Blockchain-based accounting offers enhanced transparency, immutability, and real-time transaction verification compared to traditional paper-based accounting, which relies on manual entries and physical documents prone to errors and fraud. Utilizing distributed ledger technology, blockchain streamlines audits and reduces reconciliation time by providing a single source of truth accessible to all authorized parties. Explore the key differences and benefits to understand how blockchain can transform financial record-keeping.

Why it is important

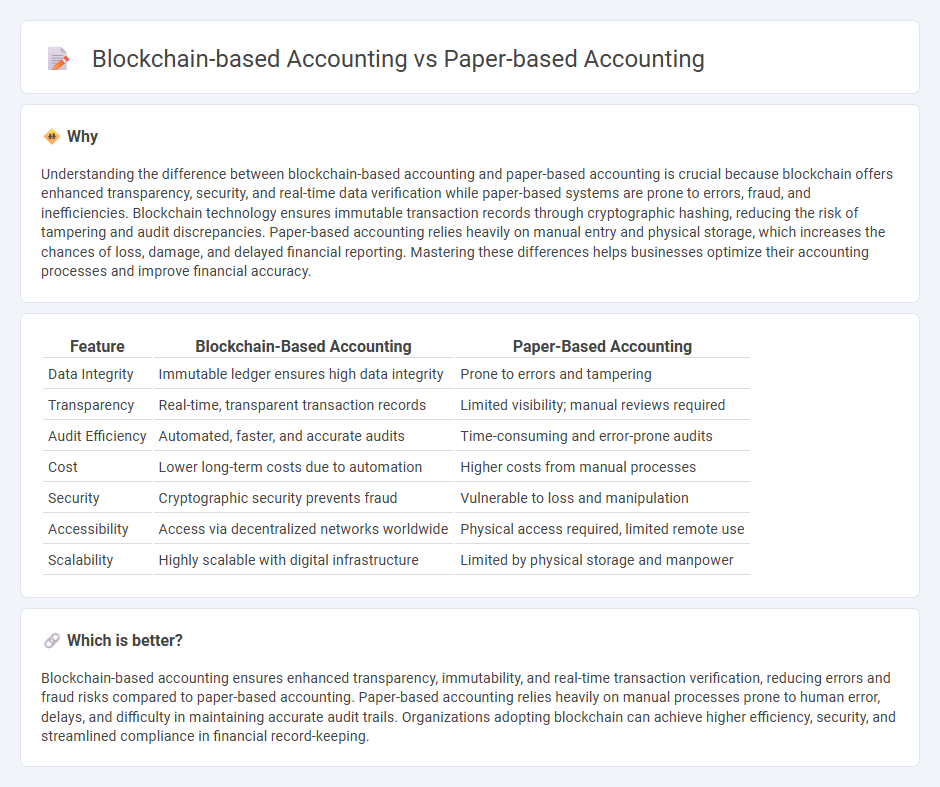

Understanding the difference between blockchain-based accounting and paper-based accounting is crucial because blockchain offers enhanced transparency, security, and real-time data verification while paper-based systems are prone to errors, fraud, and inefficiencies. Blockchain technology ensures immutable transaction records through cryptographic hashing, reducing the risk of tampering and audit discrepancies. Paper-based accounting relies heavily on manual entry and physical storage, which increases the chances of loss, damage, and delayed financial reporting. Mastering these differences helps businesses optimize their accounting processes and improve financial accuracy.

Comparison Table

| Feature | Blockchain-Based Accounting | Paper-Based Accounting |

|---|---|---|

| Data Integrity | Immutable ledger ensures high data integrity | Prone to errors and tampering |

| Transparency | Real-time, transparent transaction records | Limited visibility; manual reviews required |

| Audit Efficiency | Automated, faster, and accurate audits | Time-consuming and error-prone audits |

| Cost | Lower long-term costs due to automation | Higher costs from manual processes |

| Security | Cryptographic security prevents fraud | Vulnerable to loss and manipulation |

| Accessibility | Access via decentralized networks worldwide | Physical access required, limited remote use |

| Scalability | Highly scalable with digital infrastructure | Limited by physical storage and manpower |

Which is better?

Blockchain-based accounting ensures enhanced transparency, immutability, and real-time transaction verification, reducing errors and fraud risks compared to paper-based accounting. Paper-based accounting relies heavily on manual processes prone to human error, delays, and difficulty in maintaining accurate audit trails. Organizations adopting blockchain can achieve higher efficiency, security, and streamlined compliance in financial record-keeping.

Connection

Blockchain-based accounting and paper-based accounting both serve as foundational systems for recording financial transactions, with blockchain enhancing transparency and security through decentralized digital ledgers. Paper-based accounting relies on physical documents and manual entries, while blockchain automates verification and reduces errors by utilizing cryptographic consensus mechanisms. The integration of blockchain technology aims to modernize traditional accounting practices by providing immutable records that streamline audits and improve data accuracy.

Key Terms

Ledger

Paper-based accounting relies on physical ledgers prone to errors, fraud, and time-consuming audits, whereas blockchain-based accounting offers immutable, decentralized ledgers enhancing transparency and security. Blockchain technology ensures real-time updates, cryptographic verification, and a tamper-proof audit trail, significantly reducing reconciliation efforts. Explore the impact of blockchain on modern ledger systems and its transformative potential for financial record-keeping.

Audit Trail

Paper-based accounting relies on physical documents, often vulnerable to tampering, loss, and limited traceability, which poses challenges to maintaining a robust audit trail. Blockchain-based accounting offers an immutable, decentralized ledger that ensures transparency, real-time verification, and enhanced security of transaction records, significantly strengthening the audit trail. Explore how integrating blockchain technology can revolutionize audit processes and elevate accounting integrity.

Transparency

Paper-based accounting often lacks real-time transparency and is prone to errors or fraud due to its manual nature and centralized control. Blockchain-based accounting ensures enhanced transparency through immutable, time-stamped records accessible to all authorized participants, significantly reducing risks of tampering and promoting trust. Explore how blockchain technology revolutionizes transparency in accounting by learning more today.

Source and External Links

Accounts Payable Process: Paper vs. Paperless - Paper-based accounting involves manual handling of invoices, physical routing for approvals, printing and mailing checks, and storing documents in filing cabinets, which can be time-consuming and prone to loss or misplacement.

Digital vs. Paper Bookkeeping Ledger: Which Is Right for ... - Traditional paper ledgers require handwritten entries, offer tangible records without the need for tech skills, but are labor-intensive, susceptible to errors, and vulnerable to physical damage or loss.

How to Transition from Paper-Based to Paperless Accounting - Paper-based accounting systems are marked by manual errors, difficulty in tracking and retrieving data, limited scalability, and a significant environmental impact due to excessive paper use.

dowidth.com

dowidth.com