Integrated ESG reporting combines environmental, social, and governance factors into a single framework that aligns with financial performance to provide a comprehensive view of a company's sustainability and ethical impact. In contrast, Triple Bottom Line reporting focuses on three distinct pillars--people, planet, and profit--to measure social, environmental, and economic outcomes separately. Explore the nuances and advantages of each approach to enhance your understanding of sustainable accounting practices.

Why it is important

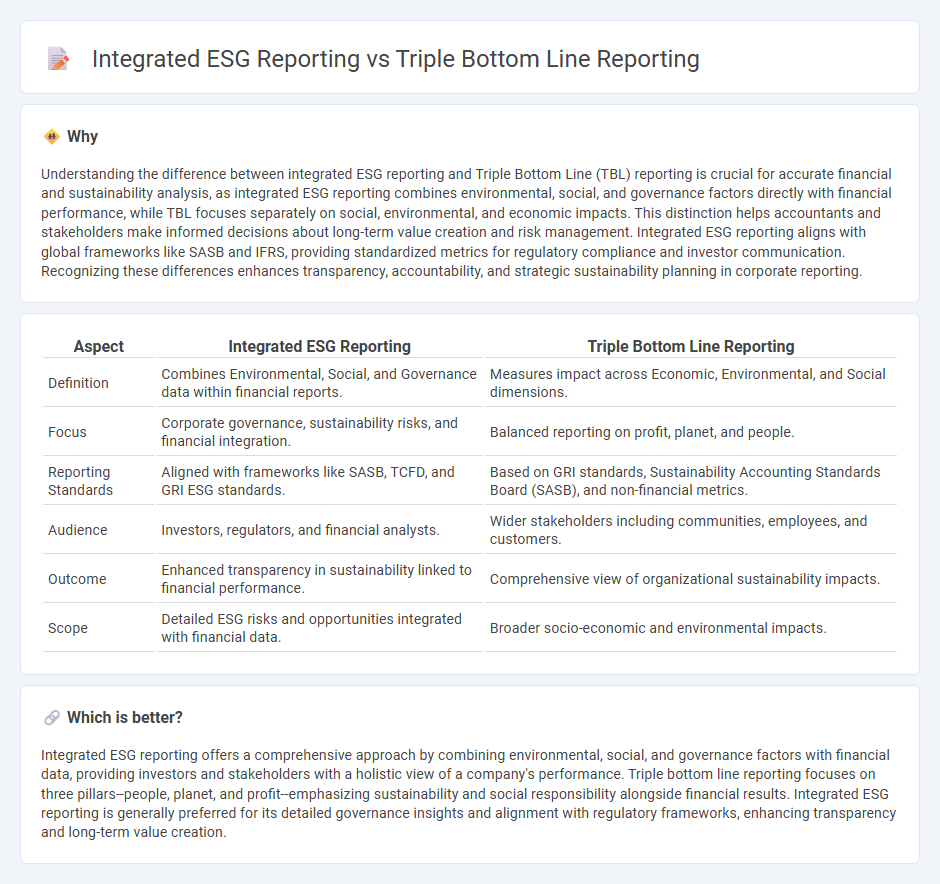

Understanding the difference between integrated ESG reporting and Triple Bottom Line (TBL) reporting is crucial for accurate financial and sustainability analysis, as integrated ESG reporting combines environmental, social, and governance factors directly with financial performance, while TBL focuses separately on social, environmental, and economic impacts. This distinction helps accountants and stakeholders make informed decisions about long-term value creation and risk management. Integrated ESG reporting aligns with global frameworks like SASB and IFRS, providing standardized metrics for regulatory compliance and investor communication. Recognizing these differences enhances transparency, accountability, and strategic sustainability planning in corporate reporting.

Comparison Table

| Aspect | Integrated ESG Reporting | Triple Bottom Line Reporting |

|---|---|---|

| Definition | Combines Environmental, Social, and Governance data within financial reports. | Measures impact across Economic, Environmental, and Social dimensions. |

| Focus | Corporate governance, sustainability risks, and financial integration. | Balanced reporting on profit, planet, and people. |

| Reporting Standards | Aligned with frameworks like SASB, TCFD, and GRI ESG standards. | Based on GRI standards, Sustainability Accounting Standards Board (SASB), and non-financial metrics. |

| Audience | Investors, regulators, and financial analysts. | Wider stakeholders including communities, employees, and customers. |

| Outcome | Enhanced transparency in sustainability linked to financial performance. | Comprehensive view of organizational sustainability impacts. |

| Scope | Detailed ESG risks and opportunities integrated with financial data. | Broader socio-economic and environmental impacts. |

Which is better?

Integrated ESG reporting offers a comprehensive approach by combining environmental, social, and governance factors with financial data, providing investors and stakeholders with a holistic view of a company's performance. Triple bottom line reporting focuses on three pillars--people, planet, and profit--emphasizing sustainability and social responsibility alongside financial results. Integrated ESG reporting is generally preferred for its detailed governance insights and alignment with regulatory frameworks, enhancing transparency and long-term value creation.

Connection

Integrated ESG reporting and Triple Bottom Line (TBL) reporting both emphasize a holistic approach to corporate performance by incorporating environmental, social, and governance factors alongside financial metrics. ESG reporting focuses on measurable criteria related to sustainability and ethical impact, while TBL reporting expands this to include social equity, environmental stewardship, and economic viability. The connection lies in their shared goal of promoting transparency and accountability in accounting, enabling stakeholders to assess long-term value creation beyond traditional financial statements.

Key Terms

Sustainability

Triple bottom line reporting centers on measuring social, environmental, and economic impacts separately, offering a comprehensive view of sustainability performance. Integrated ESG reporting combines environmental, social, and governance factors into a unified framework, aligning sustainability efforts with overall corporate strategy and investor expectations. Explore our detailed analysis to understand how these approaches drive sustainable business practices.

Stakeholders

Triple bottom line (TBL) reporting emphasizes a balanced approach to social, environmental, and economic performance, directly addressing the needs of diverse stakeholders such as employees, communities, and investors. Integrated ESG reporting combines environmental, social, and governance metrics into a comprehensive framework, often aligning with global standards like the GRI or SASB to provide stakeholders with holistic insights into corporate sustainability and ethical governance. Explore how these frameworks shape stakeholder engagement and corporate transparency in greater detail.

Materiality

Triple bottom line reporting emphasizes the economic, social, and environmental impacts of business activities, offering a broad sustainability assessment. Integrated ESG reporting concentrates on materiality by prioritizing environmental, social, and governance factors that significantly affect financial performance and stakeholder value. Explore how these approaches differ in addressing materiality and driving sustainable business strategies.

Source and External Links

The Triple Bottom Line: What Is It and How Does It Work? - This article explores the concept of triple bottom line (TBL) as an accounting framework encompassing social, environmental, and financial dimensions for measuring corporate sustainability.

What Is the Triple Bottom Line (TBL)? - IBM - The TBL is a sustainability framework that balances the three P's: people, planet, and profit, ensuring organizations have a positive impact on the world while improving financial performance.

What is the triple bottom line and why is it important to your... - The triple bottom line (TBL) approach emphasizes that companies should focus equally on social, environmental concerns, and profit, promoting sustainability and business integrity.

dowidth.com

dowidth.com