Carbon accounting quantifies greenhouse gas emissions to help businesses track and reduce their environmental impact, while forensic accounting involves investigating financial records to detect fraud and ensure legal compliance. Both disciplines require specialized expertise but serve distinctly different purposes: environmental sustainability versus financial integrity. Explore more about how these accounting fields contribute uniquely to organizational success.

Why it is important

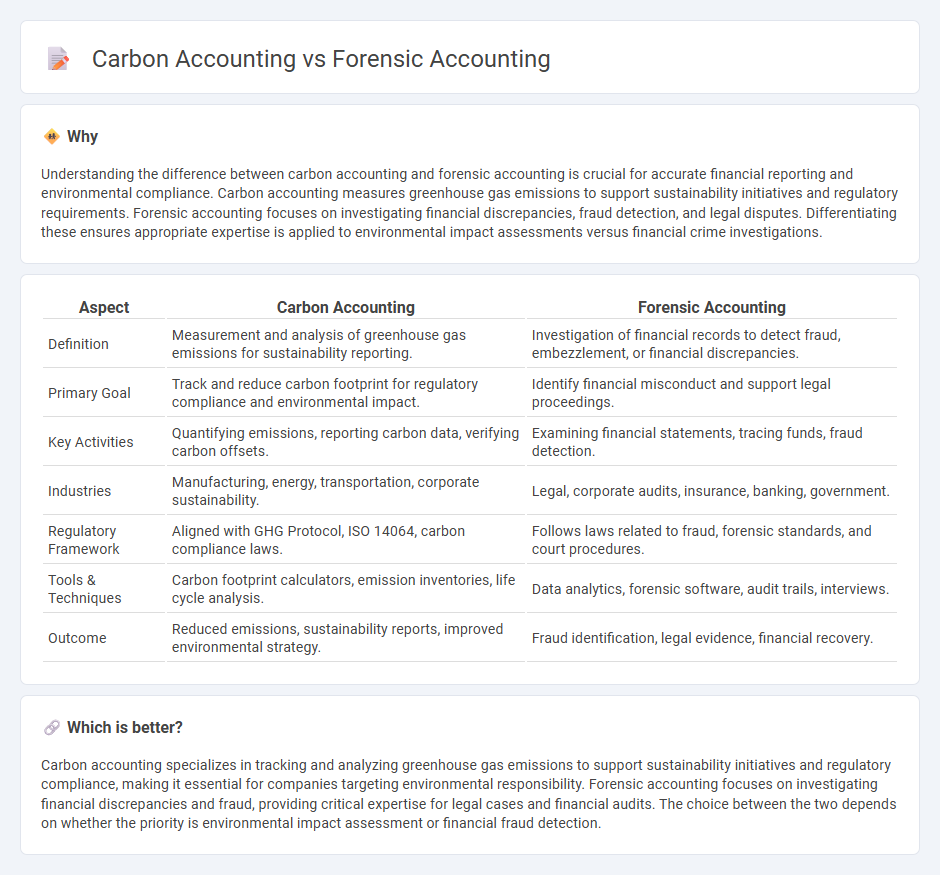

Understanding the difference between carbon accounting and forensic accounting is crucial for accurate financial reporting and environmental compliance. Carbon accounting measures greenhouse gas emissions to support sustainability initiatives and regulatory requirements. Forensic accounting focuses on investigating financial discrepancies, fraud detection, and legal disputes. Differentiating these ensures appropriate expertise is applied to environmental impact assessments versus financial crime investigations.

Comparison Table

| Aspect | Carbon Accounting | Forensic Accounting |

|---|---|---|

| Definition | Measurement and analysis of greenhouse gas emissions for sustainability reporting. | Investigation of financial records to detect fraud, embezzlement, or financial discrepancies. |

| Primary Goal | Track and reduce carbon footprint for regulatory compliance and environmental impact. | Identify financial misconduct and support legal proceedings. |

| Key Activities | Quantifying emissions, reporting carbon data, verifying carbon offsets. | Examining financial statements, tracing funds, fraud detection. |

| Industries | Manufacturing, energy, transportation, corporate sustainability. | Legal, corporate audits, insurance, banking, government. |

| Regulatory Framework | Aligned with GHG Protocol, ISO 14064, carbon compliance laws. | Follows laws related to fraud, forensic standards, and court procedures. |

| Tools & Techniques | Carbon footprint calculators, emission inventories, life cycle analysis. | Data analytics, forensic software, audit trails, interviews. |

| Outcome | Reduced emissions, sustainability reports, improved environmental strategy. | Fraud identification, legal evidence, financial recovery. |

Which is better?

Carbon accounting specializes in tracking and analyzing greenhouse gas emissions to support sustainability initiatives and regulatory compliance, making it essential for companies targeting environmental responsibility. Forensic accounting focuses on investigating financial discrepancies and fraud, providing critical expertise for legal cases and financial audits. The choice between the two depends on whether the priority is environmental impact assessment or financial fraud detection.

Connection

Carbon accounting quantifies greenhouse gas emissions for sustainability reporting, while forensic accounting investigates financial discrepancies and fraud. Both disciplines require meticulous data analysis, auditing skills, and a deep understanding of regulatory compliance to ensure accurate and transparent reporting. Integrating forensic accounting techniques enhances the reliability of carbon accounting by detecting and preventing misstatements or manipulation in environmental data disclosures.

Key Terms

Forensic Accounting:

Forensic accounting involves the application of accounting principles, investigative skills, and auditing techniques to uncover financial fraud, embezzlement, and other economic crimes. Professionals in this field analyze financial records, trace illicit transactions, and provide expert testimony in legal cases. Explore more to understand how forensic accounting safeguards financial integrity and supports legal processes.

Fraud Detection

Forensic accounting specializes in detecting and investigating financial fraud by analyzing irregularities in financial statements and transactions, while carbon accounting focuses on measuring and verifying carbon emissions for environmental compliance and sustainability reporting. Fraud detection in forensic accounting relies on detailed financial audits and forensic techniques, whereas carbon accounting primarily addresses accuracy in environmental data to prevent greenwashing. Explore the distinct methodologies and tools each field employs to enhance fraud detection effectiveness.

Litigation Support

Forensic accounting specializes in financial investigations to uncover fraud and support legal proceedings, offering detailed audits and expert testimony in litigation cases. Carbon accounting measures and reports greenhouse gas emissions to ensure regulatory compliance and quantify environmental impact, increasingly relevant in disputes over environmental regulations and corporate sustainability claims. Explore how these distinct accounting fields intersect to provide robust litigation support in complex legal challenges.

Source and External Links

Forensic Accounting Career Overview - Forensic accountants use accounting and auditing skills to analyze finances for evidence of crimes like fraud and embezzlement.

What Is Forensic Accounting? - Forensic accounting combines accounting and investigative techniques to discover financial crimes such as money laundering and embezzlement.

Forensic accounting - Forensic accounting is a specialized practice area of accounting focused on investigating financial crimes and translating complex financial data for legal purposes.

dowidth.com

dowidth.com