Transfer pricing analytics involves examining the pricing of transactions between related entities to ensure compliance with tax regulations and optimize tax liabilities. Profitability analysis, on the other hand, focuses on evaluating the financial performance of products, services, or business units to enhance strategic decision-making and resource allocation. Explore the differences and applications of transfer pricing analytics versus profitability analysis to improve your accounting strategies.

Why it is important

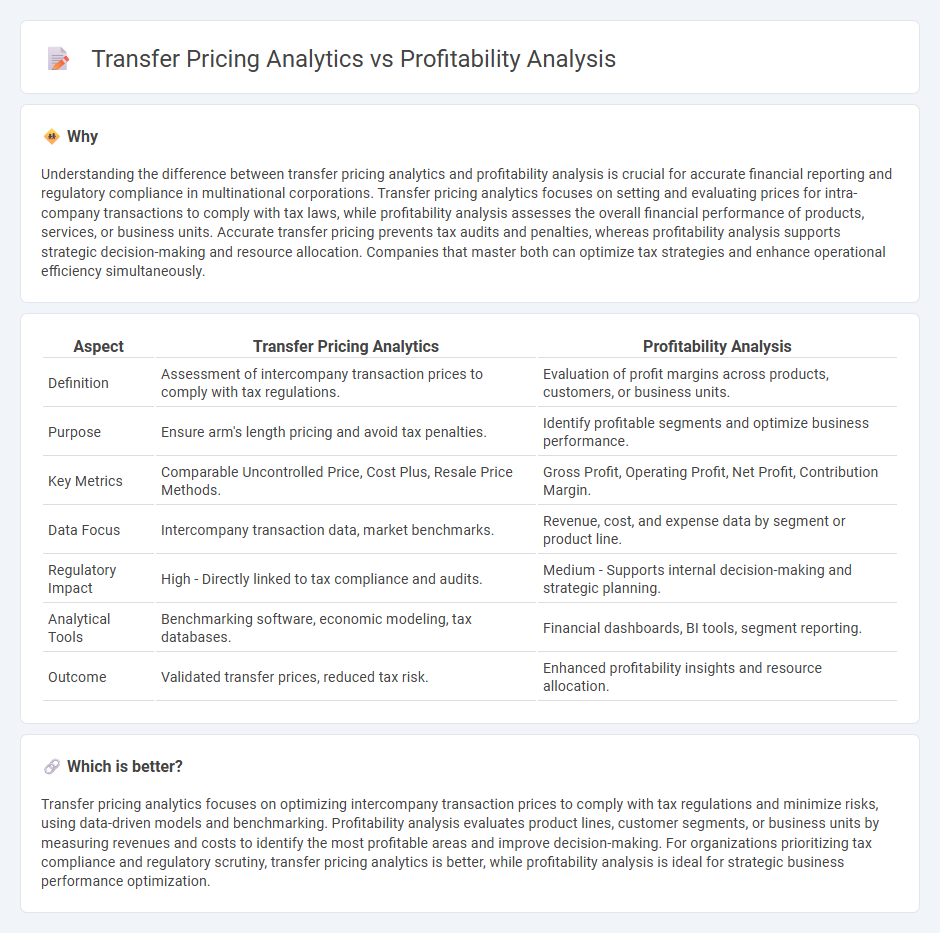

Understanding the difference between transfer pricing analytics and profitability analysis is crucial for accurate financial reporting and regulatory compliance in multinational corporations. Transfer pricing analytics focuses on setting and evaluating prices for intra-company transactions to comply with tax laws, while profitability analysis assesses the overall financial performance of products, services, or business units. Accurate transfer pricing prevents tax audits and penalties, whereas profitability analysis supports strategic decision-making and resource allocation. Companies that master both can optimize tax strategies and enhance operational efficiency simultaneously.

Comparison Table

| Aspect | Transfer Pricing Analytics | Profitability Analysis |

|---|---|---|

| Definition | Assessment of intercompany transaction prices to comply with tax regulations. | Evaluation of profit margins across products, customers, or business units. |

| Purpose | Ensure arm's length pricing and avoid tax penalties. | Identify profitable segments and optimize business performance. |

| Key Metrics | Comparable Uncontrolled Price, Cost Plus, Resale Price Methods. | Gross Profit, Operating Profit, Net Profit, Contribution Margin. |

| Data Focus | Intercompany transaction data, market benchmarks. | Revenue, cost, and expense data by segment or product line. |

| Regulatory Impact | High - Directly linked to tax compliance and audits. | Medium - Supports internal decision-making and strategic planning. |

| Analytical Tools | Benchmarking software, economic modeling, tax databases. | Financial dashboards, BI tools, segment reporting. |

| Outcome | Validated transfer prices, reduced tax risk. | Enhanced profitability insights and resource allocation. |

Which is better?

Transfer pricing analytics focuses on optimizing intercompany transaction prices to comply with tax regulations and minimize risks, using data-driven models and benchmarking. Profitability analysis evaluates product lines, customer segments, or business units by measuring revenues and costs to identify the most profitable areas and improve decision-making. For organizations prioritizing tax compliance and regulatory scrutiny, transfer pricing analytics is better, while profitability analysis is ideal for strategic business performance optimization.

Connection

Transfer pricing analytics and profitability analysis are interconnected through their focus on evaluating financial performance across different business units and jurisdictions. Transfer pricing analytics ensures compliance with tax regulations and optimizes intercompany pricing strategies, directly impacting the accuracy of profitability analysis by allocating revenues and costs appropriately. Accurate transfer pricing data provides critical insights for profitability analysis, enabling companies to identify value drivers and enhance strategic decision-making.

Key Terms

**Profitability Analysis:**

Profitability analysis examines company-wide or segment-specific financial performance to identify key profit drivers and cost centers, leveraging data from revenue streams and expense allocations to optimize operational efficiency. Transfer pricing analytics specifically scrutinizes intercompany transactions, ensuring compliance with tax regulations and aligning pricing strategies to prevent profit shifting between subsidiaries. Explore detailed methods and best practices in profitability analysis to enhance strategic decision-making and financial performance.

Gross Margin

Profitability analysis focuses on evaluating the gross margin to determine the financial performance of products, services, or business units by assessing revenue minus direct costs. Transfer pricing analytics examines the gross margin to ensure intercompany transactions comply with regulatory standards and optimize tax efficiency across jurisdictions. Explore deeper insights into how these approaches impact financial strategy and compliance.

Return on Investment (ROI)

Profitability analysis evaluates the financial performance of business units by measuring metrics like Return on Investment (ROI) to optimize resource allocation and enhance overall efficiency. Transfer pricing analytics examines pricing strategies for intercompany transactions, ensuring compliance with tax regulations and maximizing profit distribution across divisions while maintaining fair ROI benchmarks. Explore further to understand how integrating both approaches can drive strategic financial management.

Source and External Links

Product Profitability Analysis: Definition and Examples - CostPerform - This guide explains how to calculate product profitability by subtracting all direct and indirect costs from total revenue, providing a structured approach for businesses to evaluate financial performance and inform strategic decisions.

Profitability Analysis: A Comprehensive Guide to Success - Fathom - Profitability analysis involves examining revenue streams and costs, using financial data and ratios to assess trends, perform break-even analyses, and gain granular insights into the profitability of specific products or customers.

Profitability analysis - Wikipedia - In cost accounting, profitability analysis allocates all organizational costs to output units (like products or customers) to determine unit margins, enabling managers to make data-driven decisions such as discontinuing unprofitable products or optimizing sales channels.

dowidth.com

dowidth.com