Digital asset valuation involves assessing the current market value of assets like cryptocurrencies, NFTs, and digital securities to reflect real-time financial positions. Historical cost accounting records assets at their original purchase price, offering consistency but potentially overlooking market fluctuations. Explore the differences and implications of these approaches to understand their impact on financial reporting.

Why it is important

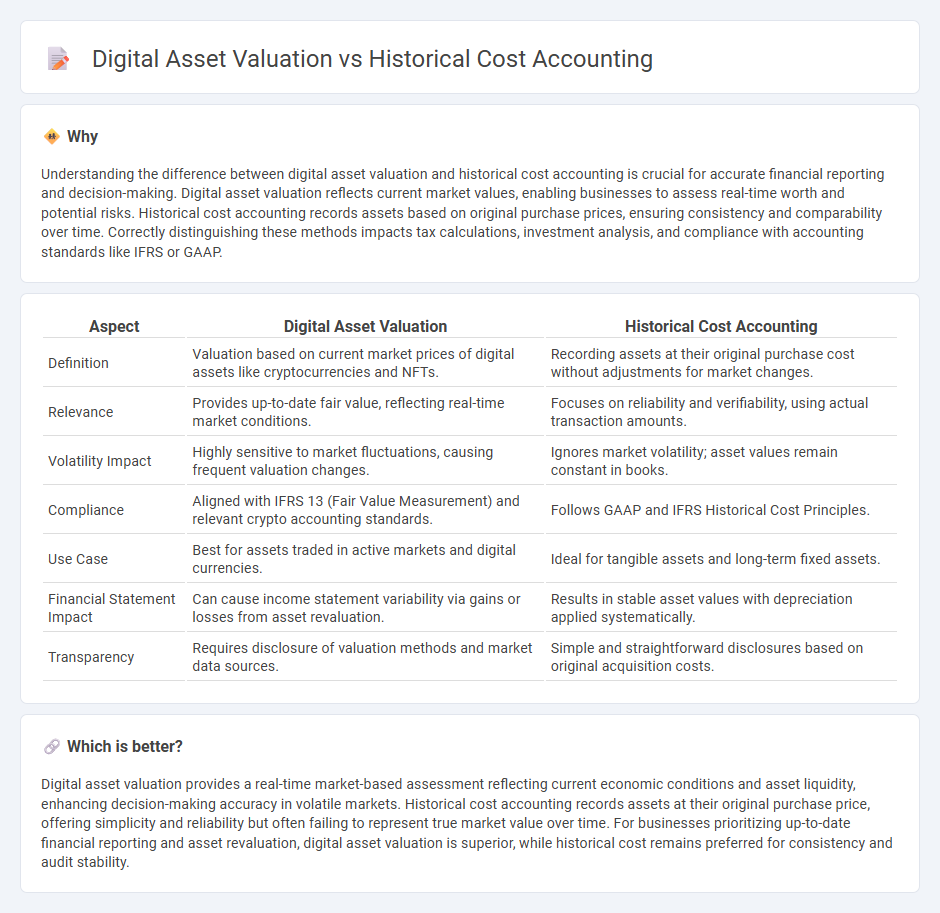

Understanding the difference between digital asset valuation and historical cost accounting is crucial for accurate financial reporting and decision-making. Digital asset valuation reflects current market values, enabling businesses to assess real-time worth and potential risks. Historical cost accounting records assets based on original purchase prices, ensuring consistency and comparability over time. Correctly distinguishing these methods impacts tax calculations, investment analysis, and compliance with accounting standards like IFRS or GAAP.

Comparison Table

| Aspect | Digital Asset Valuation | Historical Cost Accounting |

|---|---|---|

| Definition | Valuation based on current market prices of digital assets like cryptocurrencies and NFTs. | Recording assets at their original purchase cost without adjustments for market changes. |

| Relevance | Provides up-to-date fair value, reflecting real-time market conditions. | Focuses on reliability and verifiability, using actual transaction amounts. |

| Volatility Impact | Highly sensitive to market fluctuations, causing frequent valuation changes. | Ignores market volatility; asset values remain constant in books. |

| Compliance | Aligned with IFRS 13 (Fair Value Measurement) and relevant crypto accounting standards. | Follows GAAP and IFRS Historical Cost Principles. |

| Use Case | Best for assets traded in active markets and digital currencies. | Ideal for tangible assets and long-term fixed assets. |

| Financial Statement Impact | Can cause income statement variability via gains or losses from asset revaluation. | Results in stable asset values with depreciation applied systematically. |

| Transparency | Requires disclosure of valuation methods and market data sources. | Simple and straightforward disclosures based on original acquisition costs. |

Which is better?

Digital asset valuation provides a real-time market-based assessment reflecting current economic conditions and asset liquidity, enhancing decision-making accuracy in volatile markets. Historical cost accounting records assets at their original purchase price, offering simplicity and reliability but often failing to represent true market value over time. For businesses prioritizing up-to-date financial reporting and asset revaluation, digital asset valuation is superior, while historical cost remains preferred for consistency and audit stability.

Connection

Digital asset valuation and historical cost accounting are connected through their methods of recording financial information; historical cost accounting records assets at their original purchase price, while digital asset valuation often requires adjustments to reflect current market values. Accurate digital asset valuation enhances financial reporting by providing a realistic assessment of asset worth beyond historical costs, which can be outdated in volatile markets. Incorporating both approaches ensures compliance with accounting standards and improves transparency in financial statements involving digital assets such as cryptocurrencies and NFTs.

Key Terms

Cost Principle

Historical cost accounting records assets at their original purchase price, emphasizing reliability and objectivity under the Cost Principle. Digital asset valuation, however, requires frequent revaluation to reflect market volatility, challenging traditional cost-based accounting frameworks. Explore more about how these contrasting approaches impact financial reporting and investment decisions.

Fair Value

Historical cost accounting records assets at their original purchase price, providing stability and verifiability but often missing current market conditions. Digital asset valuation emphasizes Fair Value measurement, reflecting real-time market fluctuations and enhancing transparency for stakeholders in volatile cryptocurrency and blockchain markets. Explore in-depth differences and practical applications of these valuation methods to optimize financial reporting strategies.

Impairment

Historical cost accounting records assets at their original purchase price, often leading to undervaluation during market downturns. Digital asset valuation requires dynamic impairment assessments due to rapid volatility and fluctuating market demand in cryptocurrencies and NFTs. Explore the complexities of impairment recognition in both frameworks to enhance your financial reporting accuracy.

Source and External Links

Historical cost - Historical cost accounting reports assets and liabilities at their original acquisition costs without updating for changes in market value, remaining widely used despite criticism for lacking timely value updates.

What is Historical Cost? - Historical cost is the original cost of an asset recorded in accounting records, including purchase price and costs to bring the asset to a usable condition, with no upward revaluation allowed under GAAP.

Historical Cost - Overview, Example, Accounting Adjustment - The historical cost principle requires recording assets at original purchase price and making no subsequent adjustments for market fluctuations, which may cause asset values on the balance sheet to differ from current market values.

dowidth.com

dowidth.com