Continuous close streamlines financial reporting by integrating data in real-time, reducing bottlenecks and errors common in traditional quarter-end close processes. Quarter-end close consolidates all transactions within a fixed period, providing a comprehensive snapshot but often delaying actionable insights. Explore the benefits and challenges of each approach to optimize your accounting workflow.

Why it is important

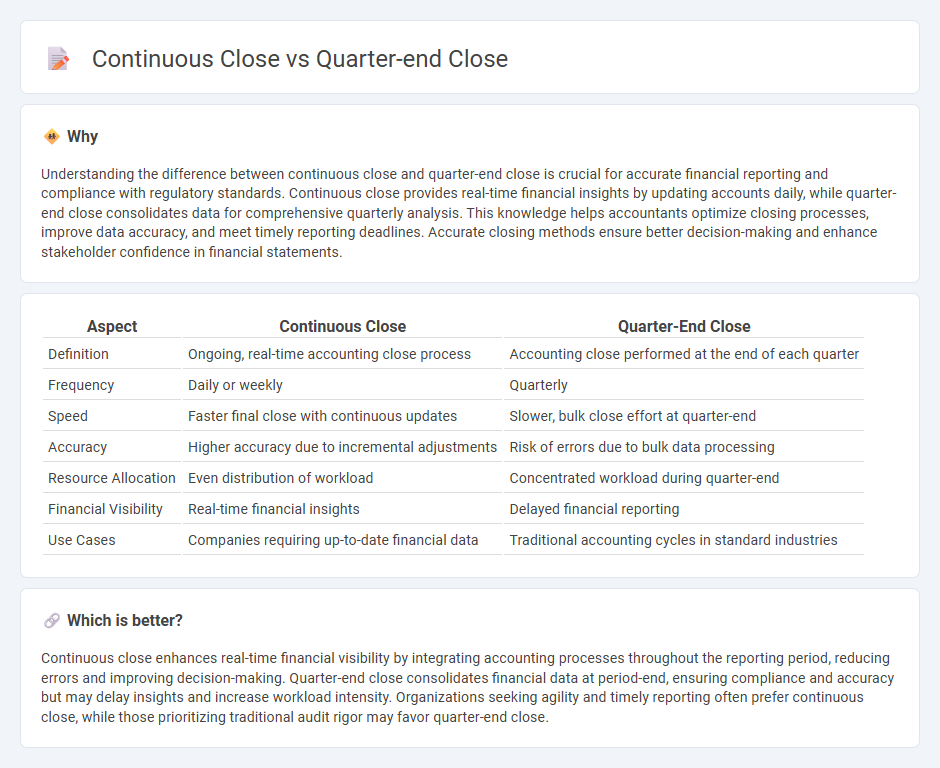

Understanding the difference between continuous close and quarter-end close is crucial for accurate financial reporting and compliance with regulatory standards. Continuous close provides real-time financial insights by updating accounts daily, while quarter-end close consolidates data for comprehensive quarterly analysis. This knowledge helps accountants optimize closing processes, improve data accuracy, and meet timely reporting deadlines. Accurate closing methods ensure better decision-making and enhance stakeholder confidence in financial statements.

Comparison Table

| Aspect | Continuous Close | Quarter-End Close |

|---|---|---|

| Definition | Ongoing, real-time accounting close process | Accounting close performed at the end of each quarter |

| Frequency | Daily or weekly | Quarterly |

| Speed | Faster final close with continuous updates | Slower, bulk close effort at quarter-end |

| Accuracy | Higher accuracy due to incremental adjustments | Risk of errors due to bulk data processing |

| Resource Allocation | Even distribution of workload | Concentrated workload during quarter-end |

| Financial Visibility | Real-time financial insights | Delayed financial reporting |

| Use Cases | Companies requiring up-to-date financial data | Traditional accounting cycles in standard industries |

Which is better?

Continuous close enhances real-time financial visibility by integrating accounting processes throughout the reporting period, reducing errors and improving decision-making. Quarter-end close consolidates financial data at period-end, ensuring compliance and accuracy but may delay insights and increase workload intensity. Organizations seeking agility and timely reporting often prefer continuous close, while those prioritizing traditional audit rigor may favor quarter-end close.

Connection

Continuous close streamlines financial data updates throughout the accounting period, enhancing accuracy and reducing errors. Quarter-end close leverages this real-time data to finalize financial statements more efficiently and with greater confidence. Integrating continuous close practices accelerates the quarter-end close process by minimizing last-minute adjustments and reconciliations.

Key Terms

Periodic Reporting

Quarter-end close involves finalizing all financial transactions and reconciliations at the end of each quarter to ensure accurate periodic reporting, often requiring significant manual adjustments and audit preparation. Continuous close streamlines this process by maintaining up-to-date, real-time financial data throughout the quarter, reducing bottlenecks and improving the accuracy and timeliness of periodic reporting. Explore how continuous close can transform your organization's financial reporting efficiency and accuracy.

Real-Time Data

Quarter-end close involves consolidating and finalizing financial data at the end of a fiscal period, often leading to delays and potential inaccuracies due to batch processing. Continuous close leverages real-time data integration and automated updates, enabling immediate visibility into financial performance and reducing the risk of errors. Explore more to understand how adopting continuous close can transform your financial reporting efficiency and accuracy.

Reconciliation

Quarter-end close requires intensive reconciliation to verify account balances and financial statements for accuracy at a specific period, often resulting in delayed reporting and increased workload. Continuous close integrates real-time reconciliation processes throughout the quarter, enabling timely error detection, improved data accuracy, and streamlined financial close cycles. Explore more to understand how continuous reconciliation enhances financial transparency and operational efficiency.

Source and External Links

Quarter Ending - Hall - This webpage describes quarter ending as the conclusion of a three-month financial period in a company's fiscal year, where businesses close their books and prepare financial statements.

Quarter End - Easy Month End - The quarter end process involves closing financial operations and records at the end of a fiscal quarter, which includes activities like preparing financial statements and reconciling accounts.

Automating Finance Operations: Quarter-End Close and Beyond - This article discusses the importance of automating finance operations during the quarter-end close process, which includes reviewing, documenting, and reconciling financial transactions.

dowidth.com

dowidth.com