Cryptocurrency taxation involves reporting and paying taxes on digital asset transactions, reflecting gains or losses per IRS guidelines. Deferred revenue represents payments received for goods or services yet to be delivered, recognized as a liability until earned. Explore deeper insights on how these concepts impact financial accounting and compliance strategies.

Why it is important

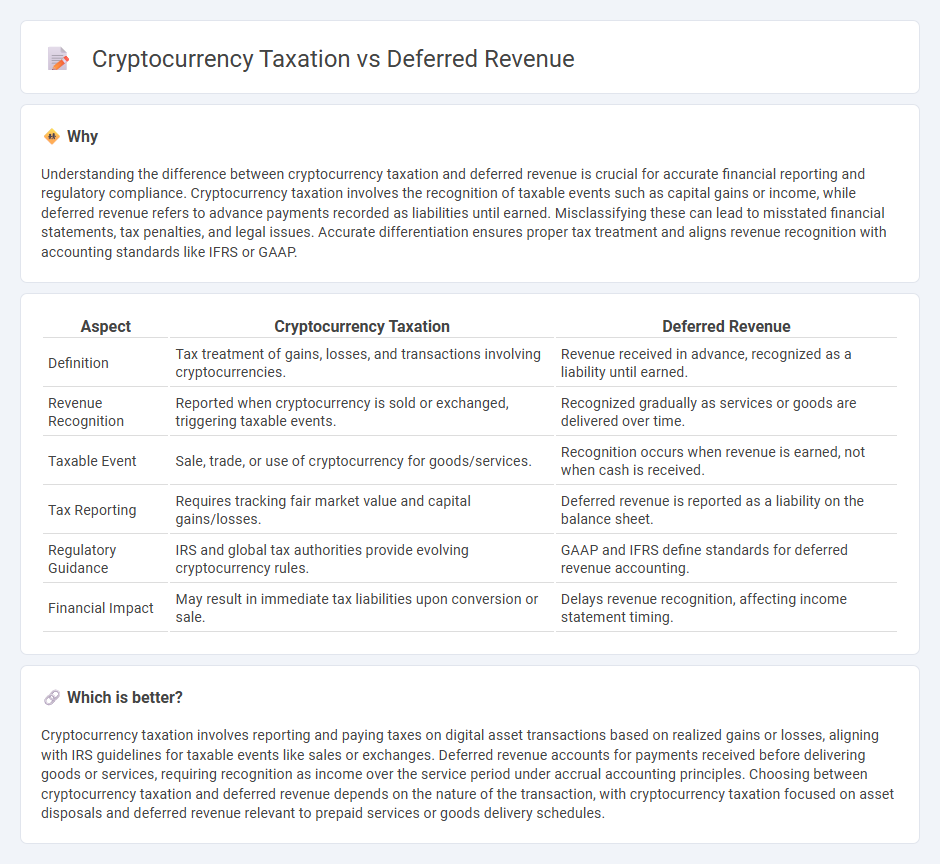

Understanding the difference between cryptocurrency taxation and deferred revenue is crucial for accurate financial reporting and regulatory compliance. Cryptocurrency taxation involves the recognition of taxable events such as capital gains or income, while deferred revenue refers to advance payments recorded as liabilities until earned. Misclassifying these can lead to misstated financial statements, tax penalties, and legal issues. Accurate differentiation ensures proper tax treatment and aligns revenue recognition with accounting standards like IFRS or GAAP.

Comparison Table

| Aspect | Cryptocurrency Taxation | Deferred Revenue |

|---|---|---|

| Definition | Tax treatment of gains, losses, and transactions involving cryptocurrencies. | Revenue received in advance, recognized as a liability until earned. |

| Revenue Recognition | Reported when cryptocurrency is sold or exchanged, triggering taxable events. | Recognized gradually as services or goods are delivered over time. |

| Taxable Event | Sale, trade, or use of cryptocurrency for goods/services. | Recognition occurs when revenue is earned, not when cash is received. |

| Tax Reporting | Requires tracking fair market value and capital gains/losses. | Deferred revenue is reported as a liability on the balance sheet. |

| Regulatory Guidance | IRS and global tax authorities provide evolving cryptocurrency rules. | GAAP and IFRS define standards for deferred revenue accounting. |

| Financial Impact | May result in immediate tax liabilities upon conversion or sale. | Delays revenue recognition, affecting income statement timing. |

Which is better?

Cryptocurrency taxation involves reporting and paying taxes on digital asset transactions based on realized gains or losses, aligning with IRS guidelines for taxable events like sales or exchanges. Deferred revenue accounts for payments received before delivering goods or services, requiring recognition as income over the service period under accrual accounting principles. Choosing between cryptocurrency taxation and deferred revenue depends on the nature of the transaction, with cryptocurrency taxation focused on asset disposals and deferred revenue relevant to prepaid services or goods delivery schedules.

Connection

Cryptocurrency taxation intersects with deferred revenue accounting as businesses receiving digital assets must recognize the fair value of the cryptocurrency at the transaction date while deferring revenue until delivery obligations are met. The volatile nature of cryptocurrency prices requires continuous reassessment, impacting the timing and amount of taxable income recorded under deferred revenue principles. Regulatory guidance from entities such as the IRS and FASB shapes compliance strategies for accurately reporting cryptocurrency transactions in financial statements.

Key Terms

Revenue Recognition

Deferred revenue represents payments received before goods or services are delivered, requiring businesses to recognize income as obligations are fulfilled under accounting standards like ASC 606 or IFRS 15. Cryptocurrency taxation depends on transaction type, such as capital gains tax on sales or income tax on mining rewards, with revenue recognition principles guiding when and how these events are recorded for accurate tax reporting. Explore the complexities of revenue recognition related to deferred revenue and cryptocurrency tax regulations to ensure compliance and optimal financial management.

Cost Basis

Deferred revenue represents income received but not yet earned, impacting financial statements differently than cryptocurrency taxation, which centers on the cost basis of digital assets to determine capital gains or losses. Understanding how cost basis is calculated for cryptocurrencies, including methods like FIFO, LIFO, and specific identification, is crucial for accurate tax reporting and avoiding penalties. Explore more about how cost basis influences your tax obligations in cryptocurrency transactions.

Taxable Event

Deferred revenue represents income received but not yet earned, typically recognized as a liability until the service or product delivery occurs, resulting in taxation upon revenue recognition. Cryptocurrency taxation hinges on taxable events such as sales, trades, or conversions that trigger capital gains or income taxes based on the asset's fair market value at the transaction time. Explore further to understand how taxable events uniquely impact deferred revenue and cryptocurrency tax obligations.

Source and External Links

What is Deferred Revenue? | DealHub - Deferred revenue is income collected in advance for products or services not yet delivered, recorded as a liability on the balance sheet until it is earned.

Deferred Revenue | Definition + Journal Entry Examples - Deferred revenue refers to payments received for goods or services not yet delivered, classified as a liability until the revenue is earned.

Deferred Revenue: Examples & How It Works For SaaS - Deferred revenue involves payments from customers for future goods or services, commonly seen in subscription-based models where payments are made upfront.

dowidth.com

dowidth.com