Carbon footprint accounting quantifies greenhouse gas emissions directly linked to business operations, enabling organizations to track and reduce their environmental impact with precision. Climate risk disclosure involves reporting potential financial and operational risks due to climate change, aligning with frameworks like TCFD to inform investors and stakeholders. Explore how integrating these practices drives sustainability and financial transparency.

Why it is important

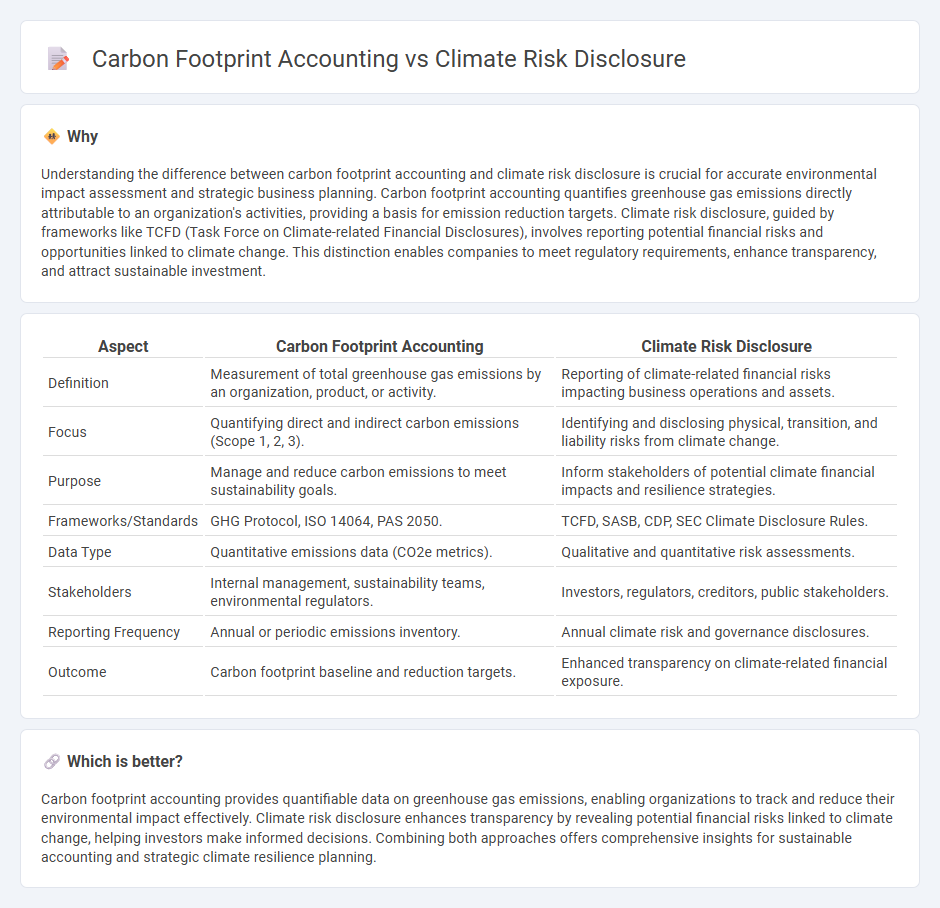

Understanding the difference between carbon footprint accounting and climate risk disclosure is crucial for accurate environmental impact assessment and strategic business planning. Carbon footprint accounting quantifies greenhouse gas emissions directly attributable to an organization's activities, providing a basis for emission reduction targets. Climate risk disclosure, guided by frameworks like TCFD (Task Force on Climate-related Financial Disclosures), involves reporting potential financial risks and opportunities linked to climate change. This distinction enables companies to meet regulatory requirements, enhance transparency, and attract sustainable investment.

Comparison Table

| Aspect | Carbon Footprint Accounting | Climate Risk Disclosure |

|---|---|---|

| Definition | Measurement of total greenhouse gas emissions by an organization, product, or activity. | Reporting of climate-related financial risks impacting business operations and assets. |

| Focus | Quantifying direct and indirect carbon emissions (Scope 1, 2, 3). | Identifying and disclosing physical, transition, and liability risks from climate change. |

| Purpose | Manage and reduce carbon emissions to meet sustainability goals. | Inform stakeholders of potential climate financial impacts and resilience strategies. |

| Frameworks/Standards | GHG Protocol, ISO 14064, PAS 2050. | TCFD, SASB, CDP, SEC Climate Disclosure Rules. |

| Data Type | Quantitative emissions data (CO2e metrics). | Qualitative and quantitative risk assessments. |

| Stakeholders | Internal management, sustainability teams, environmental regulators. | Investors, regulators, creditors, public stakeholders. |

| Reporting Frequency | Annual or periodic emissions inventory. | Annual climate risk and governance disclosures. |

| Outcome | Carbon footprint baseline and reduction targets. | Enhanced transparency on climate-related financial exposure. |

Which is better?

Carbon footprint accounting provides quantifiable data on greenhouse gas emissions, enabling organizations to track and reduce their environmental impact effectively. Climate risk disclosure enhances transparency by revealing potential financial risks linked to climate change, helping investors make informed decisions. Combining both approaches offers comprehensive insights for sustainable accounting and strategic climate resilience planning.

Connection

Carbon footprint accounting quantifies greenhouse gas emissions linked to business operations, providing critical data for climate risk disclosure frameworks. Climate risk disclosure leverages these metrics to inform investors and stakeholders about potential financial impacts from regulatory changes or physical climate hazards. Integrating carbon footprint data enhances transparency, driving more accurate assessments of environmental risks and strategic climate resilience planning in corporate reporting.

Key Terms

Greenhouse Gas (GHG) Emissions

Climate risk disclosure involves reporting potential financial risks related to climate change, focusing on how greenhouse gas (GHG) emissions impact long-term business operations and regulatory environments. Carbon footprint accounting quantifies the total GHG emissions directly and indirectly generated by an organization, product, or activity, providing a measurable basis for emission reduction strategies. Explore detailed methodologies and benefits of integrating both approaches for comprehensive climate impact management.

Materiality

Climate risk disclosure emphasizes the identification and communication of significant environmental, social, and governance (ESG) risks that can impact a company's financial performance, prioritizing materiality to ensure relevant information is reported to stakeholders. Carbon footprint accounting quantifies total greenhouse gas emissions from direct and indirect activities, focusing on accurate measurement rather than materiality thresholds. Explore in-depth analysis to understand how integrating materiality principles enhances corporate climate risk strategies.

Financial Reporting

Climate risk disclosure in financial reporting emphasizes transparency about potential impacts of climate change on assets, liabilities, and overall financial health, guiding investors and stakeholders in risk assessment. Carbon footprint accounting quantifies greenhouse gas emissions linked to business operations, offering a tangible metric for sustainability performance and regulatory compliance. Explore the evolving standards and best practices for integrating these crucial elements into comprehensive financial reports.

Source and External Links

SEC Climate Risk Disclosure: What You Need to Know - The SEC climate disclosure rule mandates public companies to disclose climate-related risks, greenhouse gas emissions, and financial impacts from extreme weather events in their annual reports and registration statements.

Corporate Climate Disclosure Has Passed a Tipping Point - New regulations in the EU and U.S. are making climate-related disclosures mandatory across a significant portion of the global economy, marking a shift from voluntary to obligatory reporting.

Climate Risk Disclosure Survey - The survey is a tool for state insurance regulators to assess insurers' management of climate-related risks, promoting transparency and strategic management within the insurance industry.

dowidth.com

dowidth.com