Forensic analytics applies advanced data analysis techniques to detect fraud, errors, and irregularities within financial data, enhancing the investigative process in accounting. Financial reporting focuses on preparing accurate and compliant financial statements that reflect an entity's financial position and performance for stakeholders. Explore the distinctions and applications of forensic analytics versus financial reporting to strengthen your accounting expertise.

Why it is important

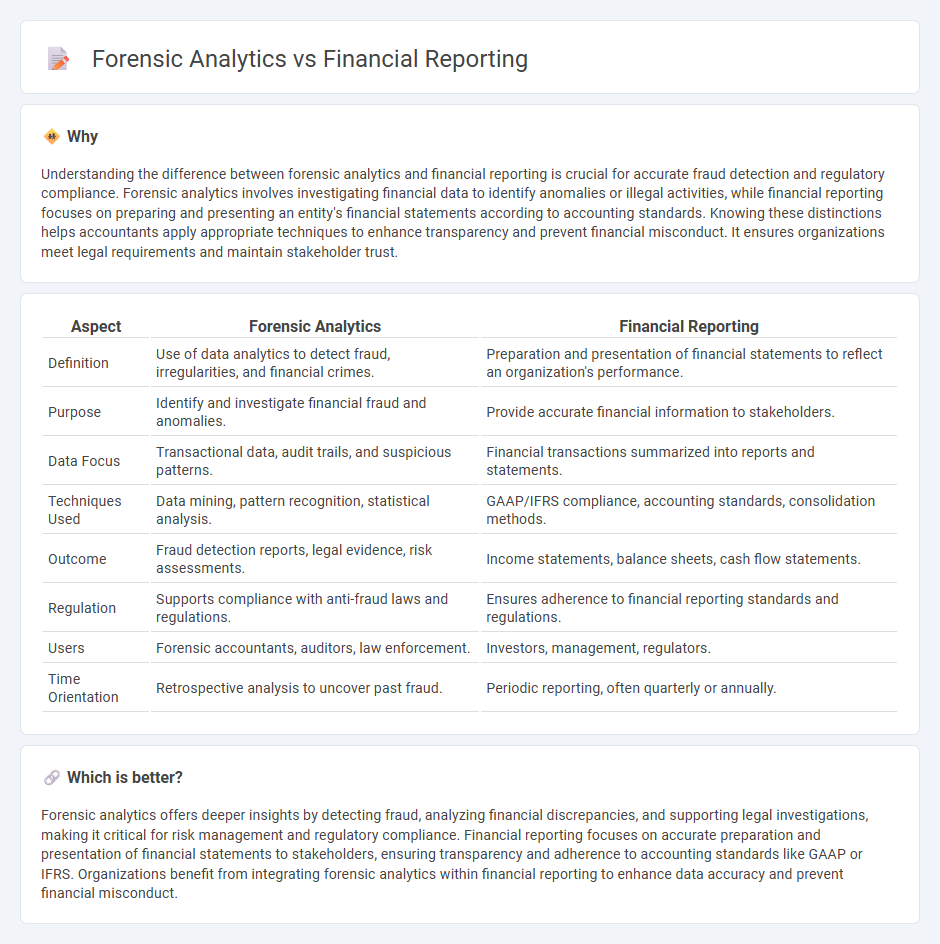

Understanding the difference between forensic analytics and financial reporting is crucial for accurate fraud detection and regulatory compliance. Forensic analytics involves investigating financial data to identify anomalies or illegal activities, while financial reporting focuses on preparing and presenting an entity's financial statements according to accounting standards. Knowing these distinctions helps accountants apply appropriate techniques to enhance transparency and prevent financial misconduct. It ensures organizations meet legal requirements and maintain stakeholder trust.

Comparison Table

| Aspect | Forensic Analytics | Financial Reporting |

|---|---|---|

| Definition | Use of data analytics to detect fraud, irregularities, and financial crimes. | Preparation and presentation of financial statements to reflect an organization's performance. |

| Purpose | Identify and investigate financial fraud and anomalies. | Provide accurate financial information to stakeholders. |

| Data Focus | Transactional data, audit trails, and suspicious patterns. | Financial transactions summarized into reports and statements. |

| Techniques Used | Data mining, pattern recognition, statistical analysis. | GAAP/IFRS compliance, accounting standards, consolidation methods. |

| Outcome | Fraud detection reports, legal evidence, risk assessments. | Income statements, balance sheets, cash flow statements. |

| Regulation | Supports compliance with anti-fraud laws and regulations. | Ensures adherence to financial reporting standards and regulations. |

| Users | Forensic accountants, auditors, law enforcement. | Investors, management, regulators. |

| Time Orientation | Retrospective analysis to uncover past fraud. | Periodic reporting, often quarterly or annually. |

Which is better?

Forensic analytics offers deeper insights by detecting fraud, analyzing financial discrepancies, and supporting legal investigations, making it critical for risk management and regulatory compliance. Financial reporting focuses on accurate preparation and presentation of financial statements to stakeholders, ensuring transparency and adherence to accounting standards like GAAP or IFRS. Organizations benefit from integrating forensic analytics within financial reporting to enhance data accuracy and prevent financial misconduct.

Connection

Forensic analytics enhances financial reporting by identifying anomalies, errors, and fraudulent activities within accounting data, ensuring accuracy and compliance. Through detailed examination of transactions and patterns, forensic analytics supports transparent financial disclosures and strengthens internal controls. Integrating these methods improves the reliability of financial statements and aids in risk management.

Key Terms

**Financial Reporting:**

Financial reporting involves the accurate preparation and presentation of financial statements in accordance with accounting standards such as GAAP or IFRS, ensuring transparency and compliance for stakeholders. It emphasizes the systematic recording, classification, and summarization of financial transactions to provide a clear snapshot of an organization's financial health. Explore how advanced tools and techniques improve financial reporting accuracy and reliability.

Income Statement

Financial reporting primarily involves the accurate presentation of income statement components such as revenue, expenses, and net income to comply with accounting standards and inform stakeholders. Forensic analytics scrutinizes income statement data to detect anomalies, fraud, and misstatements by analyzing transaction patterns and unusual trends. Explore how integrating forensic analytics can enhance the reliability of financial reporting and safeguard organizational integrity.

Balance Sheet

Financial reporting emphasizes the accurate presentation of balance sheet elements, including assets, liabilities, and equity, to comply with accounting standards and ensure transparency for stakeholders. Forensic analytics investigates discrepancies and potential fraud in balance sheet accounts by analyzing transaction patterns, anomalies, and irregularities that may affect financial integrity. Discover how forensic analytics techniques enhance the reliability of balance sheet assessments beyond traditional financial reporting.

Source and External Links

What Is Financial Reporting & Why Is It Important? - NetSuite - Financial reporting is the accounting process for communicating financial information to external stakeholders like investors and regulators, and internal management, typically through core financial statements such as the balance sheet, income statement, and cash flow statement, with requirements varying based on the audience.

What Is Financial Reporting? Definition, Importance, and Types - Financial reporting summarizes a company's financial performance via key statements including the balance sheet, income statement, cash flows, and equity changes, serving to ensure accuracy, comparability, and compliance with standards such as GAAP for stakeholders and regulatory bodies.

What is Financial Reporting? I Planful - Financial reporting is the detailed and periodic evaluation of a company's financial health and performance, used by executives, investors, and other stakeholders to make informed decisions, often comprising external mandatory reports and internal tailored reports to drive business success.

dowidth.com

dowidth.com