Invoice factoring platforms provide businesses with immediate cash flow by selling outstanding invoices to third-party financiers at a discount, improving liquidity without incurring debt. Purchase order financing involves lenders advancing funds to suppliers to fulfill customer orders, enabling businesses to accept large contracts they cannot otherwise afford to complete. Explore the key differences and benefits of these financing options to optimize your business funding strategy.

Why it is important

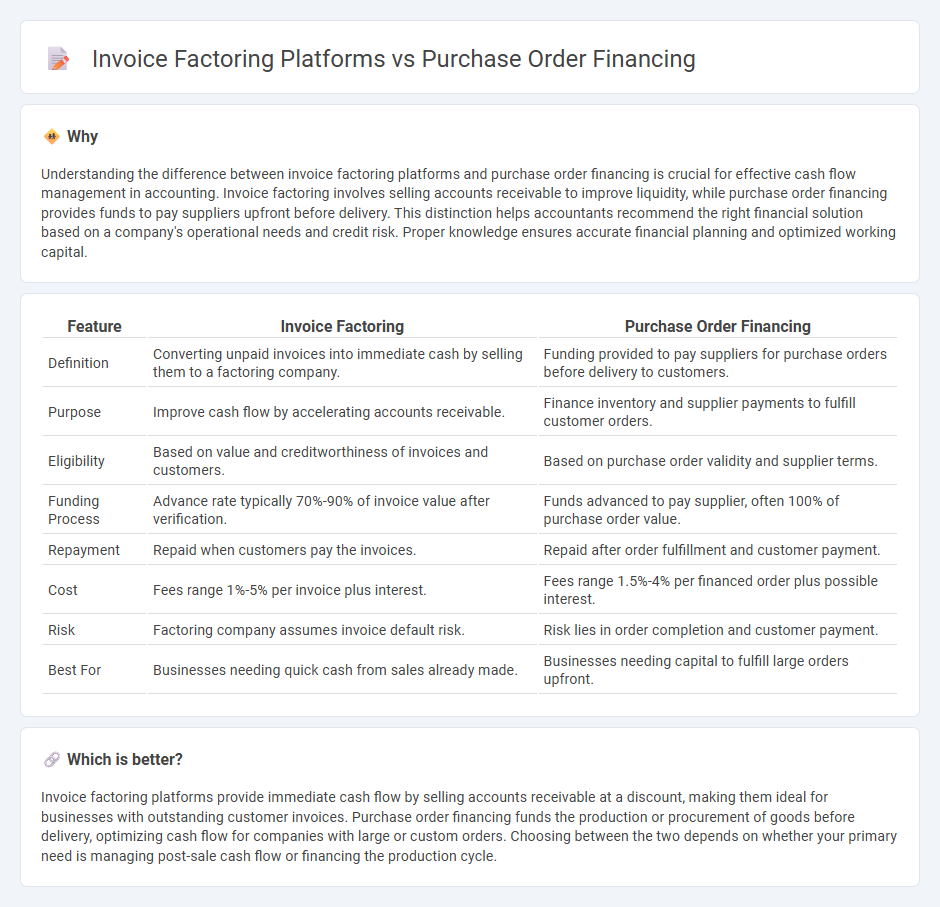

Understanding the difference between invoice factoring platforms and purchase order financing is crucial for effective cash flow management in accounting. Invoice factoring involves selling accounts receivable to improve liquidity, while purchase order financing provides funds to pay suppliers upfront before delivery. This distinction helps accountants recommend the right financial solution based on a company's operational needs and credit risk. Proper knowledge ensures accurate financial planning and optimized working capital.

Comparison Table

| Feature | Invoice Factoring | Purchase Order Financing |

|---|---|---|

| Definition | Converting unpaid invoices into immediate cash by selling them to a factoring company. | Funding provided to pay suppliers for purchase orders before delivery to customers. |

| Purpose | Improve cash flow by accelerating accounts receivable. | Finance inventory and supplier payments to fulfill customer orders. |

| Eligibility | Based on value and creditworthiness of invoices and customers. | Based on purchase order validity and supplier terms. |

| Funding Process | Advance rate typically 70%-90% of invoice value after verification. | Funds advanced to pay supplier, often 100% of purchase order value. |

| Repayment | Repaid when customers pay the invoices. | Repaid after order fulfillment and customer payment. |

| Cost | Fees range 1%-5% per invoice plus interest. | Fees range 1.5%-4% per financed order plus possible interest. |

| Risk | Factoring company assumes invoice default risk. | Risk lies in order completion and customer payment. |

| Best For | Businesses needing quick cash from sales already made. | Businesses needing capital to fulfill large orders upfront. |

Which is better?

Invoice factoring platforms provide immediate cash flow by selling accounts receivable at a discount, making them ideal for businesses with outstanding customer invoices. Purchase order financing funds the production or procurement of goods before delivery, optimizing cash flow for companies with large or custom orders. Choosing between the two depends on whether your primary need is managing post-sale cash flow or financing the production cycle.

Connection

Invoice factoring platforms and purchase order financing are connected through their role in providing working capital solutions for businesses. Invoice factoring platforms convert outstanding invoices into immediate cash, while purchase order financing funds the production of goods before the invoice is generated. Both methods enhance cash flow management by bridging the gap between sales and payment cycles.

Key Terms

Advance Rate

Purchase order financing platforms typically offer advance rates between 70% to 90% of the purchase order value, providing immediate capital to fulfill large orders. Invoice factoring platforms usually provide advance rates ranging from 75% to 95% of the outstanding invoice amount, accelerating cash flow by converting receivables into instant funds. Explore detailed comparisons of advance rates and terms to choose the best financing solution for your business needs.

Receivables

Purchase order financing platforms advance funds based on confirmed purchase orders, enabling businesses to fulfill large orders without upfront capital, while invoice factoring platforms provide cash by selling outstanding invoices to a third party at a discount. Both solutions enhance cash flow by leveraging receivables, but purchase order financing targets supplier payments prior to inventory delivery, whereas invoice factoring focuses on accelerating payment collection after sales. Explore detailed comparisons to determine which financing method optimizes your receivables management strategy.

Repayment Structure

Purchase order financing platforms typically require repayment once the purchase order is fulfilled and the goods are delivered, often linking repayment schedules directly to sales cycles. Invoice factoring platforms advance funds based on outstanding invoices and collect repayments as customers settle those invoices, usually charging fees relative to the invoice's value and duration. Explore more to understand which repayment structure aligns best with your business cash flow needs.

Source and External Links

What is Purchase Order Financing? - Purchase order financing is a funding method involving multiple parties, where a financing company pays a supplier to fulfill orders, allowing businesses to manage large orders without initial cash flow.

What Is Purchase Order Financing? - Purchase order financing is a type of financing where a lender covers supplier costs up to 100%, enabling businesses to fulfill large orders without having the necessary funds.

Purchase Order Financing Guide - Purchase order financing allows small businesses to accept larger orders by financing up to 100% of supplier costs, helping mitigate cash flow issues before receiving payment from customers.

dowidth.com

dowidth.com