Real-time expense reconciliation processes financial transactions instantly, ensuring immediate accuracy and up-to-date records, whereas batch expense reconciliation accumulates transactions over a period before processing them together, potentially causing delays in financial visibility. Real-time systems enhance cash flow management and reduce errors by providing continuous updates, while batch processes may be simpler but risk outdated information and reconciliation backlogs. Explore the advantages and applications of each approach to optimize your accounting workflows.

Why it is important

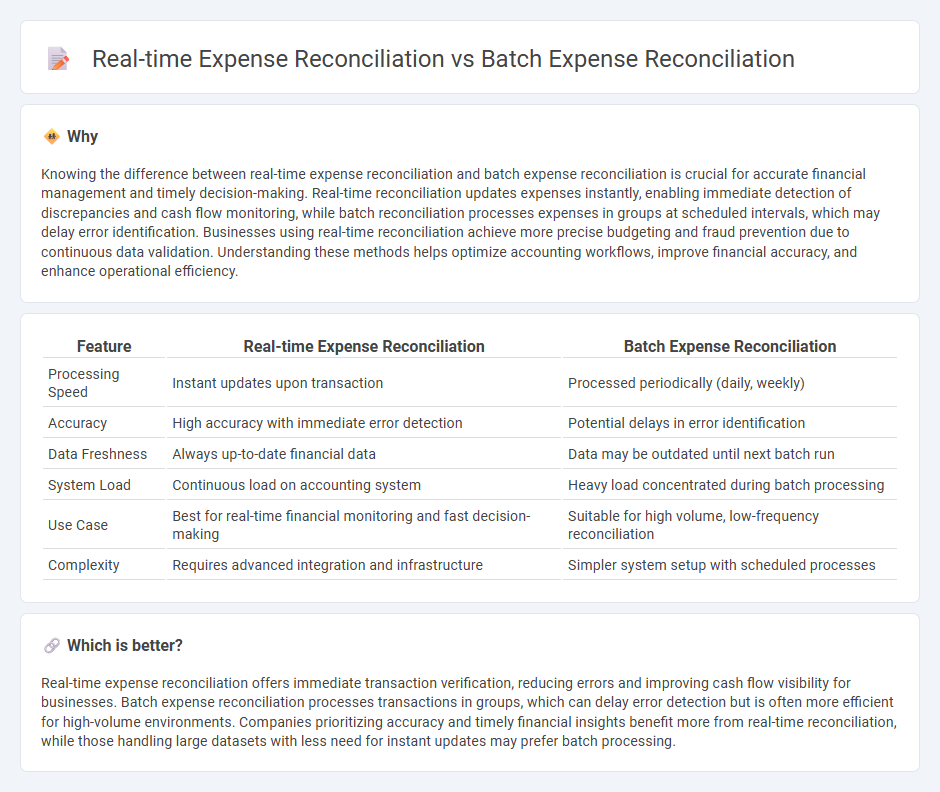

Knowing the difference between real-time expense reconciliation and batch expense reconciliation is crucial for accurate financial management and timely decision-making. Real-time reconciliation updates expenses instantly, enabling immediate detection of discrepancies and cash flow monitoring, while batch reconciliation processes expenses in groups at scheduled intervals, which may delay error identification. Businesses using real-time reconciliation achieve more precise budgeting and fraud prevention due to continuous data validation. Understanding these methods helps optimize accounting workflows, improve financial accuracy, and enhance operational efficiency.

Comparison Table

| Feature | Real-time Expense Reconciliation | Batch Expense Reconciliation |

|---|---|---|

| Processing Speed | Instant updates upon transaction | Processed periodically (daily, weekly) |

| Accuracy | High accuracy with immediate error detection | Potential delays in error identification |

| Data Freshness | Always up-to-date financial data | Data may be outdated until next batch run |

| System Load | Continuous load on accounting system | Heavy load concentrated during batch processing |

| Use Case | Best for real-time financial monitoring and fast decision-making | Suitable for high volume, low-frequency reconciliation |

| Complexity | Requires advanced integration and infrastructure | Simpler system setup with scheduled processes |

Which is better?

Real-time expense reconciliation offers immediate transaction verification, reducing errors and improving cash flow visibility for businesses. Batch expense reconciliation processes transactions in groups, which can delay error detection but is often more efficient for high-volume environments. Companies prioritizing accuracy and timely financial insights benefit more from real-time reconciliation, while those handling large datasets with less need for instant updates may prefer batch processing.

Connection

Real-time expense reconciliation and batch expense reconciliation are connected through their shared goal of ensuring accurate financial records by verifying and matching expenses against transactions. Real-time reconciliation processes transactions instantly to provide up-to-date financial insights, while batch reconciliation groups multiple transactions for periodic processing, enhancing efficiency in handling large volumes of data. Together, these methods optimize cash flow management and accounting accuracy in financial systems.

Key Terms

Timing

Batch expense reconciliation processes transactions in bulk at scheduled intervals, often causing delays between transaction occurrence and expense reflection. Real-time expense reconciliation updates records instantly as transactions occur, ensuring immediate accuracy and up-to-date financial data. Explore how choosing between these timing methods can optimize your financial management system.

Data Accuracy

Batch expense reconciliation processes transactions in groups at scheduled intervals, which can delay the identification of discrepancies and affect data accuracy. Real-time expense reconciliation updates financial records instantly, allowing immediate detection and correction of errors, significantly enhancing data accuracy. Discover how implementing real-time reconciliation can improve your financial accuracy and operational efficiency.

Workflow Efficiency

Batch expense reconciliation processes transactions in groups at scheduled intervals, which can delay issue detection and slow down financial closing. Real-time expense reconciliation updates transactions instantly, improving workflow efficiency by enabling immediate error identification and faster decision-making. Explore deeper insights into how these methods impact your financial operations and workflow productivity.

Source and External Links

Expense Reconciliation: How to Reconcile Expenses Faster - Ramp - Batch expense reconciliation involves consolidating multiple expense transactions into a single batch for review and matching against financial records, which can be done manually or automated to improve efficiency and accuracy in financial reporting.

Expense Reconciliation: How to Reconcile Expenses Faster - Brex - Automated batch expense reconciliation is enhanced by global expense management tools that capture and categorize receipts automatically, integrate with accounting software, and apply real-time policy checks to prevent errors before reconciliation.

What are you risking by sticking with batch-level reconciliation? - While batch-level reconciliation is efficient for simple operations, it risks missing individual transaction errors, potentially causing material losses and complicating audits, so businesses with complex or high-volume transactions should consider transaction-level detail reconciliation.

dowidth.com

dowidth.com