Workflow automation streamlines repetitive accounting tasks by using software to process invoices, reconcile accounts, and generate reports with higher speed and accuracy. Hybrid accounting systems integrate both manual processes and automated tools, offering flexibility to handle complex financial scenarios while maintaining control over critical decisions. Explore how these approaches can transform your accounting operations and boost efficiency.

Why it is important

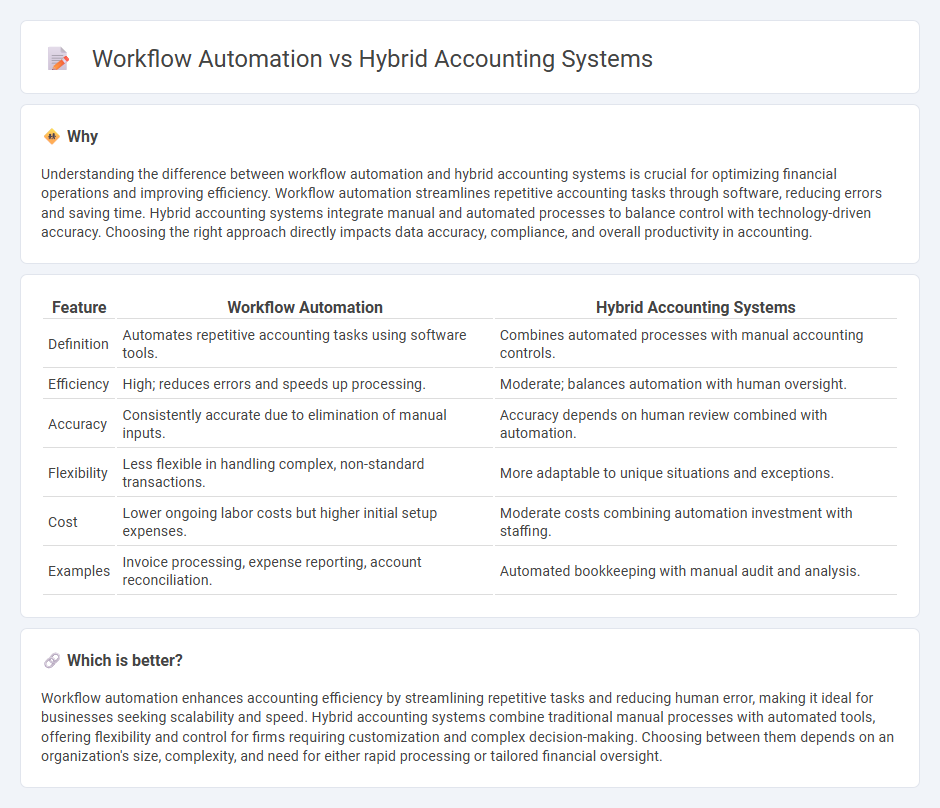

Understanding the difference between workflow automation and hybrid accounting systems is crucial for optimizing financial operations and improving efficiency. Workflow automation streamlines repetitive accounting tasks through software, reducing errors and saving time. Hybrid accounting systems integrate manual and automated processes to balance control with technology-driven accuracy. Choosing the right approach directly impacts data accuracy, compliance, and overall productivity in accounting.

Comparison Table

| Feature | Workflow Automation | Hybrid Accounting Systems |

|---|---|---|

| Definition | Automates repetitive accounting tasks using software tools. | Combines automated processes with manual accounting controls. |

| Efficiency | High; reduces errors and speeds up processing. | Moderate; balances automation with human oversight. |

| Accuracy | Consistently accurate due to elimination of manual inputs. | Accuracy depends on human review combined with automation. |

| Flexibility | Less flexible in handling complex, non-standard transactions. | More adaptable to unique situations and exceptions. |

| Cost | Lower ongoing labor costs but higher initial setup expenses. | Moderate costs combining automation investment with staffing. |

| Examples | Invoice processing, expense reporting, account reconciliation. | Automated bookkeeping with manual audit and analysis. |

Which is better?

Workflow automation enhances accounting efficiency by streamlining repetitive tasks and reducing human error, making it ideal for businesses seeking scalability and speed. Hybrid accounting systems combine traditional manual processes with automated tools, offering flexibility and control for firms requiring customization and complex decision-making. Choosing between them depends on an organization's size, complexity, and need for either rapid processing or tailored financial oversight.

Connection

Workflow automation streamlines repetitive accounting tasks such as invoicing, expense tracking, and report generation, enhancing efficiency and accuracy. Hybrid accounting systems integrate traditional manual processes with automated digital tools, enabling seamless data flow and real-time financial insights. The connection lies in leveraging workflow automation within hybrid systems to optimize accounting operations, reduce errors, and improve decision-making speed.

Key Terms

Process Integration

Hybrid accounting systems combine manual entries with automated processes, enhancing accuracy by allowing seamless data synchronization across platforms. Workflow automation streamlines repetitive tasks through predefined rules, improving efficiency and reducing human error in financial operations. Explore the benefits of integrating these approaches for optimized process management in accounting.

Real-Time Data Processing

Hybrid accounting systems integrate traditional ledger methods with cloud-based platforms to enhance real-time data processing efficiency. Workflow automation streamlines accounting tasks by using AI and machine learning, enabling instant data updates and reducing manual errors. Discover how these technologies revolutionize financial management and improve decision-making accuracy.

Source and External Links

What is Hybrid Method of Accounting | Advantages and ... - A hybrid accounting system combines elements of different accounting methods, typically cash and accrual, offering flexibility, tailored reporting, high compliance, cost efficiency, and more accurate financial insights by using the most appropriate accounting treatment for different business needs.

Understanding the Hybrid Basis of Accounting Method - Hybrid accounting uses cash basis accounting for simpler, immediate transactions and accrual basis accounting for more complex or long-term transactions, enabling businesses to get a balanced, clear view of cash flow and overall financial health with customizable flexibility.

Cash, Accrual, and Hybrid Accounting: Choosing the Right ... - Hybrid accounting allows businesses to switch between cash and accrual methods for revenue and expenses based on their financial goals and regulatory needs, but requires strict consistency and adherence to IRS rules, especially regarding inventory accounting and tax filings.

dowidth.com

dowidth.com