning and detailed account management often benefit from integrating these services. Explore how combining Fractional CFO expertise with professional bookkeeping can optimize your company's financial health.

Why it is important

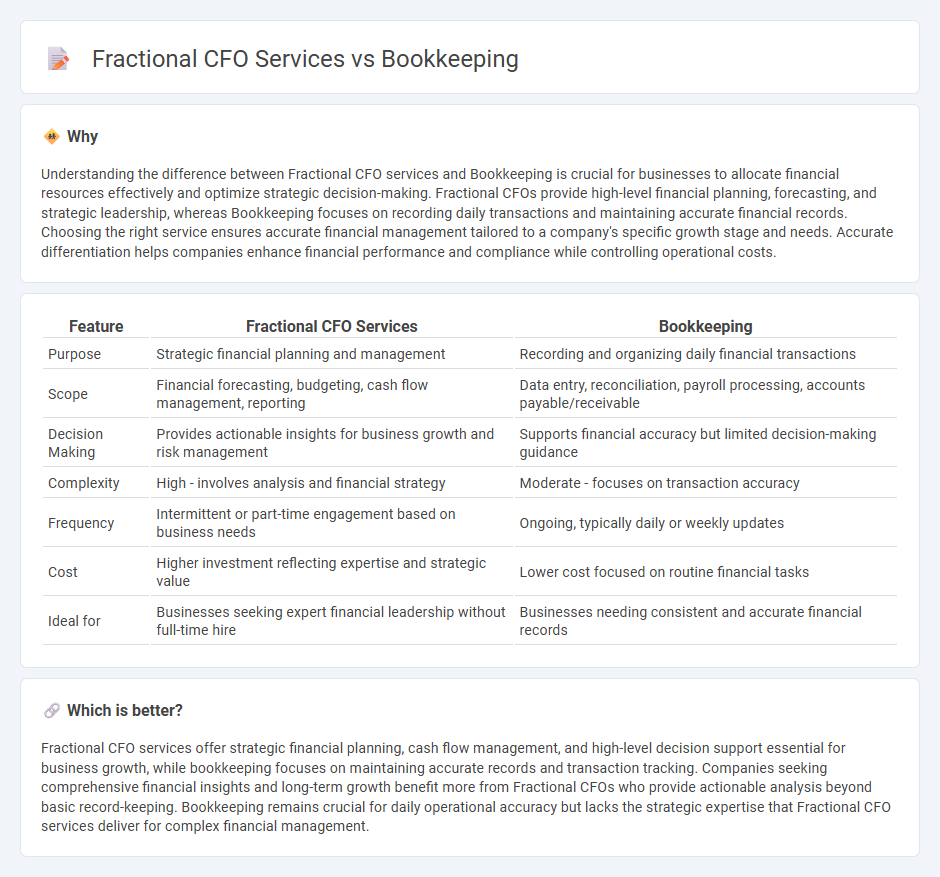

Understanding the difference between Fractional CFO services and Bookkeeping is crucial for businesses to allocate financial resources effectively and optimize strategic decision-making. Fractional CFOs provide high-level financial planning, forecasting, and strategic leadership, whereas Bookkeeping focuses on recording daily transactions and maintaining accurate financial records. Choosing the right service ensures accurate financial management tailored to a company's specific growth stage and needs. Accurate differentiation helps companies enhance financial performance and compliance while controlling operational costs.

Comparison Table

| Feature | Fractional CFO Services | Bookkeeping |

|---|---|---|

| Purpose | Strategic financial planning and management | Recording and organizing daily financial transactions |

| Scope | Financial forecasting, budgeting, cash flow management, reporting | Data entry, reconciliation, payroll processing, accounts payable/receivable |

| Decision Making | Provides actionable insights for business growth and risk management | Supports financial accuracy but limited decision-making guidance |

| Complexity | High - involves analysis and financial strategy | Moderate - focuses on transaction accuracy |

| Frequency | Intermittent or part-time engagement based on business needs | Ongoing, typically daily or weekly updates |

| Cost | Higher investment reflecting expertise and strategic value | Lower cost focused on routine financial tasks |

| Ideal for | Businesses seeking expert financial leadership without full-time hire | Businesses needing consistent and accurate financial records |

Which is better?

Fractional CFO services offer strategic financial planning, cash flow management, and high-level decision support essential for business growth, while bookkeeping focuses on maintaining accurate records and transaction tracking. Companies seeking comprehensive financial insights and long-term growth benefit more from Fractional CFOs who provide actionable analysis beyond basic record-keeping. Bookkeeping remains crucial for daily operational accuracy but lacks the strategic expertise that Fractional CFO services deliver for complex financial management.

Connection

Fractional CFO services and bookkeeping are interconnected through the critical financial data bookkeeping provides, enabling Fractional CFOs to analyze cash flow, budgeting, and strategic planning accurately. Bookkeeping maintains the day-to-day financial transactions, which serve as the foundation for the CFO's financial forecasting and decision-making processes. This synergy enhances overall financial management and supports business growth efficiently.

Key Terms

Transactions

Bookkeeping services primarily focus on recording and organizing financial transactions, ensuring accuracy in daily financial data entry, bank reconciliations, and expense tracking. Fractional CFO services, meanwhile, analyze these transactions to provide strategic financial insights, budgeting, forecasting, and cash flow management to drive business growth. Discover how aligning bookkeeping with fractional CFO expertise can optimize your company's financial health.

Financial Statements

Bookkeeping primarily involves the accurate recording of daily financial transactions, ensuring that all income and expenses are systematically logged to create foundational financial statements like the balance sheet and income statement. Fractional CFO services extend beyond bookkeeping by analyzing these financial statements to provide strategic insights, cash flow management, forecasting, and financial planning tailored to business growth. Discover how leveraging both services can enhance financial clarity and drive informed decision-making.

Strategic Financial Planning

Bookkeeping involves the systematic recording of financial transactions, ensuring accurate and up-to-date records, while Fractional CFO services encompass strategic financial planning, budgeting, cash flow management, and financial analysis to drive business growth. Unlike bookkeeping, Fractional CFOs provide expert insights, forecasting, and decision-making support tailored to long-term financial goals. Discover how integrating Fractional CFO services can elevate your organization's financial strategy by exploring more detailed comparisons.

Source and External Links

What is Bookkeeping? 2025 Business Owner's Guide | QuickBooks - This guide provides an overview of bookkeeping, including its definition, types, and importance in tracking financial transactions for business success.

What Is Bookkeeping? Tasks, Skills, and How to Become ... - Coursera - This article explains the practice of bookkeeping, its tasks, required skills, and career opportunities, highlighting its role in maintaining financial records.

Bookkeeping - Wikipedia - This page provides a detailed explanation of bookkeeping, including its definition, methods such as single-entry and double-entry systems, and its relation to accounting.

dowidth.com

dowidth.com