Digital asset valuation requires specialized approaches to accurately assess cryptocurrencies, NFTs, and other intangible digital holdings, distinct from traditional depreciation methods used for physical assets like machinery and vehicles. Depreciation methods such as straight-line or declining balance allocate the cost of tangible assets over their useful lives, while digital assets often demand market-driven valuation models due to volatility and lack of physical wear. Explore the nuances of digital asset valuation versus depreciation methods to optimize your accounting practices.

Why it is important

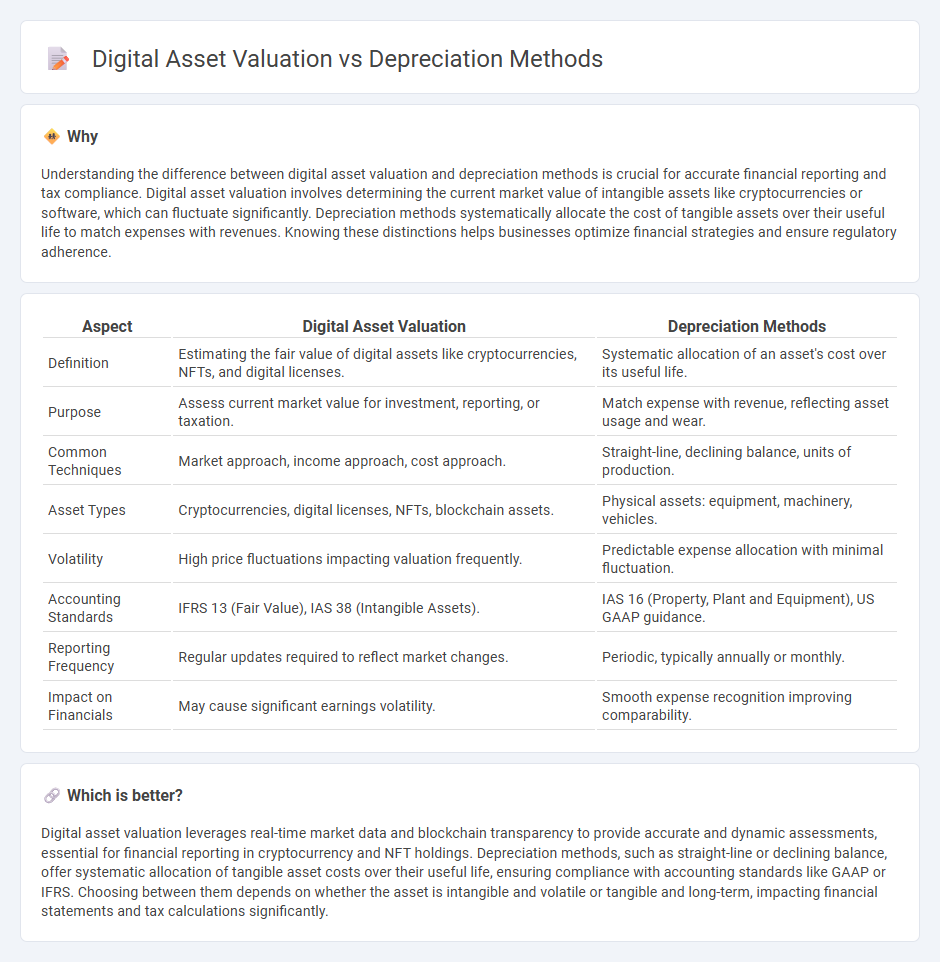

Understanding the difference between digital asset valuation and depreciation methods is crucial for accurate financial reporting and tax compliance. Digital asset valuation involves determining the current market value of intangible assets like cryptocurrencies or software, which can fluctuate significantly. Depreciation methods systematically allocate the cost of tangible assets over their useful life to match expenses with revenues. Knowing these distinctions helps businesses optimize financial strategies and ensure regulatory adherence.

Comparison Table

| Aspect | Digital Asset Valuation | Depreciation Methods |

|---|---|---|

| Definition | Estimating the fair value of digital assets like cryptocurrencies, NFTs, and digital licenses. | Systematic allocation of an asset's cost over its useful life. |

| Purpose | Assess current market value for investment, reporting, or taxation. | Match expense with revenue, reflecting asset usage and wear. |

| Common Techniques | Market approach, income approach, cost approach. | Straight-line, declining balance, units of production. |

| Asset Types | Cryptocurrencies, digital licenses, NFTs, blockchain assets. | Physical assets: equipment, machinery, vehicles. |

| Volatility | High price fluctuations impacting valuation frequently. | Predictable expense allocation with minimal fluctuation. |

| Accounting Standards | IFRS 13 (Fair Value), IAS 38 (Intangible Assets). | IAS 16 (Property, Plant and Equipment), US GAAP guidance. |

| Reporting Frequency | Regular updates required to reflect market changes. | Periodic, typically annually or monthly. |

| Impact on Financials | May cause significant earnings volatility. | Smooth expense recognition improving comparability. |

Which is better?

Digital asset valuation leverages real-time market data and blockchain transparency to provide accurate and dynamic assessments, essential for financial reporting in cryptocurrency and NFT holdings. Depreciation methods, such as straight-line or declining balance, offer systematic allocation of tangible asset costs over their useful life, ensuring compliance with accounting standards like GAAP or IFRS. Choosing between them depends on whether the asset is intangible and volatile or tangible and long-term, impacting financial statements and tax calculations significantly.

Connection

Digital asset valuation directly influences depreciation methods by determining the initial recorded cost, which serves as the basis for calculating depreciation expenses over an asset's useful life. Accurate valuation ensures compliance with accounting standards such as IFRS and GAAP, impacting financial statements and tax obligations. Depreciation methods like straight-line, declining balance, or units of production adjust the asset's book value systematically, reflecting its economic consumption and helping businesses optimize asset management.

Key Terms

Depreciation methods:

Depreciation methods such as straight-line, declining balance, and units of production are essential for allocating the cost of tangible assets over their useful lives, impacting financial reporting and tax calculations. In contrast, digital asset valuation often relies on market-based approaches and intangible asset assessment due to the absence of physical wear and tear. Explore our comprehensive analysis to understand how each depreciation method optimizes asset management and financial accuracy.

Straight-Line Method

The Straight-Line Method is a widely used depreciation technique that spreads the cost of a tangible asset evenly over its useful life, providing a clear and predictable expense pattern for financial reporting. Digital asset valuation, however, involves more complex considerations such as market demand, technological obsolescence, and intangible factors that cannot be captured by traditional straight-line depreciation. Discover how integrating advanced valuation models can enhance accuracy in assessing digital assets beyond conventional methods.

Declining Balance Method

The Declining Balance Method accelerates depreciation by applying a fixed percentage to the book value each year, optimizing asset value reduction for tax purposes. Digital asset valuation often contrasts this by emphasizing intangible factors like market trends and utility rather than physical wear. Explore how these methods impact financial strategy and asset management in evolving digital economies.

Source and External Links

Selecting the Best Depreciation Method: A Complete Guide - This guide discusses choosing the right depreciation method, including straight-line, accelerated, and units of production methods, and how they apply to different assets.

Depreciation Methods: 4 Types with Formulas and Examples - This article outlines four depreciation methods: straight-line, declining balance, units of production, and sum of years digits, providing formulas and examples.

Depreciation Methods - 4 Types of - This resource explains the four main types of depreciation methods, including straight-line, double declining balance, units of production, and sum of years digits, used for different asset depreciations.

dowidth.com

dowidth.com