Taxonomy alignment in accounting ensures consistent categorization of financial data across reporting frameworks, improving comparability and accuracy. Lease classification determines whether a lease qualifies as an operating or finance lease based on criteria such as lease term and asset ownership transfer. Explore deeper insights to understand how these elements impact financial statements and compliance.

Why it is important

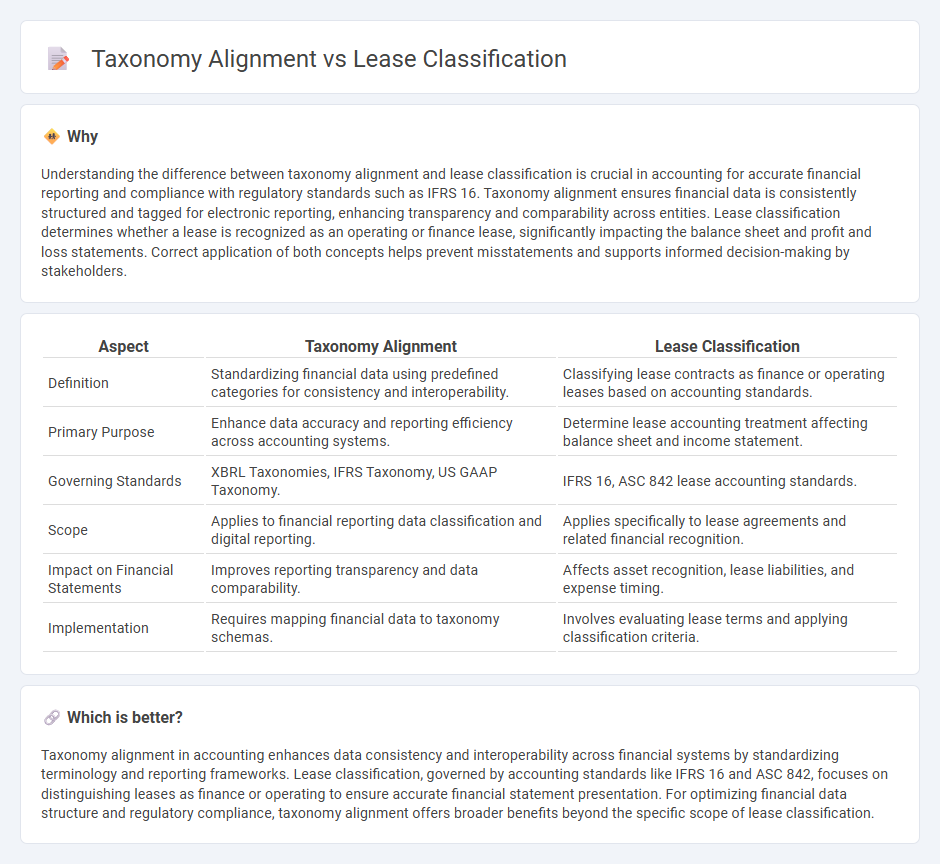

Understanding the difference between taxonomy alignment and lease classification is crucial in accounting for accurate financial reporting and compliance with regulatory standards such as IFRS 16. Taxonomy alignment ensures financial data is consistently structured and tagged for electronic reporting, enhancing transparency and comparability across entities. Lease classification determines whether a lease is recognized as an operating or finance lease, significantly impacting the balance sheet and profit and loss statements. Correct application of both concepts helps prevent misstatements and supports informed decision-making by stakeholders.

Comparison Table

| Aspect | Taxonomy Alignment | Lease Classification |

|---|---|---|

| Definition | Standardizing financial data using predefined categories for consistency and interoperability. | Classifying lease contracts as finance or operating leases based on accounting standards. |

| Primary Purpose | Enhance data accuracy and reporting efficiency across accounting systems. | Determine lease accounting treatment affecting balance sheet and income statement. |

| Governing Standards | XBRL Taxonomies, IFRS Taxonomy, US GAAP Taxonomy. | IFRS 16, ASC 842 lease accounting standards. |

| Scope | Applies to financial reporting data classification and digital reporting. | Applies specifically to lease agreements and related financial recognition. |

| Impact on Financial Statements | Improves reporting transparency and data comparability. | Affects asset recognition, lease liabilities, and expense timing. |

| Implementation | Requires mapping financial data to taxonomy schemas. | Involves evaluating lease terms and applying classification criteria. |

Which is better?

Taxonomy alignment in accounting enhances data consistency and interoperability across financial systems by standardizing terminology and reporting frameworks. Lease classification, governed by accounting standards like IFRS 16 and ASC 842, focuses on distinguishing leases as finance or operating to ensure accurate financial statement presentation. For optimizing financial data structure and regulatory compliance, taxonomy alignment offers broader benefits beyond the specific scope of lease classification.

Connection

Taxonomy alignment enhances lease classification by structuring financial data according to standardized frameworks such as IFRS 16 and ASC 842, ensuring consistency and transparency in lease reporting. Accurate taxonomy alignment facilitates the identification of lease components, differentiating between finance and operating leases based on criteria like lease term, present value of lease payments, and asset ownership transfer. This integration supports compliance with regulatory requirements and improves the reliability of financial statements in accounting systems.

Key Terms

Operating Lease

Operating lease classification is determined by criteria set in accounting standards such as IFRS 16 and ASC 842, focusing on lease term, asset ownership, and risk transfer. Taxonomy alignment ensures consistent financial reporting by mapping operating lease data elements to structured frameworks, enabling transparent and comparable disclosures. Discover how proper taxonomy alignment enhances accuracy and compliance in operating lease reporting.

Finance Lease

Finance lease classification requires distinguishing between operating and finance leases based on criteria such as transfer of ownership, lease term length, and present value of lease payments. Taxonomy alignment ensures that financial reporting frameworks, like IFRS 16 or ASC 842, consistently categorize finance leases in standardized data models to enhance accuracy and comparability. Explore further to understand how taxonomy alignment impacts lease reporting accuracy and regulatory compliance.

IFRS 16

IFRS 16 mandates specific lease classification criteria to distinguish between finance leases and operating leases based on the transfer of risks and rewards. Taxonomy alignment ensures that financial reports comply with IFRS 16 by mapping lease data accurately into standardized XBRL tags, enhancing clarity and comparability. Explore our detailed analysis to better understand the impact of taxonomy alignment on IFRS 16 lease classification accuracy.

Source and External Links

ASC 842 - Classification and Accounting Treatment of Lease - This webpage provides detailed information on how ASC 842 governs the classification of leases into finance and operating leases for lessees, and sales-type, direct financing, and operating leases for lessors.

Leases: Overview of ASC 842 - This whitepaper offers an overview of ASC 842, including the criteria used for lease classification and the implications for both lessees and lessors.

Capital/Finance Lease vs. Operating Lease Explained - This article explains the differences between capital/finance leases and operating leases under ASC 842, focusing on the criteria for classification and accounting treatment.

dowidth.com

dowidth.com