Microtransaction accounting focuses on recording and managing individual, small-value financial transactions typically occurring in digital environments, emphasizing accuracy and real-time processing. Virtual goods accounting handles the valuation, revenue recognition, and inventory management of intangible digital products, integrating with broader financial systems to reflect their economic impact. Explore detailed methods and best practices to optimize your digital commerce accounting strategies.

Why it is important

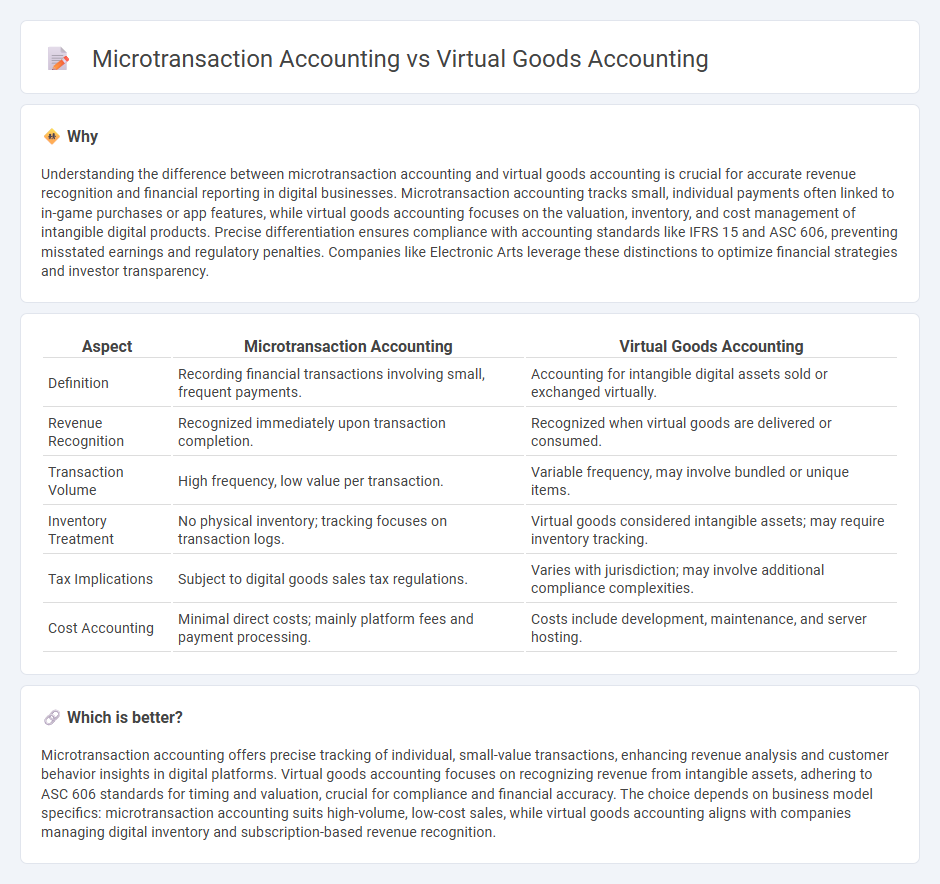

Understanding the difference between microtransaction accounting and virtual goods accounting is crucial for accurate revenue recognition and financial reporting in digital businesses. Microtransaction accounting tracks small, individual payments often linked to in-game purchases or app features, while virtual goods accounting focuses on the valuation, inventory, and cost management of intangible digital products. Precise differentiation ensures compliance with accounting standards like IFRS 15 and ASC 606, preventing misstated earnings and regulatory penalties. Companies like Electronic Arts leverage these distinctions to optimize financial strategies and investor transparency.

Comparison Table

| Aspect | Microtransaction Accounting | Virtual Goods Accounting |

|---|---|---|

| Definition | Recording financial transactions involving small, frequent payments. | Accounting for intangible digital assets sold or exchanged virtually. |

| Revenue Recognition | Recognized immediately upon transaction completion. | Recognized when virtual goods are delivered or consumed. |

| Transaction Volume | High frequency, low value per transaction. | Variable frequency, may involve bundled or unique items. |

| Inventory Treatment | No physical inventory; tracking focuses on transaction logs. | Virtual goods considered intangible assets; may require inventory tracking. |

| Tax Implications | Subject to digital goods sales tax regulations. | Varies with jurisdiction; may involve additional compliance complexities. |

| Cost Accounting | Minimal direct costs; mainly platform fees and payment processing. | Costs include development, maintenance, and server hosting. |

Which is better?

Microtransaction accounting offers precise tracking of individual, small-value transactions, enhancing revenue analysis and customer behavior insights in digital platforms. Virtual goods accounting focuses on recognizing revenue from intangible assets, adhering to ASC 606 standards for timing and valuation, crucial for compliance and financial accuracy. The choice depends on business model specifics: microtransaction accounting suits high-volume, low-cost sales, while virtual goods accounting aligns with companies managing digital inventory and subscription-based revenue recognition.

Connection

Microtransaction accounting and virtual goods accounting are interconnected through the management of revenue recognition and expense tracking for digital transactions within online platforms and gaming environments. Both require precise categorization of small-scale sales and the valuation of intangible assets to ensure accurate financial reporting and compliance with accounting standards like ASC 606 and IFRS 15. Effective integration of these accounting practices enables businesses to monitor cash flow, optimize profitability, and provide transparent financial statements related to digital economies.

Key Terms

Revenue Recognition

Virtual goods accounting emphasizes recognizing revenue when virtual items are delivered or accessed by users, aligning with ASC 606 standards for performance obligations. Microtransaction accounting requires detailed tracking of small, frequent transactions, ensuring revenue is recognized promptly as each transaction occurs to reflect real-time user engagement. Explore our in-depth guide to master revenue recognition for virtual goods and microtransactions.

Deferred Revenue

Deferred Revenue in virtual goods accounting reflects income received for in-game items not yet delivered or consumed, requiring precise matching of revenue over the user's engagement period. Microtransaction accounting similarly defers revenue until the digital service or content is fulfilled, ensuring compliance with revenue recognition standards like ASC 606 or IFRS 15. Explore detailed accounting treatments and best practices to optimize financial reporting and compliance in digital commerce.

In-game Currency Valuation

In-game currency valuation is a critical factor distinguishing virtual goods accounting from microtransaction accounting, as it requires precise measurement of digital asset value fluctuating within a game's economy. Virtual goods accounting emphasizes recognizing and amortizing virtual inventory, while microtransaction accounting prioritizes revenue recognition from individual player purchases. Explore detailed methodologies to optimize your in-game currency valuation and ensure accurate financial reporting.

Source and External Links

Recognizing revenue from sales in a virtual world - IAS Plus - Virtual goods accounting often requires recognizing revenue over time as the benefits are consumed, with gaming entities adopting diverse policies depending on the nature of goods and contracts, due to the lack of specific guidance.

Accounting for online gaming sector - KPMG - Revenue recognition for virtual goods depends on contract terms, delivery mechanisms, and how customers consume the virtual items, requiring detailed judgment to align revenue with performance obligations.

The Ultimate Guide to Understanding Virtual Currency Accounting - Ravix Group - Virtual goods accounting uses different models such as game-based amortization over expected game life, with decisions driven by virtual good characteristics and quality of usage data.

dowidth.com

dowidth.com