Supply chain finance accounting focuses on optimizing financial processes related to purchasing, supplier payments, and inventory management, emphasizing working capital efficiency within the supply chain. Cash flow accounting, on the other hand, tracks the inflows and outflows of cash to ensure liquidity and operational stability for the business. Explore the distinctions and benefits of each method to enhance your financial strategy.

Why it is important

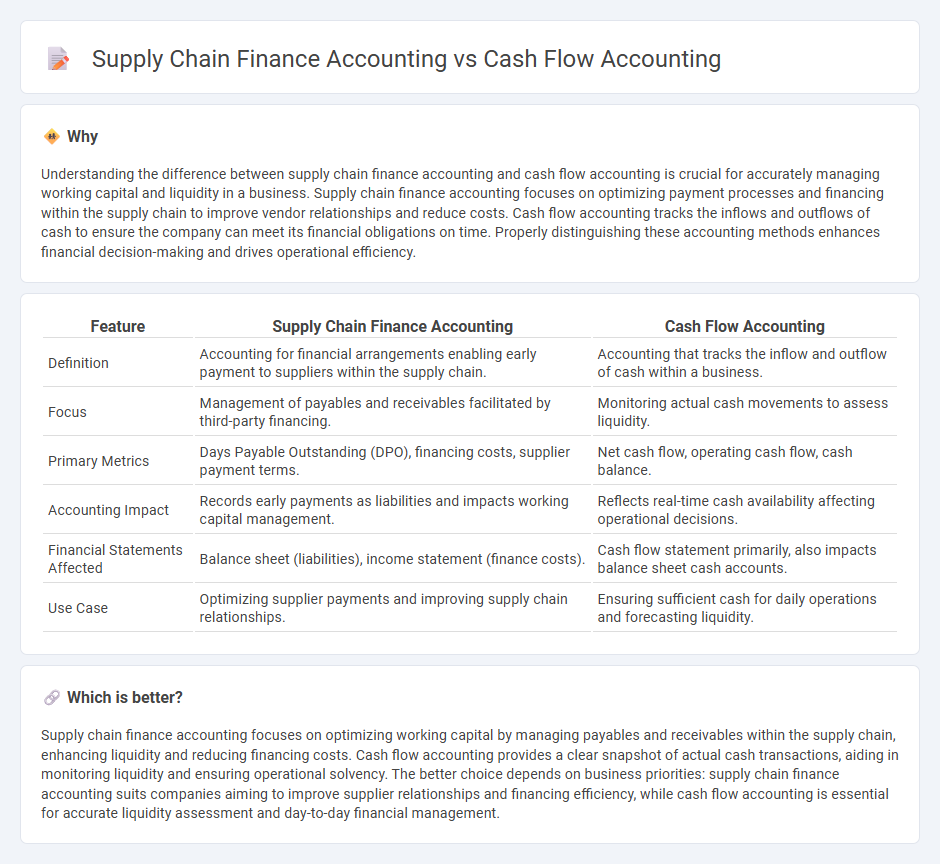

Understanding the difference between supply chain finance accounting and cash flow accounting is crucial for accurately managing working capital and liquidity in a business. Supply chain finance accounting focuses on optimizing payment processes and financing within the supply chain to improve vendor relationships and reduce costs. Cash flow accounting tracks the inflows and outflows of cash to ensure the company can meet its financial obligations on time. Properly distinguishing these accounting methods enhances financial decision-making and drives operational efficiency.

Comparison Table

| Feature | Supply Chain Finance Accounting | Cash Flow Accounting |

|---|---|---|

| Definition | Accounting for financial arrangements enabling early payment to suppliers within the supply chain. | Accounting that tracks the inflow and outflow of cash within a business. |

| Focus | Management of payables and receivables facilitated by third-party financing. | Monitoring actual cash movements to assess liquidity. |

| Primary Metrics | Days Payable Outstanding (DPO), financing costs, supplier payment terms. | Net cash flow, operating cash flow, cash balance. |

| Accounting Impact | Records early payments as liabilities and impacts working capital management. | Reflects real-time cash availability affecting operational decisions. |

| Financial Statements Affected | Balance sheet (liabilities), income statement (finance costs). | Cash flow statement primarily, also impacts balance sheet cash accounts. |

| Use Case | Optimizing supplier payments and improving supply chain relationships. | Ensuring sufficient cash for daily operations and forecasting liquidity. |

Which is better?

Supply chain finance accounting focuses on optimizing working capital by managing payables and receivables within the supply chain, enhancing liquidity and reducing financing costs. Cash flow accounting provides a clear snapshot of actual cash transactions, aiding in monitoring liquidity and ensuring operational solvency. The better choice depends on business priorities: supply chain finance accounting suits companies aiming to improve supplier relationships and financing efficiency, while cash flow accounting is essential for accurate liquidity assessment and day-to-day financial management.

Connection

Supply chain finance accounting improves cash flow accounting by accelerating payments to suppliers, which optimizes working capital and reduces days payable outstanding (DPO). Enhanced visibility into payables and receivables allows precise cash flow forecasting, ensuring liquidity management aligns with operational needs. Integrating these accounting functions supports strategic financial planning and strengthens overall supply chain efficiency.

Key Terms

**Cash Flow Accounting:**

Cash flow accounting tracks the inflows and outflows of cash within a business, emphasizing liquidity and cash management for operational efficiency. It provides real-time visibility into cash positions, enabling better forecasting and financial decision-making. Explore more to understand how cash flow accounting impacts business stability and growth.

Operating Cash Flow

Operating cash flow in cash flow accounting measures the cash generated from core business operations, reflecting liquidity from day-to-day activities. Supply chain finance accounting includes operating cash flow but emphasizes optimizing working capital and payment terms between buyers and suppliers to enhance cash flow efficiency. Explore more to understand how aligning these accounting practices can improve financial performance and supply chain resilience.

Free Cash Flow

Free Cash Flow (FCF) is a critical metric in cash flow accounting, representing the cash a company generates after accounting for capital expenditures necessary to maintain or expand its asset base. In supply chain finance accounting, emphasis is placed on optimizing working capital and payment terms to improve liquidity without impacting FCF negatively. Explore how integrating cash flow and supply chain finance accounting strategies can enhance overall financial performance and free cash generation.

Source and External Links

How to Prepare a Cash Flow Statement - A cash flow statement shows how cash entered and left a business during a reporting period, using either the direct method (listing cash transactions) or the indirect method (starting with net income and adjusting for non-cash items like depreciation).

How to Read & Understand a Cash Flow Statement - Cash flow accounting involves reporting cash inflows and outflows using the direct method based on transactional data or the indirect method starting from net income and adjusting for accruals such as depreciation and amortization.

Statement of Cash Flows: Free Template & Examples - The statement of cash flows records cash generated and spent over a period, breaking down cash flows into operating, investing, and financing activities, and adjusting net income for non-cash expenses like depreciation and amortization to show actual cash flow.

dowidth.com

dowidth.com