Taxonomy alignment ensures financial statements adhere to standardized classification systems, improving consistency and comparability across accounting periods and entities. Accruals and deferrals adjust revenues and expenses to reflect the correct accounting period, enhancing the accuracy of financial reporting. Explore deeper insights into how taxonomy frameworks integrate with accrual and deferral processes for robust accounting practices.

Why it is important

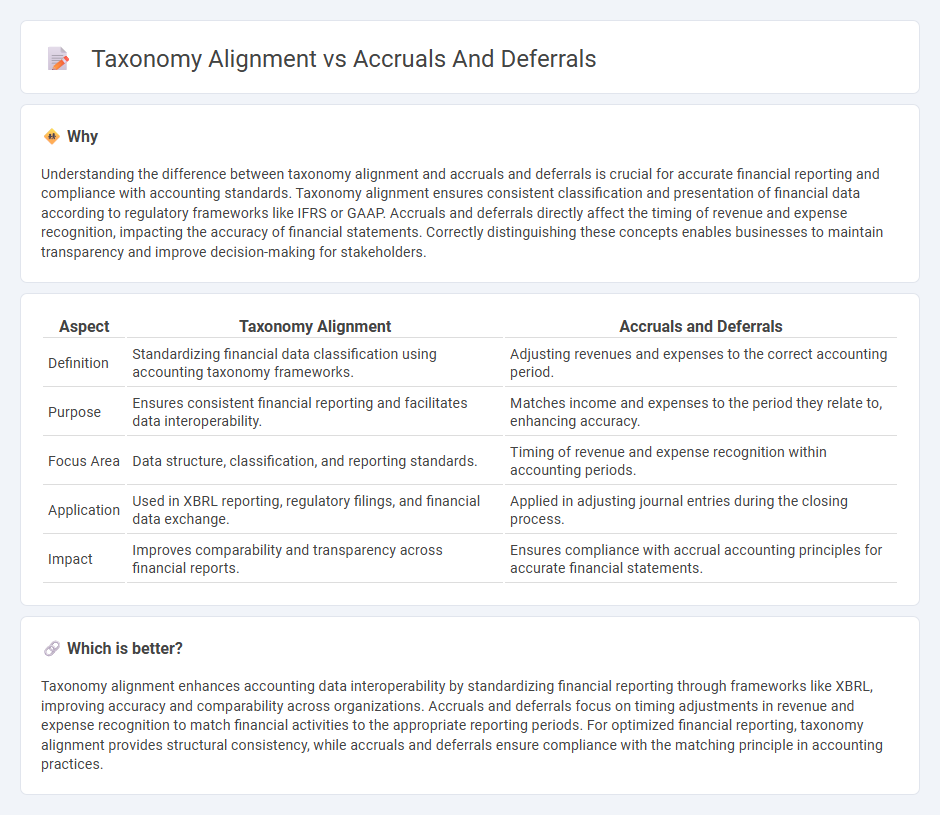

Understanding the difference between taxonomy alignment and accruals and deferrals is crucial for accurate financial reporting and compliance with accounting standards. Taxonomy alignment ensures consistent classification and presentation of financial data according to regulatory frameworks like IFRS or GAAP. Accruals and deferrals directly affect the timing of revenue and expense recognition, impacting the accuracy of financial statements. Correctly distinguishing these concepts enables businesses to maintain transparency and improve decision-making for stakeholders.

Comparison Table

| Aspect | Taxonomy Alignment | Accruals and Deferrals |

|---|---|---|

| Definition | Standardizing financial data classification using accounting taxonomy frameworks. | Adjusting revenues and expenses to the correct accounting period. |

| Purpose | Ensures consistent financial reporting and facilitates data interoperability. | Matches income and expenses to the period they relate to, enhancing accuracy. |

| Focus Area | Data structure, classification, and reporting standards. | Timing of revenue and expense recognition within accounting periods. |

| Application | Used in XBRL reporting, regulatory filings, and financial data exchange. | Applied in adjusting journal entries during the closing process. |

| Impact | Improves comparability and transparency across financial reports. | Ensures compliance with accrual accounting principles for accurate financial statements. |

Which is better?

Taxonomy alignment enhances accounting data interoperability by standardizing financial reporting through frameworks like XBRL, improving accuracy and comparability across organizations. Accruals and deferrals focus on timing adjustments in revenue and expense recognition to match financial activities to the appropriate reporting periods. For optimized financial reporting, taxonomy alignment provides structural consistency, while accruals and deferrals ensure compliance with the matching principle in accounting practices.

Connection

Taxonomy alignment ensures consistent classification of financial data, directly affecting the accurate recording of accruals and deferrals in accounting. Proper alignment enables seamless mapping of transactions to financial statements, enhancing transparency and compliance with accounting standards. This connection supports precise timing of revenue and expense recognition, critical for accurate financial reporting and analysis.

Key Terms

**Accruals and Deferrals:**

Accruals and deferrals are fundamental accounting concepts that ensure expenses and revenues are recognized in the period they occur, aligning financial reporting with the matching principle. Taxonomy alignment in financial reporting involves structuring data according to standardized frameworks like IFRS or US GAAP, facilitating consistent and comparable disclosures of accruals and deferrals. Explore how effective taxonomy alignment enhances transparency and accuracy in managing accruals and deferrals.

Revenue Recognition

Accruals and deferrals are critical accounting adjustments ensuring revenues and expenses are recognized in the correct period, directly impacting accurate revenue recognition under accounting standards like IFRS 15 and ASC 606. Taxonomy alignment involves mapping financial report elements to established taxonomies such as XBRL, enabling standardized, transparent, and automated revenue recognition disclosures. Explore how aligning accruals and deferrals with taxonomy frameworks optimizes financial reporting and compliance.

Matching Principle

Accruals and deferrals ensure revenues and expenses are recognized in the period they are incurred, aligning with the Matching Principle for accurate financial reporting. Taxonomy alignment supports this by standardizing financial data classification, enabling consistent interpretation and compliance with accounting frameworks. Explore how integrating accrual concepts with taxonomy enhances financial statement reliability and transparency.

dowidth.com

dowidth.com