Single entry accounting records each financial transaction only once, typically focusing on cash flow, while triple entry accounting uses blockchain technology to create a cryptographic receipt for every transaction shared between sender, receiver, and an immutable ledger. Triple entry accounting enhances transparency, reduces fraud risk, and improves accuracy compared to traditional single entry systems. Discover how triple entry accounting is revolutionizing financial record-keeping and boosting trust in transactions.

Why it is important

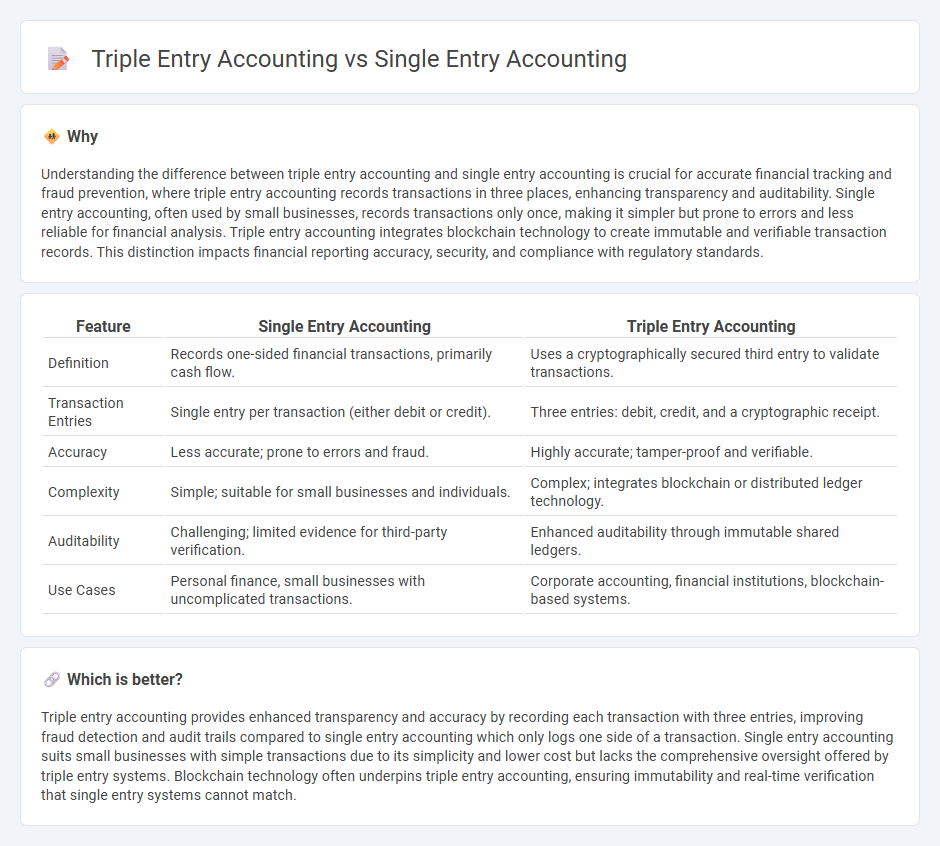

Understanding the difference between triple entry accounting and single entry accounting is crucial for accurate financial tracking and fraud prevention, where triple entry accounting records transactions in three places, enhancing transparency and auditability. Single entry accounting, often used by small businesses, records transactions only once, making it simpler but prone to errors and less reliable for financial analysis. Triple entry accounting integrates blockchain technology to create immutable and verifiable transaction records. This distinction impacts financial reporting accuracy, security, and compliance with regulatory standards.

Comparison Table

| Feature | Single Entry Accounting | Triple Entry Accounting |

|---|---|---|

| Definition | Records one-sided financial transactions, primarily cash flow. | Uses a cryptographically secured third entry to validate transactions. |

| Transaction Entries | Single entry per transaction (either debit or credit). | Three entries: debit, credit, and a cryptographic receipt. |

| Accuracy | Less accurate; prone to errors and fraud. | Highly accurate; tamper-proof and verifiable. |

| Complexity | Simple; suitable for small businesses and individuals. | Complex; integrates blockchain or distributed ledger technology. |

| Auditability | Challenging; limited evidence for third-party verification. | Enhanced auditability through immutable shared ledgers. |

| Use Cases | Personal finance, small businesses with uncomplicated transactions. | Corporate accounting, financial institutions, blockchain-based systems. |

Which is better?

Triple entry accounting provides enhanced transparency and accuracy by recording each transaction with three entries, improving fraud detection and audit trails compared to single entry accounting which only logs one side of a transaction. Single entry accounting suits small businesses with simple transactions due to its simplicity and lower cost but lacks the comprehensive oversight offered by triple entry systems. Blockchain technology often underpins triple entry accounting, ensuring immutability and real-time verification that single entry systems cannot match.

Connection

Triple entry accounting builds upon the principles of single entry accounting by recording each transaction twice, adding a third entry as a cryptographic proof, enhancing transparency and security. Single entry accounting tracks individual transactions in a single ledger, suitable for small businesses with straightforward financial activities. The connection lies in triple entry accounting extending the simplicity of single entry while integrating blockchain technology to create a verifiable and tamper-proof record system.

Key Terms

Ledger

Single entry accounting records transactions with a simple, one-sided ledger entry, primarily tracking income and expenses without detailed asset or liability management. Triple entry accounting enhances transparency and security by incorporating a cryptographically verifiable third ledger, linking entries across multiple parties for improved accuracy and fraud prevention. Explore the advantages of triple entry accounting to understand its impact on modern ledger systems.

Double-entry

Double-entry accounting records financial transactions through two corresponding accounts to maintain balanced financial statements, contrasting with single entry's simpler, less detailed approach. Triple-entry accounting builds on double-entry by adding a cryptographic verification layer for enhanced transparency and security. Explore how double-entry's foundational role supports modern accounting systems for more accurate financial management.

Blockchain

Single entry accounting records transactions as individual entries, often lacking verification and audit trails, making it prone to errors and fraud. Triple entry accounting, enhanced by blockchain technology, uses cryptographic validation to create an immutable ledger where each transaction is independently verified and recorded across multiple parties, increasing transparency and trust. Explore how blockchain revolutionizes accounting practices by ensuring data integrity and real-time collaboration.

Source and External Links

Key Term - Single-Entry Accounting - Aurora Training Advantage - Single-entry accounting is a simple bookkeeping system where each transaction is recorded once in a cash book or journal, mainly tracking cash flow and profits but lacking detailed asset and liability records, making it ideal for small businesses and freelancers.

single-entry accounting | Wex | US Law | LII - Single-entry accounting records each transaction a single time focusing on income and expenses but does not provide a full balance sheet or detailed inventory tracking, making it suitable mainly for small and simple businesses.

Single Entry System In Accounting | Definition, Types & Example - Single-entry accounting records each transaction only once, often in a cash book, showing a simple example of cash balances increasing or decreasing through income and expenses, illustrating the system's ease of use and focus on cash flow.

dowidth.com

dowidth.com