Invoice factoring platforms provide businesses immediate cash flow by selling outstanding invoices at a discount, allowing faster access to working capital without incurring debt. Lines of credit offer flexible borrowing options based on approved credit limits, enabling companies to draw funds as needed while managing interest payments only on the withdrawn amount. Explore more to determine which financial tool best supports your accounting and cash flow management needs.

Why it is important

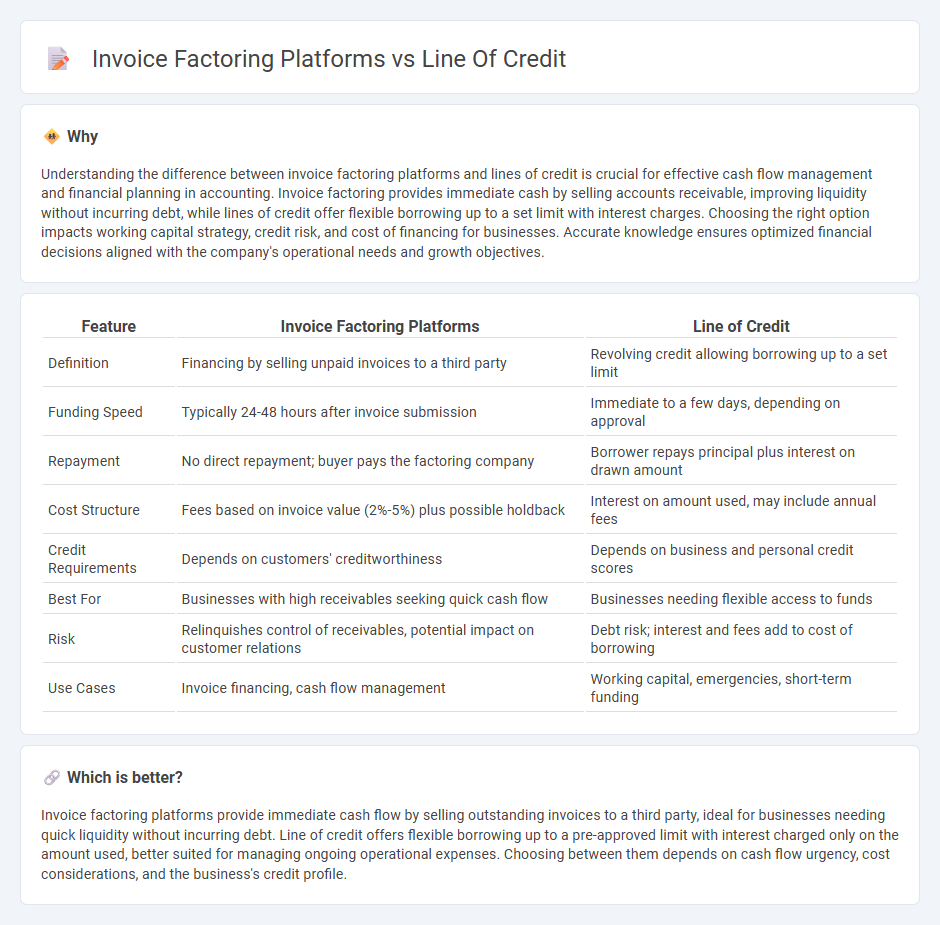

Understanding the difference between invoice factoring platforms and lines of credit is crucial for effective cash flow management and financial planning in accounting. Invoice factoring provides immediate cash by selling accounts receivable, improving liquidity without incurring debt, while lines of credit offer flexible borrowing up to a set limit with interest charges. Choosing the right option impacts working capital strategy, credit risk, and cost of financing for businesses. Accurate knowledge ensures optimized financial decisions aligned with the company's operational needs and growth objectives.

Comparison Table

| Feature | Invoice Factoring Platforms | Line of Credit |

|---|---|---|

| Definition | Financing by selling unpaid invoices to a third party | Revolving credit allowing borrowing up to a set limit |

| Funding Speed | Typically 24-48 hours after invoice submission | Immediate to a few days, depending on approval |

| Repayment | No direct repayment; buyer pays the factoring company | Borrower repays principal plus interest on drawn amount |

| Cost Structure | Fees based on invoice value (2%-5%) plus possible holdback | Interest on amount used, may include annual fees |

| Credit Requirements | Depends on customers' creditworthiness | Depends on business and personal credit scores |

| Best For | Businesses with high receivables seeking quick cash flow | Businesses needing flexible access to funds |

| Risk | Relinquishes control of receivables, potential impact on customer relations | Debt risk; interest and fees add to cost of borrowing |

| Use Cases | Invoice financing, cash flow management | Working capital, emergencies, short-term funding |

Which is better?

Invoice factoring platforms provide immediate cash flow by selling outstanding invoices to a third party, ideal for businesses needing quick liquidity without incurring debt. Line of credit offers flexible borrowing up to a pre-approved limit with interest charged only on the amount used, better suited for managing ongoing operational expenses. Choosing between them depends on cash flow urgency, cost considerations, and the business's credit profile.

Connection

Invoice factoring platforms and lines of credit both serve as financial solutions to improve business cash flow by providing immediate access to working capital. Invoice factoring allows companies to sell their outstanding invoices at a discount to receive faster payments, while lines of credit offer revolving borrowing limits that businesses can draw from as needed. These tools are connected through their role in managing short-term liquidity challenges and are often used in tandem to optimize cash flow and support operational expenses.

Key Terms

Credit Limit

Credit limit on line of credit platforms typically depends on the borrower's credit score, business financials, and repayment history, offering flexible access to funds up to the approved amount. Invoice factoring platforms base credit limits on the value and quality of outstanding invoices, providing immediate cash tied directly to receivables rather than overall creditworthiness. Explore detailed comparisons of credit limits to choose the best financing option for your business needs.

Accounts Receivable

Line of credit platforms offer businesses flexible borrowing limits based on creditworthiness, allowing them to draw funds as needed for cash flow management. Invoice factoring platforms provide immediate cash by purchasing accounts receivable at a discount, transferring collection responsibilities to the factor company. Explore our detailed comparison to understand which accounts receivable financing solution best suits your business needs.

Advance Rate

Advance rate plays a critical role in both line of credit and invoice factoring platforms, directly affecting the amount of capital available to businesses. Lines of credit typically offer advance rates ranging from 70% to 90% on approved credit limits, whereas invoice factoring platforms provide advance rates of 70% to 85% based on the value of outstanding invoices. Explore detailed comparisons to understand how advance rates impact cash flow management and financing costs.

Source and External Links

Lines of credit: What they are & how they work - Capital One - A line of credit is a flexible loan that lets you borrow and repay repeatedly up to a preset limit, often unsecured or secured and available for personal or business use.

What Is a Line of Credit? - Experian - A line of credit provides revolving credit with a set limit and defined draw and repayment periods, with options for secured or unsecured lending and varying interest rates based on risk.

Business Line of Credit | American Express Business Blueprint - A business line of credit offers flexible funding access for businesses, allowing draws up to an approved limit that replenish as you repay, ideal for managing cash flow or seasonal expenses.

dowidth.com

dowidth.com