Ledger tokenization enhances accounting accuracy by converting traditional ledger entries into secure, tamper-proof digital tokens, ensuring transparent transaction tracking. Digital assets represent a broader category, including cryptocurrencies and tokenized real-world assets, recorded on distributed ledgers to facilitate seamless ownership transfer and valuation. Explore how these innovations transform modern accounting processes for improved financial management.

Why it is important

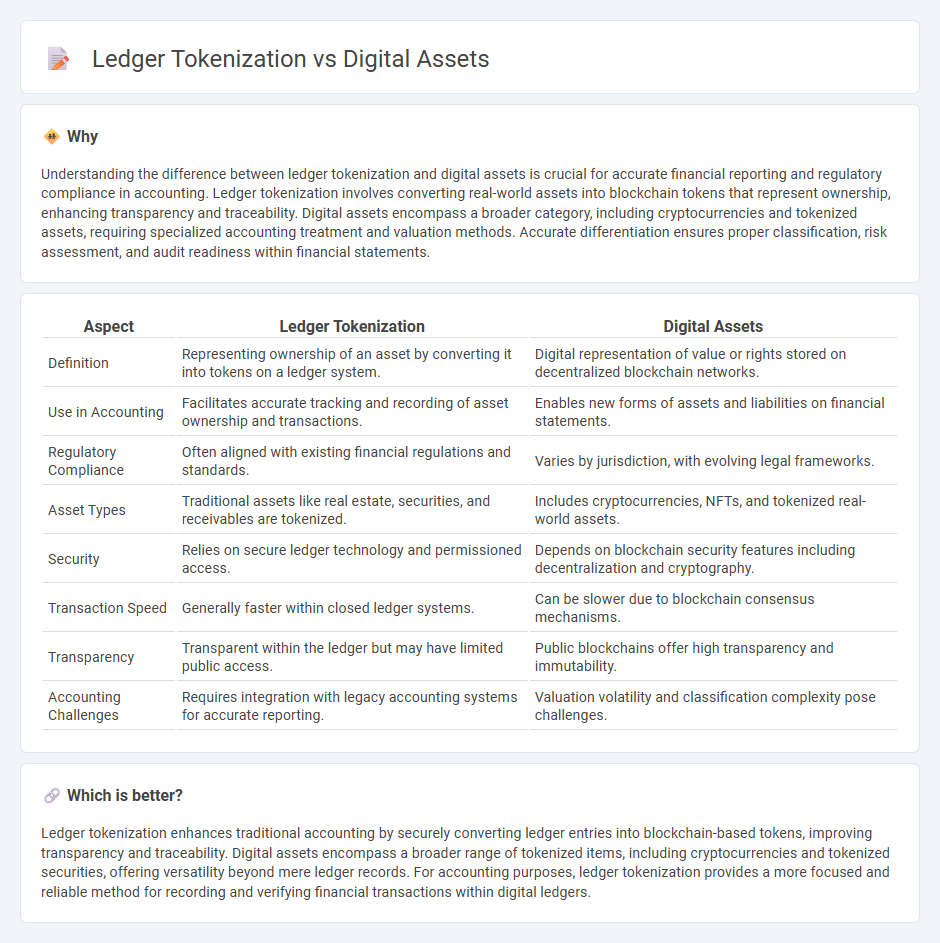

Understanding the difference between ledger tokenization and digital assets is crucial for accurate financial reporting and regulatory compliance in accounting. Ledger tokenization involves converting real-world assets into blockchain tokens that represent ownership, enhancing transparency and traceability. Digital assets encompass a broader category, including cryptocurrencies and tokenized assets, requiring specialized accounting treatment and valuation methods. Accurate differentiation ensures proper classification, risk assessment, and audit readiness within financial statements.

Comparison Table

| Aspect | Ledger Tokenization | Digital Assets |

|---|---|---|

| Definition | Representing ownership of an asset by converting it into tokens on a ledger system. | Digital representation of value or rights stored on decentralized blockchain networks. |

| Use in Accounting | Facilitates accurate tracking and recording of asset ownership and transactions. | Enables new forms of assets and liabilities on financial statements. |

| Regulatory Compliance | Often aligned with existing financial regulations and standards. | Varies by jurisdiction, with evolving legal frameworks. |

| Asset Types | Traditional assets like real estate, securities, and receivables are tokenized. | Includes cryptocurrencies, NFTs, and tokenized real-world assets. |

| Security | Relies on secure ledger technology and permissioned access. | Depends on blockchain security features including decentralization and cryptography. |

| Transaction Speed | Generally faster within closed ledger systems. | Can be slower due to blockchain consensus mechanisms. |

| Transparency | Transparent within the ledger but may have limited public access. | Public blockchains offer high transparency and immutability. |

| Accounting Challenges | Requires integration with legacy accounting systems for accurate reporting. | Valuation volatility and classification complexity pose challenges. |

Which is better?

Ledger tokenization enhances traditional accounting by securely converting ledger entries into blockchain-based tokens, improving transparency and traceability. Digital assets encompass a broader range of tokenized items, including cryptocurrencies and tokenized securities, offering versatility beyond mere ledger records. For accounting purposes, ledger tokenization provides a more focused and reliable method for recording and verifying financial transactions within digital ledgers.

Connection

Ledger tokenization transforms traditional financial records into secure, blockchain-based digital tokens, enhancing transparency and traceability in accounting processes. Digital assets represent these tokenized entries, enabling real-time verification and streamlined auditing. This connection reduces fraud risks and increases efficiency by leveraging decentralized ledger technology.

Key Terms

Ownership Recording

Digital assets represent ownership of value stored electronically, while ledger tokenization digitizes ownership rights as tokens on a blockchain or distributed ledger. Tokenization enhances transparency, immutability, and real-time verification of ownership compared to traditional digital asset records. Explore how ledger tokenization revolutionizes ownership recording through secure, traceable digital tokens.

Asset Valuation

Digital assets represent ownership or value in electronic form, encompassing cryptocurrencies, tokens, and digital representations of physical assets. Ledger tokenization involves converting real-world assets into blockchain-based tokens, enhancing transparency and liquidity while providing precise asset valuation through immutable records. Explore further to understand how ledger tokenization transforms asset valuation in digital finance.

Transferability

Digital assets represent ownership rights or value stored in electronic form, while ledger tokenization converts physical or digital assets into tokens recorded on a blockchain or distributed ledger, enhancing their traceability and transferability. Transferability in ledger tokenization is streamlined through smart contracts, enabling instantaneous, frictionless peer-to-peer transactions without intermediaries. Explore how transferability differences impact liquidity and security in digital economies to understand these concepts better.

Source and External Links

What are digital assets? - Digital assets are digital creations that have or provide value, including photos, documents, videos, cryptocurrencies, and tokenized assets, which can be transferred and generate value for their owner.

Digital asset - A digital asset exists only in digital form and includes items like documents, audio, images, software, and others that come with distinct usage rights.

Digital assets | Internal Revenue Service - Digital asset transactions, including cryptocurrency and NFTs, must be reported for tax purposes, with specific record-keeping requirements regarding transactions, valuations, and capital gains or losses.

dowidth.com

dowidth.com