Digital asset reporting streamlines the tracking and valuation of cryptocurrencies and blockchain-based assets, ensuring regulatory compliance with evolving tax laws. Automated accounting systems integrate artificial intelligence and machine learning to increase accuracy, reduce manual errors, and enhance real-time financial analysis. Explore the latest advancements to optimize your digital financial management strategies.

Why it is important

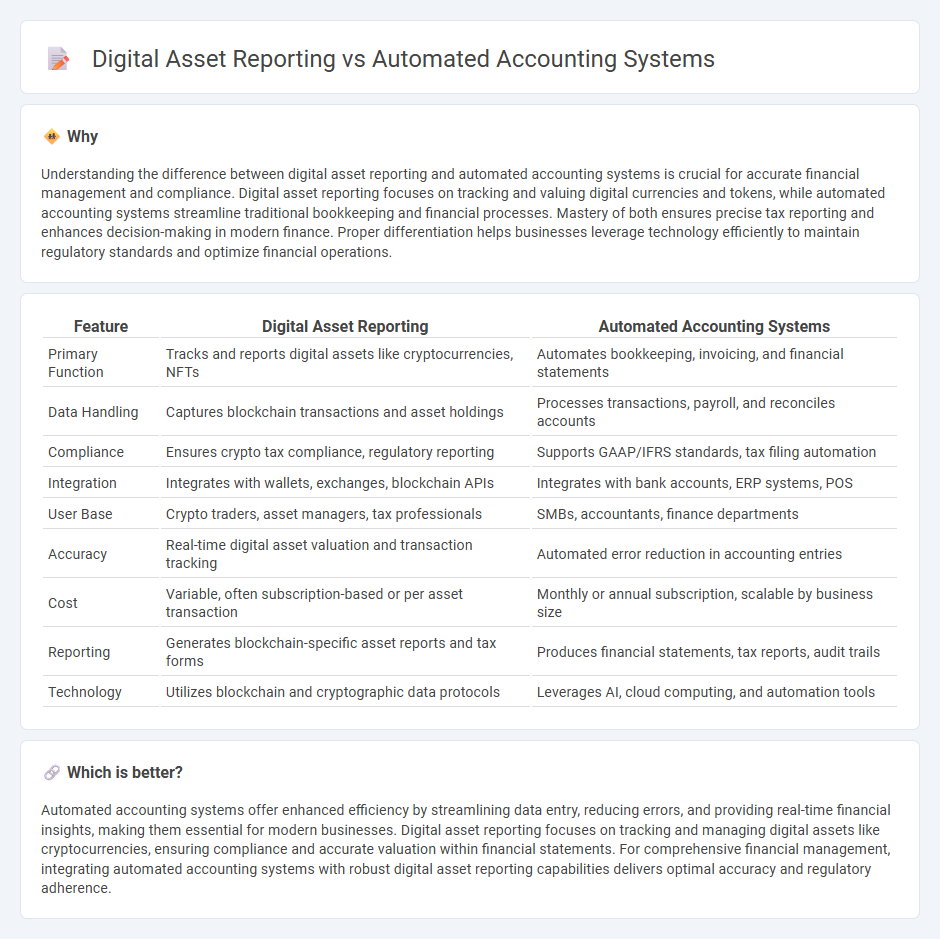

Understanding the difference between digital asset reporting and automated accounting systems is crucial for accurate financial management and compliance. Digital asset reporting focuses on tracking and valuing digital currencies and tokens, while automated accounting systems streamline traditional bookkeeping and financial processes. Mastery of both ensures precise tax reporting and enhances decision-making in modern finance. Proper differentiation helps businesses leverage technology efficiently to maintain regulatory standards and optimize financial operations.

Comparison Table

| Feature | Digital Asset Reporting | Automated Accounting Systems |

|---|---|---|

| Primary Function | Tracks and reports digital assets like cryptocurrencies, NFTs | Automates bookkeeping, invoicing, and financial statements |

| Data Handling | Captures blockchain transactions and asset holdings | Processes transactions, payroll, and reconciles accounts |

| Compliance | Ensures crypto tax compliance, regulatory reporting | Supports GAAP/IFRS standards, tax filing automation |

| Integration | Integrates with wallets, exchanges, blockchain APIs | Integrates with bank accounts, ERP systems, POS |

| User Base | Crypto traders, asset managers, tax professionals | SMBs, accountants, finance departments |

| Accuracy | Real-time digital asset valuation and transaction tracking | Automated error reduction in accounting entries |

| Cost | Variable, often subscription-based or per asset transaction | Monthly or annual subscription, scalable by business size |

| Reporting | Generates blockchain-specific asset reports and tax forms | Produces financial statements, tax reports, audit trails |

| Technology | Utilizes blockchain and cryptographic data protocols | Leverages AI, cloud computing, and automation tools |

Which is better?

Automated accounting systems offer enhanced efficiency by streamlining data entry, reducing errors, and providing real-time financial insights, making them essential for modern businesses. Digital asset reporting focuses on tracking and managing digital assets like cryptocurrencies, ensuring compliance and accurate valuation within financial statements. For comprehensive financial management, integrating automated accounting systems with robust digital asset reporting capabilities delivers optimal accuracy and regulatory adherence.

Connection

Digital asset reporting integrates seamlessly with automated accounting systems by capturing real-time transaction data across blockchain platforms, enhancing accuracy and compliance in financial statements. Automated accounting systems process this data to generate detailed reports that reflect digital asset holdings, valuations, and exchanges, aiding businesses in meeting regulatory requirements. This connection reduces manual errors and streamlines audit trails, ensuring transparency and efficiency in managing cryptocurrency and tokenized assets.

Key Terms

**Automated Accounting Systems:**

Automated accounting systems streamline financial data entry, reconciliation, and reporting through software tools that minimize human error and increase efficiency. These systems integrate features like AI-driven analytics, real-time transaction processing, and compliance monitoring to optimize business financial management. Explore how automated accounting systems can transform your financial operations and improve accuracy.

Integration

Automated accounting systems streamline financial data processing by integrating transaction records, while digital asset reporting focuses on consolidating blockchain and cryptocurrency portfolio information for accurate valuation. Seamless integration between these systems enhances real-time financial insights, regulatory compliance, and audit readiness by unifying traditional accounting data with emerging digital asset records. Explore how combining automated accounting solutions with digital asset reporting can revolutionize your financial management strategies.

Real-time Processing

Automated accounting systems leverage real-time processing to instantly record and categorize financial transactions, enhancing accuracy and operational efficiency. Digital asset reporting utilizes real-time data feeds to provide continuous updates on asset valuations and portfolio performance, ensuring timely decision-making. Explore how integrating these technologies can revolutionize financial management by clicking here.

Source and External Links

12 Time-Saving Benefits of Automated Accounting - Automated accounting systems use specialized, often cloud-based software and AI to capture, categorize, and process financial transactions in real time, reducing human error and manual effort while integrating seamlessly with existing enterprise systems for improved financial visibility and compliance.

Accounting automation: A Complete guide - These systems automate a wide range of financial tasks--including invoice processing, payroll, expense management, bank reconciliation, and tax preparation--streamlining operations, minimizing manual data entry, and enhancing accuracy across the accounting lifecycle.

How Accounting Automation Simplifies Financial Management - Automated accounting software enables fast retrieval and secure storage of financial records, provides comprehensive analytics and real-time reporting, and prepares accurate, up-to-date records for tax deductions and audit readiness, significantly reducing the administrative burden on accounting teams.

dowidth.com

dowidth.com