Cryptofinance reconciliation involves matching cryptocurrency transaction records with blockchain data to ensure accuracy and detect discrepancies, while bank reconciliation focuses on verifying company financial records against bank statements to identify and resolve inconsistencies. Both processes are crucial for maintaining transparent and accurate financial reporting, yet they differ in complexity due to blockchain's decentralized nature and cryptocurrency volatility. Explore more to understand the detailed procedures and benefits of each reconciliation method.

Why it is important

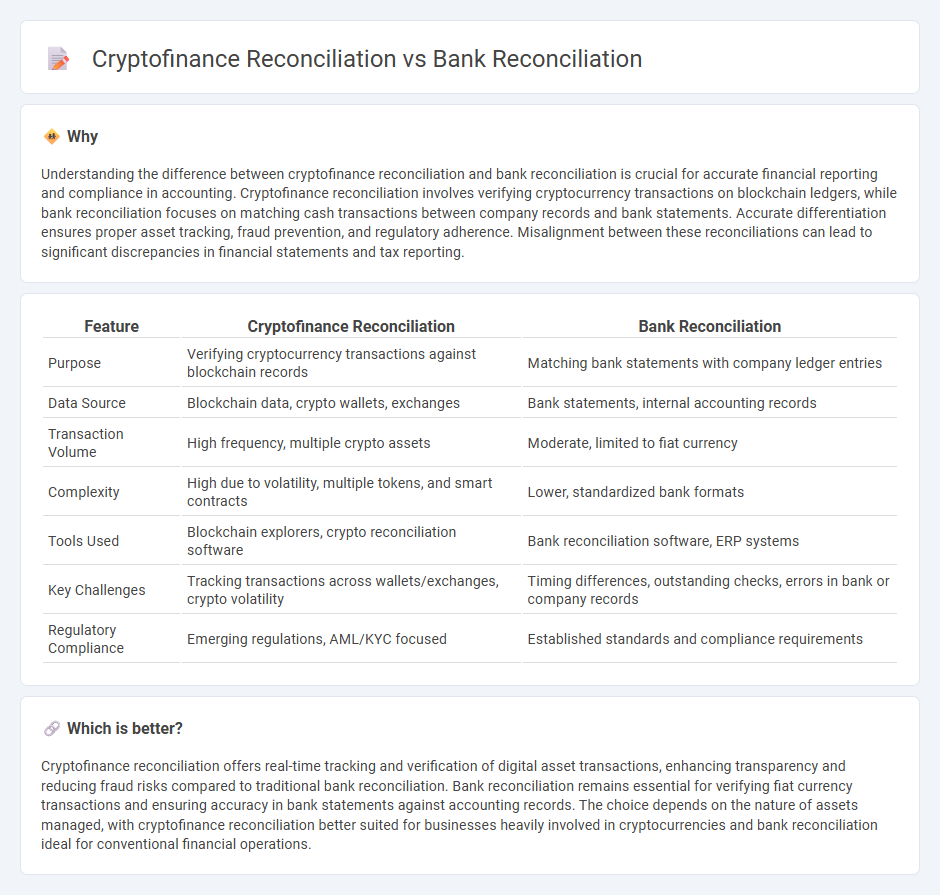

Understanding the difference between cryptofinance reconciliation and bank reconciliation is crucial for accurate financial reporting and compliance in accounting. Cryptofinance reconciliation involves verifying cryptocurrency transactions on blockchain ledgers, while bank reconciliation focuses on matching cash transactions between company records and bank statements. Accurate differentiation ensures proper asset tracking, fraud prevention, and regulatory adherence. Misalignment between these reconciliations can lead to significant discrepancies in financial statements and tax reporting.

Comparison Table

| Feature | Cryptofinance Reconciliation | Bank Reconciliation |

|---|---|---|

| Purpose | Verifying cryptocurrency transactions against blockchain records | Matching bank statements with company ledger entries |

| Data Source | Blockchain data, crypto wallets, exchanges | Bank statements, internal accounting records |

| Transaction Volume | High frequency, multiple crypto assets | Moderate, limited to fiat currency |

| Complexity | High due to volatility, multiple tokens, and smart contracts | Lower, standardized bank formats |

| Tools Used | Blockchain explorers, crypto reconciliation software | Bank reconciliation software, ERP systems |

| Key Challenges | Tracking transactions across wallets/exchanges, crypto volatility | Timing differences, outstanding checks, errors in bank or company records |

| Regulatory Compliance | Emerging regulations, AML/KYC focused | Established standards and compliance requirements |

Which is better?

Cryptofinance reconciliation offers real-time tracking and verification of digital asset transactions, enhancing transparency and reducing fraud risks compared to traditional bank reconciliation. Bank reconciliation remains essential for verifying fiat currency transactions and ensuring accuracy in bank statements against accounting records. The choice depends on the nature of assets managed, with cryptofinance reconciliation better suited for businesses heavily involved in cryptocurrencies and bank reconciliation ideal for conventional financial operations.

Connection

Cryptofinance reconciliation and bank reconciliation both involve verifying transaction records to ensure accuracy in financial statements. While bank reconciliation focuses on cross-verifying a company's ledger with bank statements, cryptofinance reconciliation addresses the unique challenges of matching cryptocurrency transactions with blockchain records and exchange statements. Both processes are crucial for maintaining accurate accounting records and preventing discrepancies or fraud in digital and traditional financial systems.

Key Terms

Outstanding Cheques (Bank Reconciliation)

Outstanding cheques in bank reconciliation refer to issued cheques that have not yet cleared the bank, causing timing differences between the company's ledger and bank statement. In cryptofinance reconciliation, the concept differs as transactions are confirmed on the blockchain rather than waiting for traditional clearing processes, reducing delays associated with outstanding payments. Explore how managing outstanding cheques shapes the accuracy of financial records in both banking and cryptofinance contexts.

Private Keys (Cryptofinance Reconciliation)

Bank reconciliation involves matching a company's financial records with bank statements to identify discrepancies and ensure accuracy, typically focusing on account balances and transaction records. Cryptofinance reconciliation, however, centers on verifying transaction completeness and ownership using private keys, which confirm authority over cryptocurrency assets and prevent unauthorized access. Explore how private key management fundamentally differentiates cryptofinance reconciliation from traditional bank processes.

Ledger Balance

Bank reconciliation primarily focuses on matching the ledger balance with bank statements to ensure accuracy in cash transactions and detect discrepancies such as outstanding checks or deposits in transit. Cryptofinance reconciliation extends this process by incorporating the verification of digital asset transactions across multiple blockchain ledgers and wallets, accounting for volatility and transaction finality delays. Explore more about the unique challenges and tools used in cryptofinance reconciliation to master modern ledger balance management.

Source and External Links

Complete Guide to Bank Reconciliation + 5 Steps Involved - This guide provides a comprehensive overview of bank reconciliation, including its types and a step-by-step process to ensure accurate financial records.

Definition & Example of Bank Reconciliation - This page explains the concept of bank reconciliation with examples, highlighting its importance in financial reporting and fraud detection.

Bank Reconciliation: In-Depth Explanation with Examples - This resource offers a detailed explanation and examples of bank reconciliation, focusing on its purpose and necessary adjustments in financial records.

dowidth.com

dowidth.com